Claim for Repayment of Tax Deducted from Savings and 2020

What is the Claim For Repayment Of Tax Deducted From Savings?

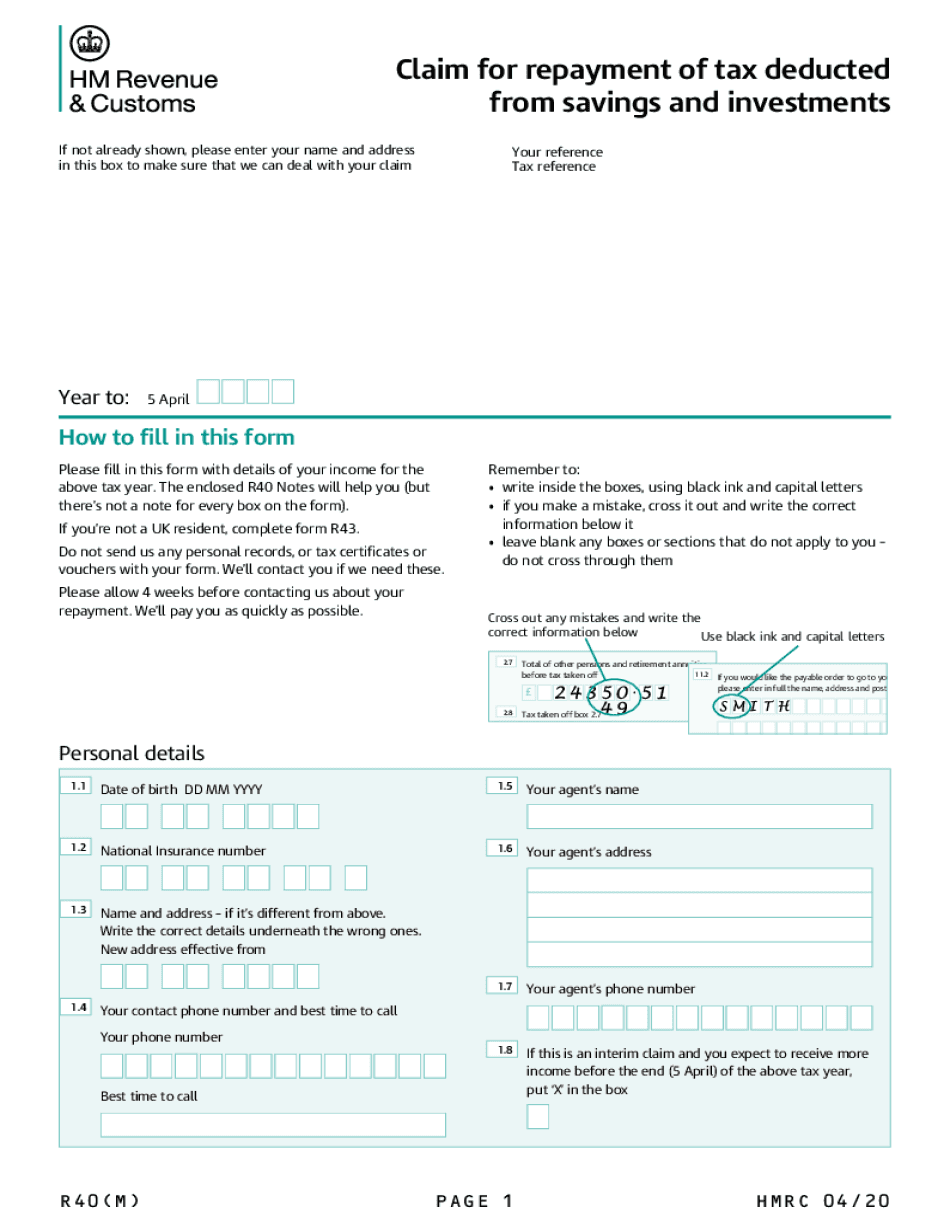

The R40 claim form, officially known as the Claim For Repayment Of Tax Deducted From Savings, is a document used by individuals in the United States to reclaim tax that has been deducted from their savings interest. This form is particularly relevant for taxpayers who have had tax withheld on their savings income and believe they are entitled to a refund. The claim is applicable when the total income falls below the personal allowance threshold, meaning that the taxpayer should not have paid tax on that income.

Steps to Complete the Claim For Repayment Of Tax Deducted From Savings

Filling out the R40 claim form involves several important steps to ensure accuracy and compliance. Here is a straightforward guide to assist you:

- Gather necessary information: Collect all relevant financial documents, including bank statements and details of tax deducted.

- Fill out personal details: Provide your name, address, and taxpayer identification number.

- Detail your income: Clearly outline your savings income and any tax that has been deducted.

- Sign and date the form: Ensure that you sign the form to validate your claim.

- Submit the form: Choose your preferred method of submission, whether online, by mail, or in person.

Eligibility Criteria for the R40 Claim Form

To qualify for submitting the R40 claim form, certain criteria must be met. Taxpayers must ensure that their total income, including savings interest, does not exceed the personal allowance limit set by the IRS. Additionally, the claim should be made for the tax year in which the tax was deducted. Individuals who have paid tax on their savings income and believe they are eligible for a refund should consider filing this claim.

Required Documents for the R40 Claim Form

When completing the R40 claim form, it is essential to have specific documents on hand to support your claim. The following documents are typically required:

- Bank statements showing interest earned and tax deducted.

- Any previous correspondence regarding tax deductions from savings.

- Proof of identity, such as a driver's license or Social Security card.

Form Submission Methods for the R40 Claim Form

Taxpayers have several options for submitting the R40 claim form. The methods include:

- Online submission: Many taxpayers prefer to complete and submit the form electronically for convenience.

- Mail: You can print the completed form and send it to the appropriate tax office by postal mail.

- In-person: Submitting the form directly at a local tax office is also an option for those who prefer face-to-face assistance.

IRS Guidelines for Claiming Tax Refunds

It is crucial to adhere to IRS guidelines when submitting the R40 claim form. The IRS provides specific instructions regarding eligibility, required documentation, and deadlines for submission. Familiarizing yourself with these guidelines can help ensure that your claim is processed smoothly and efficiently.

Filing Deadlines for the R40 Claim Form

Timely submission of the R40 claim form is essential to avoid missing out on potential refunds. The IRS typically sets specific deadlines for filing claims, which may vary based on the tax year. It is advisable to check the IRS website or consult with a tax professional to confirm the exact deadlines applicable to your situation.

Quick guide on how to complete claim for repayment of tax deducted from savings and

Effortlessly Prepare Claim For Repayment Of Tax Deducted From Savings And on Any Device

Managing documents online has gained immense popularity among both companies and individuals. It presents an ideal environmentally friendly substitute for conventional printed and signed papers, as you can easily obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without any delays. Manage Claim For Repayment Of Tax Deducted From Savings And on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign Claim For Repayment Of Tax Deducted From Savings And Effortlessly

- Locate Claim For Repayment Of Tax Deducted From Savings And and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal standing as a standard wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form—via email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and eSign Claim For Repayment Of Tax Deducted From Savings And to guarantee effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for repayment of tax deducted from savings and

Create this form in 5 minutes!

How to create an eSignature for the claim for repayment of tax deducted from savings and

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the r40 claim form?

The r40 claim form is a document used in the United Kingdom for individuals to claim tax refunds on overpaid taxes. This form is essential for taxpayers who wish to get back money that they've overpaid or were not entitled to. Understanding how to properly fill out the r40 claim form can help maximize your refunds.

-

How can airSlate SignNow help me with the r40 claim form?

airSlate SignNow simplifies the process of completing and signing the r40 claim form by providing an intuitive platform for electronic signatures. You can easily upload, fill out, and send your r40 claim form securely and efficiently. This feature ensures that your document is handled promptly, smoothing the process of receiving your tax refund.

-

Is there a cost associated with using airSlate SignNow for the r40 claim form?

Yes, airSlate SignNow offers various pricing plans to suit your needs, allowing you to choose a plan that fits your budget while providing access to features for managing the r40 claim form. Pricing is competitive and offers excellent value, especially considering the time saved in processing documents. You can explore the plans on our website to find one that meets your requirements.

-

Are there any special features for the r40 claim form on airSlate SignNow?

Absolutely! airSlate SignNow features templates specifically designed for the r40 claim form, allowing for quick access to necessary fields and signatures. Additionally, you can track the status of your document at any time, ensuring transparency throughout the signing process. This means your tax refund is processed faster and with less hassle.

-

Can I integrate airSlate SignNow with other applications when using the r40 claim form?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and Zapier, enhancing your workflow while managing the r40 claim form. This integration allows for easy access to your documents stored in different platforms, enabling efficient document management. By integrating, you streamline your processes and ensure a smoother experience.

-

What are the benefits of using airSlate SignNow for the r40 claim form?

Using airSlate SignNow for the r40 claim form provides numerous benefits, including security, speed, and ease of use. You can ensure your documents are encrypted and protected, while our user-friendly interface makes filling out forms simple. Additionally, recipients can sign documents from any device, making it more convenient for everyone involved.

-

How do I ensure my r40 claim form is securely signed with airSlate SignNow?

airSlate SignNow employs top-level security measures, including encryption and secure signing processes, ensuring your r40 claim form is signed securely. Our platform is compliant with industry standards, providing peace of mind as you manage your sensitive tax documents. Users can sign with confidence, knowing their information remains protected.

Get more for Claim For Repayment Of Tax Deducted From Savings And

- Foundation contractor package wisconsin form

- Plumbing contractor package wisconsin form

- Brick mason contractor package wisconsin form

- Roofing contractor package wisconsin form

- Electrical contractor package wisconsin form

- Sheetrock drywall contractor package wisconsin form

- Flooring contractor package wisconsin form

- Trim carpentry contractor package wisconsin form

Find out other Claim For Repayment Of Tax Deducted From Savings And

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure