R40 Claim for Repayment of Tax Deducted from Savings 2023

What is the R40 Claim for Repayment of Tax Deducted from Savings

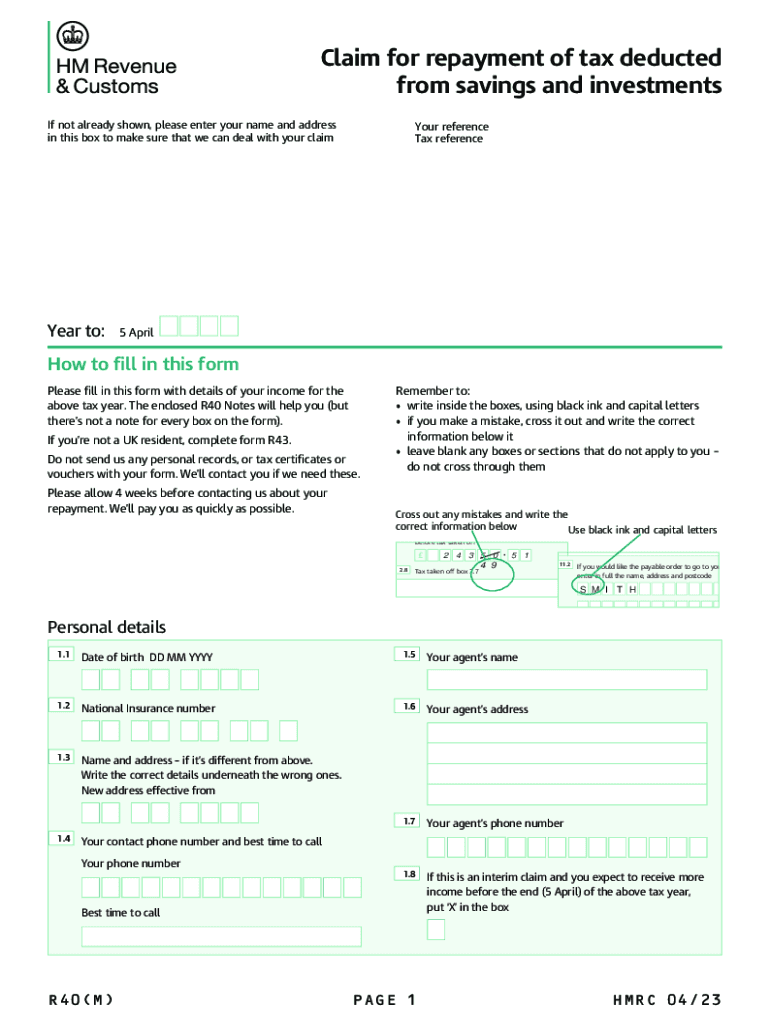

The R40 form is a tax reclaim document used in the United Kingdom, specifically designed for individuals who have had tax deducted from their savings. This form allows taxpayers to claim back any overpaid tax on interest earned from savings accounts, which may have been taxed at the basic rate. Understanding the purpose of the R40 form is essential for those eligible to ensure they receive any potential refunds due to them.

How to Use the R40 Claim for Repayment of Tax Deducted from Savings

To use the R40 form effectively, individuals must first gather all necessary information regarding their savings accounts and the tax deducted. This includes statements showing interest earned and the amount of tax withheld. Once the form is completed, it can be submitted to HM Revenue and Customs (HMRC) for processing. It is important to ensure that all details are accurate to avoid delays in receiving any refunds.

Steps to Complete the R40 Claim for Repayment of Tax Deducted from Savings

Completing the R40 form involves several key steps:

- Gather your financial information, including interest statements from your banks or building societies.

- Fill out the R40 form with your personal details and the relevant financial information.

- Double-check all entries for accuracy to prevent any issues with your claim.

- Submit the completed form to HMRC, either online or via mail, depending on your preference.

Required Documents for the R40 Claim

When submitting the R40 form, certain documents are required to support your claim. These typically include:

- Bank or building society statements showing interest earned.

- Any previous correspondence with HMRC regarding your tax status.

- Identification documents, if requested by HMRC.

Eligibility Criteria for the R40 Claim

To be eligible for a refund using the R40 form, individuals must meet specific criteria. Primarily, the claimant should have had tax deducted from their savings interest and must not have exceeded the personal savings allowance. It is also essential that the claimant is a UK resident and has not already claimed the tax back through other means.

Form Submission Methods for the R40 Claim

The R40 form can be submitted in various ways. Taxpayers may choose to complete the form online through HMRC's digital services or print and mail the form directly to HMRC. Each method has its own processing times, so individuals should consider their preferences and urgency when choosing how to submit their claim.

Quick guide on how to complete r40 claim for repayment of tax deducted from savings

Complete R40 Claim For Repayment Of Tax Deducted From Savings effortlessly on any device

Online document management has gained considerable traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Handle R40 Claim For Repayment Of Tax Deducted From Savings on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign R40 Claim For Repayment Of Tax Deducted From Savings without hassle

- Locate R40 Claim For Repayment Of Tax Deducted From Savings and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign R40 Claim For Repayment Of Tax Deducted From Savings and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r40 claim for repayment of tax deducted from savings

Create this form in 5 minutes!

How to create an eSignature for the r40 claim for repayment of tax deducted from savings

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the r40 form, and why is it important?

The r40 form is a document used for tax refunds in certain jurisdictions. It is important because it allows individuals to claim tax overpayments, which can lead to signNow financial benefits. Understanding how to properly fill out the r40 form can streamline the refund process.

-

How can airSlate SignNow help with the r40 form?

airSlate SignNow provides a user-friendly platform for electronically signing and sending the r40 form. This not only enhances the efficiency of the submission process but also ensures that your document is securely handled and easily accessible for tracking purposes.

-

What features does airSlate SignNow offer for the r40 form?

airSlate SignNow offers features such as customizable templates, secure e-signatures, and document tracking specifically for the r40 form. These features make it easier to manage your forms and ensure compliance with legal signing requirements.

-

Is there a cost associated with using airSlate SignNow for the r40 form?

Yes, there are different pricing plans available for using airSlate SignNow for the r40 form. These plans are designed to be cost-effective and cater to various business needs, allowing you to choose the one that best suits your requirements without overspending.

-

Can I integrate airSlate SignNow with other software for managing the r40 form?

Absolutely! airSlate SignNow offers seamless integrations with popular software solutions that can help you manage the r40 form more efficiently. Integrations with platforms like Google Drive, Salesforce, and others can enhance your workflow, making document management a breeze.

-

What benefits does airSlate SignNow provide when processing the r40 form?

Using airSlate SignNow for the r40 form streamlines the signing process, saves time, and reduces the potential for errors. The ability to electronically sign documents also increases convenience, ensuring that your forms are processed quickly and efficiently.

-

Is the r40 form secure when using airSlate SignNow?

Yes, the r40 form is secured when processed through airSlate SignNow. The platform employs advanced encryption and security protocols to protect your sensitive information, giving you peace of mind while managing your documents.

Get more for R40 Claim For Repayment Of Tax Deducted From Savings

- Specialty pharmacy program exception form anthem

- Vocabulary workshop level e answer key pdf form

- Club cash advance form pub

- How is a controlled experiment performed virtual lab

- What did cupid say when asked where is there honey underground form

- Mo 1040 v form

- Sample nursing student resume baylor university baylor form

- Form ew 212 may fax to 304 558 4322 or mail t

Find out other R40 Claim For Repayment Of Tax Deducted From Savings

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy