Fillable Claim for Repayment of Tax Deducted from Savings 2023-2026

What is the fillable claim for repayment of tax deducted from savings

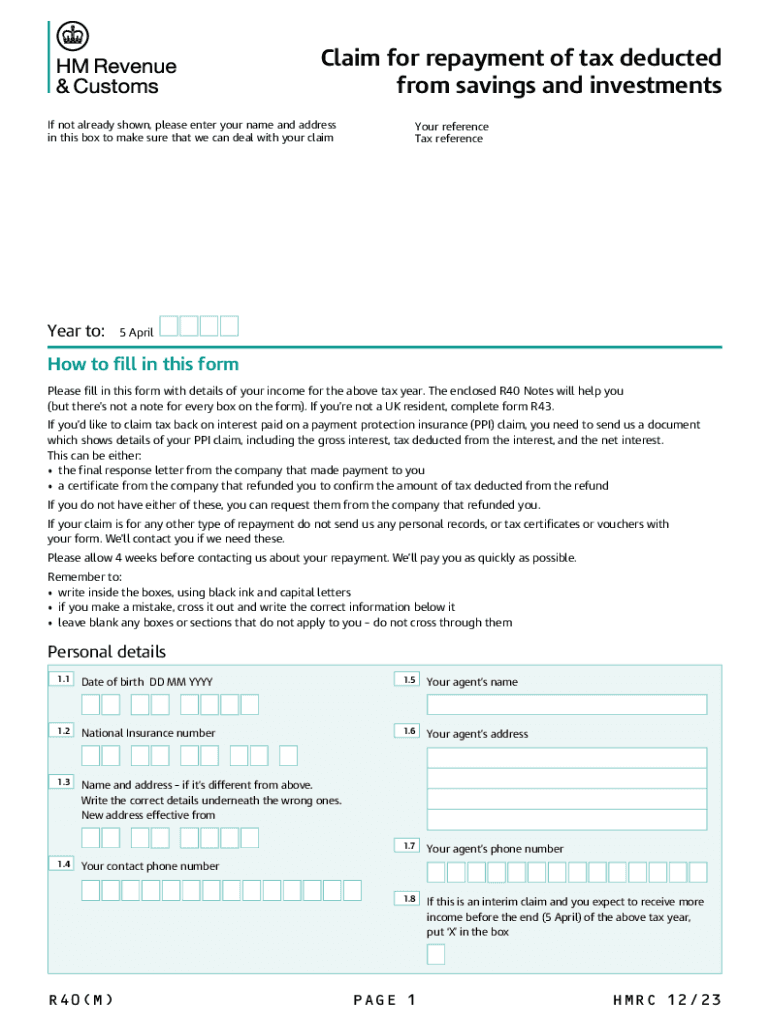

The fillable claim for repayment of tax deducted from savings, commonly referred to as the R40 form, is a document used by individuals to reclaim tax that has been deducted from interest earned on savings accounts. This form is particularly relevant for taxpayers who have had tax withheld at source on their savings income but are not liable to pay tax due to their overall income level or personal circumstances. By completing this form, individuals can receive a refund for the excess tax paid.

How to use the fillable claim for repayment of tax deducted from savings

To use the fillable claim for repayment of tax deducted from savings, individuals must first download the R40 form from the appropriate source. After obtaining the form, users should fill it out with accurate personal information, including their name, address, and National Insurance number. Next, they need to provide details about the interest earned and the tax that has been deducted. Once completed, the form can be submitted to the relevant tax authority for processing.

Steps to complete the fillable claim for repayment of tax deducted from savings

Completing the fillable claim for repayment of tax deducted from savings involves several key steps:

- Download the R40 form from a reliable source.

- Fill in personal details, including your name and contact information.

- Provide information regarding your savings accounts and the interest earned.

- Indicate the amount of tax that has been deducted from your savings.

- Review the form for accuracy and completeness.

- Submit the form to the tax authority via mail or online, if available.

Eligibility criteria for the fillable claim for repayment of tax deducted from savings

To be eligible for the fillable claim for repayment of tax deducted from savings, individuals must meet certain criteria. Typically, this includes having paid tax on savings income that exceeds the personal allowance threshold. Additionally, taxpayers must not have an overall income that places them in a higher tax bracket. Individuals should also ensure that they have the necessary documentation to support their claim, including bank statements showing interest earned and tax deducted.

Required documents for the fillable claim for repayment of tax deducted from savings

When submitting the fillable claim for repayment of tax deducted from savings, individuals should prepare and include several key documents:

- Completed R40 form with accurate personal and financial information.

- Bank statements or documentation showing interest earned on savings.

- Evidence of tax deducted, such as tax certificates or statements from financial institutions.

- Any additional documentation that supports the claim for repayment.

Form submission methods for the fillable claim for repayment of tax deducted from savings

The fillable claim for repayment of tax deducted from savings can typically be submitted through various methods. Individuals may choose to send the completed R40 form via traditional mail to the designated tax authority. Some jurisdictions may also allow for online submissions through secure portals. It is important to verify the submission methods available in your specific area to ensure timely processing of the claim.

Quick guide on how to complete fillable claim for repayment of tax deducted from savings

Prepare Fillable Claim For Repayment Of Tax Deducted From Savings seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features you need to create, edit, and eSign your documents promptly without holdups. Manage Fillable Claim For Repayment Of Tax Deducted From Savings on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Fillable Claim For Repayment Of Tax Deducted From Savings with ease

- Obtain Fillable Claim For Repayment Of Tax Deducted From Savings and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize crucial sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Claim For Repayment Of Tax Deducted From Savings and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable claim for repayment of tax deducted from savings

Create this form in 5 minutes!

How to create an eSignature for the fillable claim for repayment of tax deducted from savings

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HMRC Form R40 and why do I need to download it?

The HMRC Form R40 is used to claim a tax refund for individuals who have paid too much tax on savings or investments. Downloading the HMRC Form R40 is essential for ensuring you receive any eligible refunds efficiently. With airSlate SignNow, you can easily manage and eSign your HMRC Form R40 download, streamlining the process.

-

How can I download the HMRC Form R40 using airSlate SignNow?

To download the HMRC Form R40 using airSlate SignNow, simply navigate to our platform, locate the form, and follow the prompts to download it. Our user-friendly interface makes it easy to access and manage your HMRC Form R40 download. Once downloaded, you can fill it out and eSign it directly on our platform.

-

Is there a cost associated with downloading the HMRC Form R40?

Downloading the HMRC Form R40 itself is free; however, using airSlate SignNow may involve subscription fees depending on the features you choose. Our pricing plans are designed to be cost-effective, providing great value for businesses needing to manage documents like the HMRC Form R40 download. Check our pricing page for more details.

-

What features does airSlate SignNow offer for managing the HMRC Form R40?

airSlate SignNow offers a range of features for managing the HMRC Form R40, including eSigning, document templates, and secure storage. These features ensure that your HMRC Form R40 download is not only easy to complete but also securely stored and accessible whenever you need it. Our platform enhances your document workflow signNowly.

-

Can I integrate airSlate SignNow with other applications for my HMRC Form R40?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage your HMRC Form R40 download alongside other tools you use. This integration helps streamline your workflow, making it easier to handle tax documents and other important files. Explore our integration options to see how we can enhance your productivity.

-

What are the benefits of using airSlate SignNow for my HMRC Form R40?

Using airSlate SignNow for your HMRC Form R40 offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform allows you to quickly download, fill out, and eSign your HMRC Form R40, ensuring a smooth process. Additionally, our secure environment protects your sensitive information.

-

How does airSlate SignNow ensure the security of my HMRC Form R40 download?

airSlate SignNow prioritizes security by employing advanced encryption and secure storage solutions for your documents, including the HMRC Form R40 download. We comply with industry standards to protect your data, ensuring that your information remains confidential and secure throughout the signing process. Trust us to keep your documents safe.

Get more for Fillable Claim For Repayment Of Tax Deducted From Savings

Find out other Fillable Claim For Repayment Of Tax Deducted From Savings

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online