R40 Form 2012

What is the R40 Form

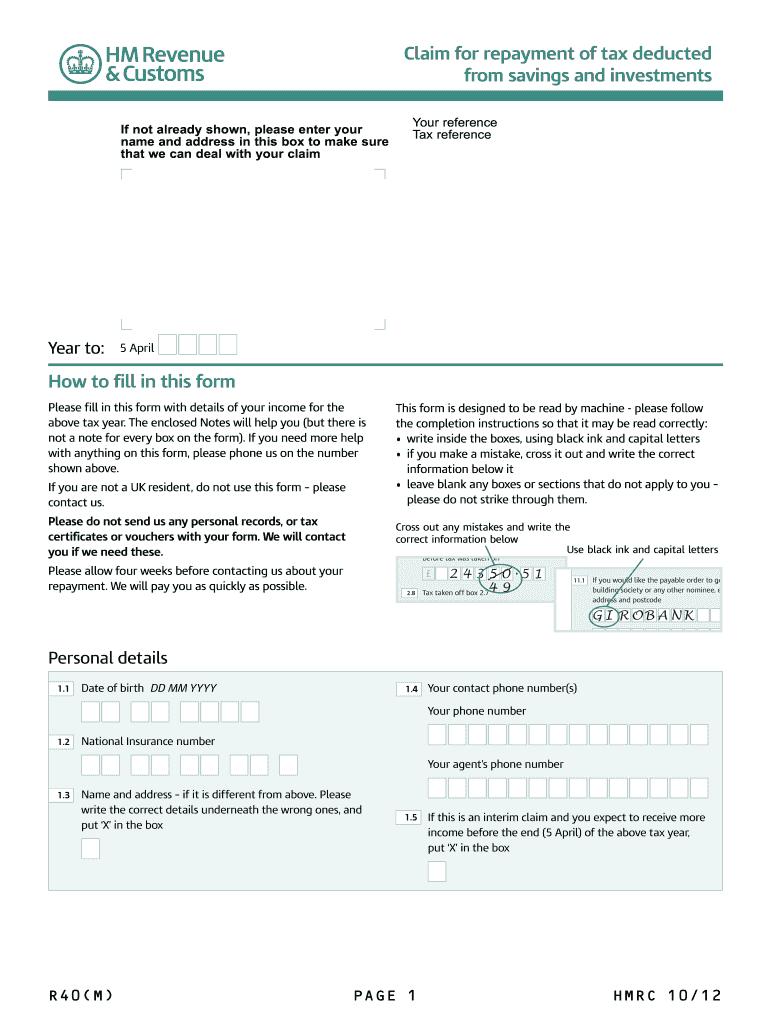

The R40 form is a tax document utilized by residents of certain states to claim a refund for overpaid taxes or to report their income. It is primarily designed for individuals who have had taxes withheld from their earnings but may not owe the full amount reported. The R40 form allows taxpayers to reconcile their tax obligations and potentially receive a refund from the state.

How to use the R40 Form

Using the R40 form involves several steps to ensure accurate reporting of income and taxes. First, gather all necessary financial documents, including W-2s and 1099s. Next, fill out the form with your personal information, including your Social Security number and address. After entering your income details, calculate the total tax withheld and compare it with your tax liability. If you find that you have overpaid, you can file the form to request a refund.

Steps to complete the R40 Form

Completing the R40 form requires careful attention to detail. Here are the essential steps:

- Collect all relevant income documentation, such as W-2 forms and 1099 forms.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Report your total income from all sources on the designated lines of the form.

- Calculate your total tax liability based on the provided instructions.

- Compare your tax liability with the amount already withheld to determine if you are eligible for a refund.

- Sign and date the form before submission.

Legal use of the R40 Form

The R40 form is legally recognized as a valid document for tax reporting and refund requests. To ensure its legal standing, it must be completed accurately and submitted by the specified deadlines. Compliance with state tax regulations is crucial, as any discrepancies or inaccuracies may lead to penalties or delays in processing your refund.

Filing Deadlines / Important Dates

Filing deadlines for the R40 form vary by state, but generally, it must be submitted by April 15 of the following tax year. It's essential to stay informed about specific dates to avoid late fees or penalties. Some states may offer extensions, but these must be requested in advance and adhere to state guidelines.

Who Issues the Form

The R40 form is typically issued by the state tax authority. Each state may have its version of the R40 form, so it is important to ensure you are using the correct document for your state of residence. The state tax authority's website usually provides access to the latest version of the form and any accompanying instructions.

Quick guide on how to complete r40 form

Effortlessly Prepare R40 Form on Any Device

Digital document management has gained popularity among companies and individuals alike. It serves as an excellent environmentally-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and keep it securely stored online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without any holdups. Manage R40 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign R40 Form with Ease

- Find R40 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign R40 Form to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r40 form

Create this form in 5 minutes!

How to create an eSignature for the r40 form

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the form r40 in relation to airSlate SignNow?

The form r40 refers to a specific document type that can be managed using airSlate SignNow's eSignature platform. With airSlate SignNow, users can easily create, send, and sign form r40 documents electronically, ensuring a streamlined process for all parties involved.

-

How can I prepare and send a form r40 using airSlate SignNow?

Preparing a form r40 with airSlate SignNow is simple and intuitive. You can upload your form r40 document directly into the platform, customize it as needed, and then send it to the designated recipients for eSignature, all within a few clicks.

-

What are the key features of airSlate SignNow for managing form r40?

AirSlate SignNow offers several key features for managing form r40, including customizable templates, bulk sending, and real-time tracking of document status. These features enhance efficiency and ensure that your form r40 is handled effectively throughout the signing process.

-

Is airSlate SignNow cost-effective for businesses dealing with form r40?

Yes, airSlate SignNow provides a cost-effective solution for businesses that frequently handle form r40. With competitive pricing plans and no hidden fees, users can manage their document signing needs without breaking the budget.

-

What integrations does airSlate SignNow offer for maximizing the use of form r40?

AirSlate SignNow integrates seamlessly with various applications, such as Google Drive and Salesforce, to enhance the handling of form r40. These integrations allow users to streamline workflows and improve document management efficiency.

-

How secure is the signing process for form r40 on airSlate SignNow?

AirSlate SignNow ensures the highest level of security for signing form r40, employing features like encryption and two-factor authentication. This robust security framework ensures that your sensitive documents are protected throughout the entire signing process.

-

Can I track the status of my form r40 after sending it for signature?

Absolutely! With airSlate SignNow, you can easily track the status of your form r40 once it has been sent out for signature. The platform provides real-time updates, allowing you to see when the document has been viewed, signed, or is still pending.

Get more for R40 Form

- Foundation contractor package massachusetts form

- Plumbing contractor package massachusetts form

- Brick mason contractor package massachusetts form

- Roofing contractor package massachusetts form

- Electrical contractor package massachusetts form

- Sheetrock drywall contractor package massachusetts form

- Flooring contractor package massachusetts form

- Trim carpentry contractor package massachusetts form

Find out other R40 Form

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval