KANSAS DEPARTMENT of REVENUE SPECIAL EVENT SALES TAX REMITTANCE RETURN 2022-2026

Understanding the Kansas Department of Revenue Special Event Sales Tax Remittance Return

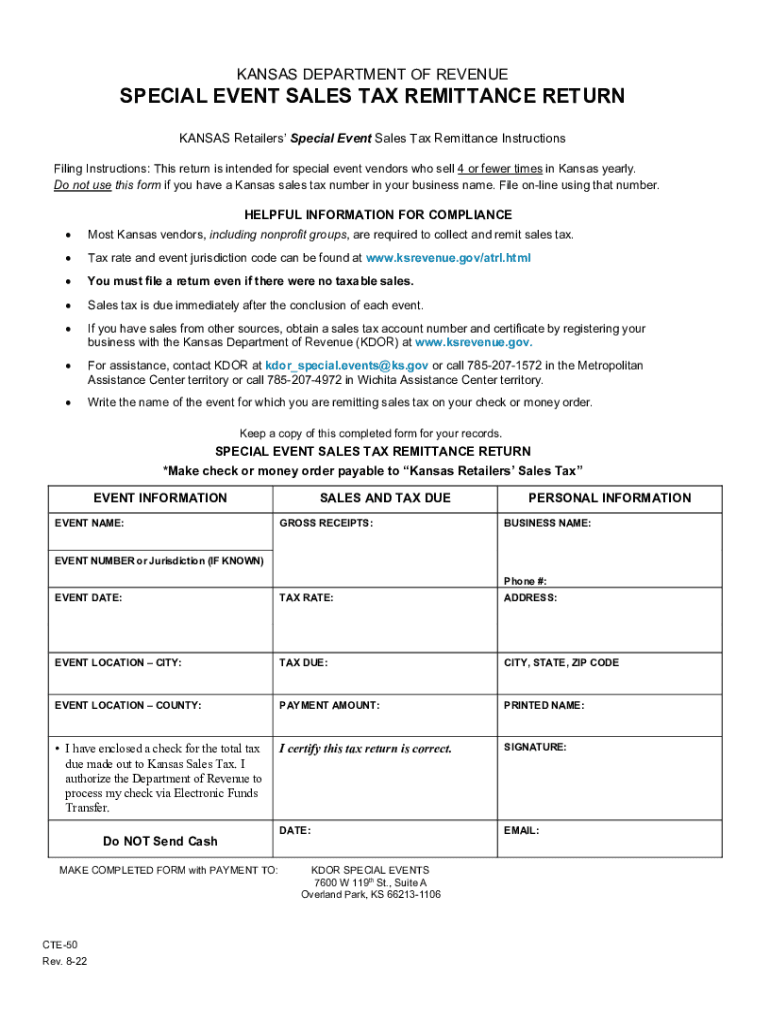

The Kansas Department of Revenue Special Event Sales Tax Remittance Return is a crucial document for businesses hosting events that involve sales. This form allows event organizers to report and remit sales tax collected during special events, ensuring compliance with state tax regulations. It is essential for maintaining transparency and accountability in financial dealings related to events. The return includes details about the sales made, the tax collected, and the total amount due to the state.

Steps to Complete the Kansas Special Event Sales Tax Remittance Return

Completing the Kansas Special Event Sales Tax Remittance Return involves several key steps:

- Gather necessary information, including event details, sales figures, and tax rates.

- Fill out the return form accurately, ensuring all sections are completed.

- Calculate the total sales tax collected during the event.

- Double-check all entries for accuracy to avoid errors.

- Submit the completed return by the specified deadline.

Legal Use of the Kansas Special Event Sales Tax Remittance Return

The Kansas Special Event Sales Tax Remittance Return is legally binding when completed and submitted in accordance with state regulations. It serves as proof of compliance with tax obligations and can be used in the event of an audit. To ensure legal validity, it is important that the form is signed and submitted through an authorized method, such as online filing or mail.

Filing Deadlines for the Kansas Special Event Sales Tax Remittance Return

Filing deadlines for the Kansas Special Event Sales Tax Remittance Return vary depending on the event date. Typically, returns must be filed within a specific timeframe after the event concludes. It is crucial to be aware of these deadlines to avoid penalties. Keeping track of important dates ensures that the return is submitted on time, maintaining compliance with state tax laws.

Required Documents for the Kansas Special Event Sales Tax Remittance Return

To complete the Kansas Special Event Sales Tax Remittance Return, certain documents are necessary. These may include:

- Sales records from the event.

- Invoices or receipts showing the sales tax collected.

- Any prior correspondence with the Kansas Department of Revenue regarding the event.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Submission Methods for the Kansas Special Event Sales Tax Remittance Return

The Kansas Special Event Sales Tax Remittance Return can be submitted through various methods, including:

- Online submission via the Kansas Department of Revenue website.

- Mailing a physical copy of the return to the appropriate office.

- In-person submission at designated locations.

Choosing the right submission method can enhance efficiency and ensure timely processing of the return.

Quick guide on how to complete kansas department of revenue special event sales tax remittance return

Complete KANSAS DEPARTMENT OF REVENUE SPECIAL EVENT SALES TAX REMITTANCE RETURN effortlessly on any device

Digital document management has gained traction with organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, amend, and electronically sign your documents promptly without delays. Handle KANSAS DEPARTMENT OF REVENUE SPECIAL EVENT SALES TAX REMITTANCE RETURN on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to modify and electronically sign KANSAS DEPARTMENT OF REVENUE SPECIAL EVENT SALES TAX REMITTANCE RETURN with ease

- Obtain KANSAS DEPARTMENT OF REVENUE SPECIAL EVENT SALES TAX REMITTANCE RETURN and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive data using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign KANSAS DEPARTMENT OF REVENUE SPECIAL EVENT SALES TAX REMITTANCE RETURN and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas department of revenue special event sales tax remittance return

Create this form in 5 minutes!

People also ask

-

What is the Kansas CTE50 tax and how does it affect businesses?

The Kansas CTE50 tax is a tax incentive designed to support businesses in the education and training sectors. By understanding this tax, businesses can leverage potential savings while investing in workforce development. This can signNowly impact cash flow and profitability for companies operating in Kansas.

-

How can airSlate SignNow help with Kansas CTE50 tax documentation?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign documents related to the Kansas CTE50 tax. This easy-to-use solution ensures that all documentation is compliant and securely stored, saving time and reducing administrative burdens. Effortlessly managing these documents can contribute to better financial management.

-

What are the pricing options for using airSlate SignNow with Kansas CTE50 tax needs?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs, including those focused on Kansas CTE50 tax. These plans are designed to be cost-effective while providing essential features for document management and eSigning. Businesses can choose a plan that best fits their budget while ensuring they effectively manage Kansas CTE50 tax documentation.

-

What features does airSlate SignNow offer that are beneficial for Kansas CTE50 tax compliance?

AirSlate SignNow includes features such as secure eSigning, customizable templates, and real-time tracking, all of which are advantageous for managing Kansas CTE50 tax compliance. These features help ensure that all necessary documents are signed and stored digitally, facilitating easy access and compliance with Kansas state regulations. The solution promotes efficiency and accountability in tax-related processes.

-

How does airSlate SignNow integrate with other software for Kansas CTE50 tax purposes?

airSlate SignNow seamlessly integrates with various third-party applications, enhancing workflow for those managing Kansas CTE50 tax documentation. By connecting with accounting, CRM, and HR software, businesses can automate data transfer and improve operational efficiency. This integration capability minimizes errors and streamlines the overall tax documentation process.

-

Can airSlate SignNow help me track my Kansas CTE50 tax submissions?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Kansas CTE50 tax submissions. You can receive notifications when documents are viewed or signed, ensuring timely follow-ups and compliance. This valuable tracking functionality is essential for maintaining accurate records and effective communication with stakeholders.

-

Is airSlate SignNow secure for handling Kansas CTE50 tax documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive Kansas CTE50 tax documents. The platform uses advanced encryption and authentication protocols to safeguard all data transmitted and stored. Users can have peace of mind knowing their tax-related information is well-protected against unauthorized access.

Get more for KANSAS DEPARTMENT OF REVENUE SPECIAL EVENT SALES TAX REMITTANCE RETURN

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction new 497321318 form

- Letter from landlord to tenant returning security deposit less deductions new york form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return new york form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return new york form

- Letter landlord request form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages new form

- New york letter rent form

- Letter tenant landlord sample 497321325 form

Find out other KANSAS DEPARTMENT OF REVENUE SPECIAL EVENT SALES TAX REMITTANCE RETURN

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer