CTE 50 Kansas Department of Revenue Ksrevenue 2011

What is the CTE 50 Kansas Department Of Revenue Ksrevenue

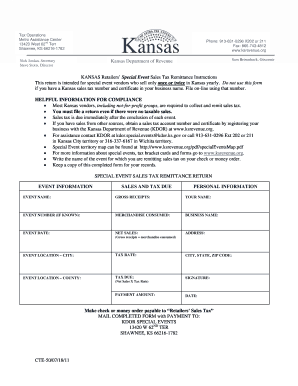

The CTE 50 form, issued by the Kansas Department of Revenue, is a critical document used for tax purposes. It primarily serves as a certificate of exemption for certain transactions. This form is essential for individuals and businesses seeking to claim exemptions from sales tax on specific purchases, thereby ensuring compliance with Kansas tax regulations. Understanding the purpose and implications of the CTE 50 is vital for anyone engaging in exempt transactions within the state.

How to use the CTE 50 Kansas Department Of Revenue Ksrevenue

Using the CTE 50 form involves several straightforward steps. First, individuals or businesses must accurately complete the form, providing necessary details such as the purchaser's information and the nature of the exempt purchase. After filling out the form, it should be presented to the seller at the time of the transaction. The seller retains the form for their records, ensuring that they comply with state tax laws. Proper use of the CTE 50 can facilitate seamless transactions while maintaining compliance with Kansas tax regulations.

Steps to complete the CTE 50 Kansas Department Of Revenue Ksrevenue

Completing the CTE 50 form requires careful attention to detail. Here are the key steps:

- Download the CTE 50 form from the Kansas Department of Revenue website or obtain a physical copy.

- Fill in the purchaser's name, address, and the type of exemption being claimed.

- Provide a description of the items being purchased and the reason for the exemption.

- Sign and date the form to certify the information is accurate.

- Present the completed form to the seller during the transaction.

Following these steps ensures that the form is completed correctly, minimizing the risk of issues during tax audits.

Legal use of the CTE 50 Kansas Department Of Revenue Ksrevenue

The legal use of the CTE 50 form is governed by Kansas tax laws. This form must be used only for legitimate exempt purchases, and misuse can lead to penalties. To ensure compliance, it is essential that the purchaser understands the specific exemptions allowed under Kansas law. The form must be accurately completed and presented to the seller to validate the exemption claim. Adhering to these legal requirements protects both the purchaser and seller during tax assessments.

Required Documents for the CTE 50 Kansas Department Of Revenue Ksrevenue

When completing the CTE 50 form, certain documents may be required to support the exemption claim. These can include:

- Proof of the purchaser's tax-exempt status, such as a tax-exempt certificate.

- Invoices or receipts for the purchases being claimed as exempt.

- Any additional documentation that verifies the nature of the exempt purchase.

Having these documents ready can streamline the process and ensure compliance with the Kansas Department of Revenue's requirements.

Form Submission Methods for the CTE 50 Kansas Department Of Revenue Ksrevenue

The CTE 50 form can be submitted through various methods, depending on the seller's preferences. Typically, the form is presented in person at the time of the transaction. However, some sellers may allow for electronic submission via email or other digital means. It is important to confirm with the seller their preferred method of receiving the CTE 50 to ensure that the exemption is properly documented and accepted.

Quick guide on how to complete cte 50 kansas department of revenue ksrevenue

Complete CTE 50 Kansas Department Of Revenue Ksrevenue effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage CTE 50 Kansas Department Of Revenue Ksrevenue on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest method to alter and eSign CTE 50 Kansas Department Of Revenue Ksrevenue with ease

- Obtain CTE 50 Kansas Department Of Revenue Ksrevenue and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the tedious search for forms, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your preferred device. Modify and eSign CTE 50 Kansas Department Of Revenue Ksrevenue and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cte 50 kansas department of revenue ksrevenue

Create this form in 5 minutes!

How to create an eSignature for the cte 50 kansas department of revenue ksrevenue

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the CTE 50 Kansas Department Of Revenue Ksrevenue form?

The CTE 50 Kansas Department Of Revenue Ksrevenue form is a crucial document used for tax purposes. This form ensures that businesses comply with state tax regulations, enabling easy reporting and efficient processing of tax-related activities.

-

How can airSlate SignNow assist with the CTE 50 Kansas Department Of Revenue Ksrevenue form?

airSlate SignNow simplifies the process of completing and submitting the CTE 50 Kansas Department Of Revenue Ksrevenue form. With our eSigning capabilities, you can quickly gather signatures, ensuring a smooth and compliant submission process.

-

What are the pricing options for using airSlate SignNow for CTE 50 Kansas Department Of Revenue Ksrevenue?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You'll find options that allow you to manage your CTE 50 Kansas Department Of Revenue Ksrevenue forms efficiently while keeping your costs low.

-

What features does airSlate SignNow provide for handling CTE 50 Kansas Department Of Revenue Ksrevenue forms?

AirSlate SignNow provides features such as customizable templates, secure storage, and real-time tracking for CTE 50 Kansas Department Of Revenue Ksrevenue forms. These capabilities help streamline your workflow, saving time and reducing the risk of errors.

-

Is airSlate SignNow compliant with the CTE 50 Kansas Department Of Revenue Ksrevenue requirements?

Yes, airSlate SignNow is fully compliant with the security and legal requirements for processing the CTE 50 Kansas Department Of Revenue Ksrevenue form. This ensures that your documents are handled securely and meet all regulatory standards.

-

Can I integrate airSlate SignNow with other applications for CTE 50 Kansas Department Of Revenue Ksrevenue?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage CTE 50 Kansas Department Of Revenue Ksrevenue forms within your existing workflow. This connectivity helps streamline processes and improve overall efficiency.

-

What benefits does airSlate SignNow offer for businesses filing CTE 50 Kansas Department Of Revenue Ksrevenue?

By using airSlate SignNow, businesses benefit from faster turnaround times, reduced paper usage, and improved accuracy when filing the CTE 50 Kansas Department Of Revenue Ksrevenue form. Our platform empowers you to focus on your core tasks while we handle the paperwork.

Get more for CTE 50 Kansas Department Of Revenue Ksrevenue

Find out other CTE 50 Kansas Department Of Revenue Ksrevenue

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure