REG 1 , Business Taxes Registration Application Intuit 2006

Understanding the REG 1, Business Taxes Registration Application Intuit

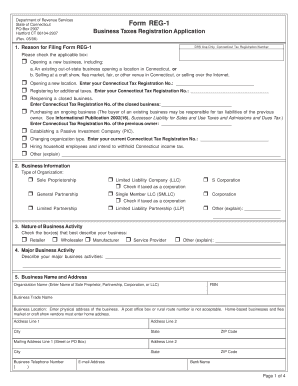

The REG 1, Business Taxes Registration Application Intuit is a crucial document for businesses in the United States looking to register for various state taxes. This form is typically used to collect essential information about the business, including its name, address, and type of business activities. By completing this application, businesses can ensure they are compliant with state tax regulations and can properly remit taxes owed.

Steps to Complete the REG 1, Business Taxes Registration Application Intuit

Completing the REG 1 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, such as your business's legal name, address, and federal Employer Identification Number (EIN). Next, accurately fill out each section of the form, paying close attention to the specific tax types applicable to your business. Finally, review the completed application for any errors before submission. This careful approach will help prevent delays in processing.

Key Elements of the REG 1, Business Taxes Registration Application Intuit

The REG 1 form includes several critical sections that must be completed. These sections typically cover:

- Business Information: Name, address, and contact details.

- Ownership Structure: Type of business entity, such as LLC, corporation, or partnership.

- Tax Types: Indication of which state taxes the business will be liable for, including sales tax and employment tax.

- Signature: An authorized representative must sign the application to validate the information provided.

Legal Use of the REG 1, Business Taxes Registration Application Intuit

The REG 1 form is legally binding once completed and submitted to the appropriate state agency. It serves as an official declaration of a business's intent to operate within the state and comply with tax obligations. Businesses must ensure that all information is accurate and truthful, as providing false information can lead to penalties and legal repercussions.

Form Submission Methods for the REG 1, Business Taxes Registration Application Intuit

Businesses can submit the REG 1 form through various methods, depending on state regulations. Common submission methods include:

- Online Submission: Many states offer an online portal for electronic filing, which can expedite processing times.

- Mail: The form can often be printed and mailed to the appropriate state tax office.

- In-Person Submission: Some businesses may choose to submit the form in person at their local tax office for immediate confirmation.

Filing Deadlines for the REG 1, Business Taxes Registration Application Intuit

Each state may have different deadlines for submitting the REG 1 form. It is essential for businesses to be aware of these deadlines to avoid penalties. Typically, businesses should aim to submit the application before they commence operations or as soon as possible after establishing the business. Checking the specific state's guidelines will provide the most accurate information regarding filing deadlines.

Quick guide on how to complete reg 1 business taxes registration application intuit

Prepare REG 1 , Business Taxes Registration Application Intuit effortlessly on any device

Online document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, adjust, and eSign your documents rapidly and without delays. Handle REG 1 , Business Taxes Registration Application Intuit on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign REG 1 , Business Taxes Registration Application Intuit with ease

- Obtain REG 1 , Business Taxes Registration Application Intuit and click Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all information carefully and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, laborious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign REG 1 , Business Taxes Registration Application Intuit to ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reg 1 business taxes registration application intuit

Create this form in 5 minutes!

How to create an eSignature for the reg 1 business taxes registration application intuit

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the REG 1, Business Taxes Registration Application Intuit?

The REG 1, Business Taxes Registration Application Intuit is a comprehensive tool designed to help businesses effectively register for various state taxes. It streamlines the process of submitting the necessary forms, ensuring compliance and minimizing errors. With airSlate SignNow's eSigning capabilities, this application enhances the efficiency of your tax registration process.

-

How does airSlate SignNow simplify the REG 1, Business Taxes Registration Application Intuit?

airSlate SignNow simplifies the REG 1, Business Taxes Registration Application Intuit by providing an easy-to-use digital platform for document management and eSigning. Users can quickly fill out the registration form and sign it electronically, saving time and reducing the hassle of printing and mailing paperwork. This ensures a smoother registration process for your business.

-

What are the benefits of using airSlate SignNow for the REG 1, Business Taxes Registration Application Intuit?

Using airSlate SignNow for the REG 1, Business Taxes Registration Application Intuit offers numerous benefits, including increased efficiency, enhanced accuracy, and reduced processing times. The platform provides a secure environment for your sensitive information, ensuring that documents are protected throughout the registration process. Additionally, you can access completed applications quickly and easily.

-

Is airSlate SignNow cost-effective for filing the REG 1, Business Taxes Registration Application Intuit?

Yes, airSlate SignNow is a cost-effective solution for filing the REG 1, Business Taxes Registration Application Intuit. With its subscription plans tailored for various business sizes, you can choose an option that fits your budget while still accessing powerful features. The time saved through automation and efficiency further enhances its value proposition.

-

What features does airSlate SignNow offer for the REG 1, Business Taxes Registration Application Intuit?

airSlate SignNow provides several robust features for the REG 1, Business Taxes Registration Application Intuit, such as electronic signatures, document templates, and workflow automation. These features allow businesses to create, send, and manage documents seamlessly. Additionally, tracking tools enable you to monitor the status of your applications in real-time.

-

Can airSlate SignNow integrate with accounting software for the REG 1, Business Taxes Registration Application Intuit?

Yes, airSlate SignNow can integrate with various accounting software solutions, enhancing the efficiency of the REG 1, Business Taxes Registration Application Intuit process. By connecting your existing tools, you can automatically import data and streamline workflows, ensuring smooth data transfer and compliance management. This integration empowers users to maintain organized financial records effortlessly.

-

What support does airSlate SignNow provide for the REG 1, Business Taxes Registration Application Intuit?

airSlate SignNow offers dedicated customer support for users navigating the REG 1, Business Taxes Registration Application Intuit. Whether you have questions about setup or need assistance with features, their support team is available to guide you. Access helpful resources, including FAQs and tutorials, to ensure a smooth user experience.

Get more for REG 1 , Business Taxes Registration Application Intuit

- Assumption agreement of deed of trust and release of original mortgagors maryland form

- Unlawful detainer 497310437 form

- Expungement in maryland form

- Final settlement agreement form

- Maryland request form

- Maryland request hearing form

- Maryland reconsideration form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497310444 form

Find out other REG 1 , Business Taxes Registration Application Intuit

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online