Natwest Frb Form

What is the Natwest Frb?

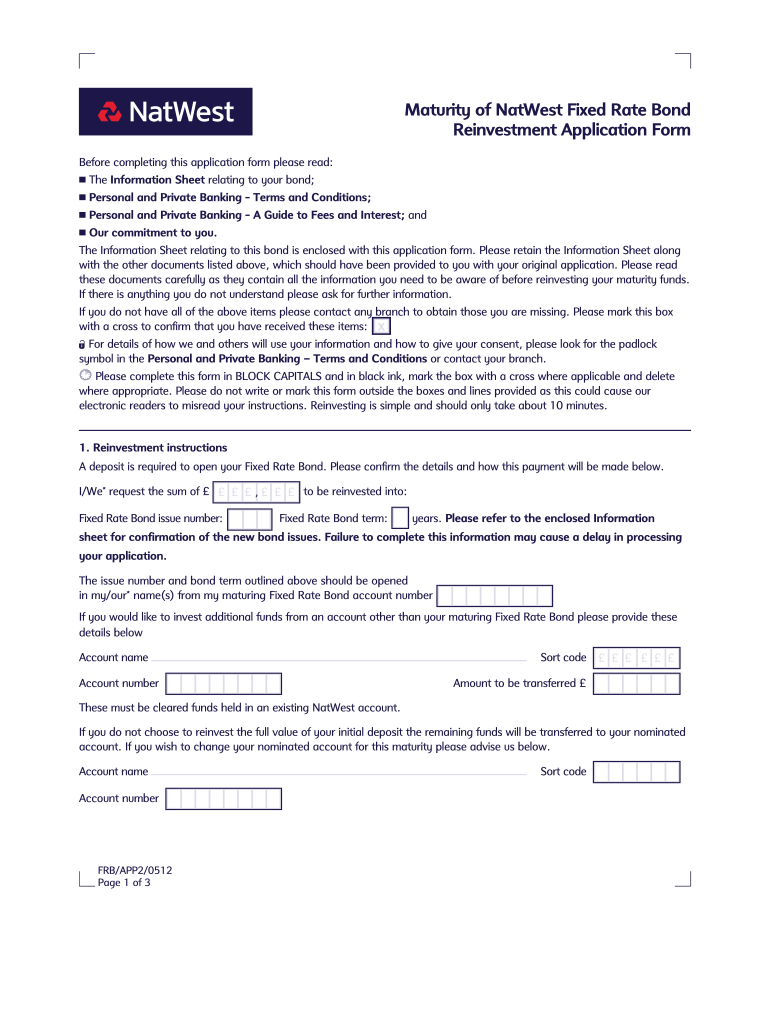

The Natwest Frb, or the maturity rate form, is a document used primarily for managing and documenting the maturity of investment bonds issued by Natwest. This form is essential for individuals and businesses looking to track the maturity of their bonds, ensuring they can make informed decisions regarding reinvestment or withdrawal. The maturity rate form captures critical information, such as the bond's maturity date, interest rates, and any options available upon maturity.

Steps to Complete the Natwest Frb

Completing the maturity rate form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information related to your bond, including the bond number and maturity date. Next, fill out the required fields on the form, ensuring that all information is accurate and complete. Common sections include personal details, bond details, and instructions for what to do upon maturity. After completing the form, review it thoroughly for any errors before submission.

Legal Use of the Natwest Frb

The maturity rate form must be completed in accordance with legal requirements to ensure its validity. This includes adhering to regulations set forth by financial governing bodies in the United States. It is crucial to provide truthful and accurate information, as inaccuracies can lead to legal repercussions, including penalties or invalidation of the document. Familiarizing oneself with the relevant laws can help ensure compliance and protect against potential issues.

Required Documents

When completing the Natwest maturity rate form, certain documents may be required to support your application. These typically include proof of identity, such as a government-issued ID, and documentation related to the bond, such as purchase receipts or prior statements. Having these documents ready can facilitate a smoother application process and ensure that all necessary information is readily available for review.

Form Submission Methods

The maturity rate form can typically be submitted through various methods, depending on the preferences of the user and the requirements of Natwest. Options may include online submission through a secure portal, mailing the completed form to a designated address, or delivering it in person at a local branch. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits your needs.

Eligibility Criteria

To utilize the maturity rate form, individuals must meet specific eligibility criteria set by Natwest. Generally, this includes being the registered owner of the bond and having the legal capacity to manage financial documents. Additionally, certain age restrictions may apply, particularly for minors. Understanding these criteria can help ensure that the form is completed correctly and that the user qualifies for the options available upon maturity.

Quick guide on how to complete maturity of natwest fixed rate bond reinvestment application form

A concise guide on how to prepare your Natwest Frb

Finding the appropriate template can turn into a difficulty when you are required to present official international documents. Even if you possess the necessary form, it can be tedious to swiftly prepare it in accordance with all the specifications if you rely on physical copies instead of handling everything online. airSlate SignNow is the digital eSignature platform that assists you in navigating these challenges. It enables you to select your Natwest Frb and promptly complete and sign it on-site without needing to reprint documents whenever you make an error.

Here are the steps you should follow to prepare your Natwest Frb with airSlate SignNow:

- Click the Get Form button to swiftly upload your document to our editor.

- Begin with the first empty field, enter your information, and proceed with the Next tool.

- Use the Cross and Check tools from the panel above to fill in the blank spaces.

- Choose the Highlight or Line options to emphasize the most important information.

- Select Image and upload one if your Natwest Frb requires it.

- Utilize the right-hand pane to add additional fields for you or others to complete if needed.

- Review your inputs and approve the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing process by clicking the Done button and selecting your file-sharing preferences.

After your Natwest Frb is ready, you can share it however you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your preferences. Don’t spend time on manual document completion; try airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

How do people quantify interest rate risk in fixed income markets? Does the elasticity of bond price against market yield to maturity make sense?

The opposite of the elasticity of a bond price with respect to yield to maturity is called the “modified duration” of the bond.Modified duration cannot be used to quantify interest rate risk in a fixed income portfolio. One minor problem is that it doesn’t aggregate, you’re better off using the derivative of bond price with respect to yield because you can add those up. With modified duration you’d have to take the sum weighted by market value and that doesn’t work for derivative securities.One major problem is modified duration only tells you the relation of price volatility to yield volatility, and only for small yield moves. So it ignores credit, funding, liquidity, volatility, optionality and other risks; and even for price risk it only gives you a conversion factor for translating yield risk to price risk, not an absolute measure of risk.The other major problem is that you’re taking the derivative of the price of each security on its own yield. You’re answering the question, “What will happen to the price of my portfolio if all yields to maturity move by the same amount?” But that’s not a realistic scenario, and it can miss most of the risk.If your portfolio consists only of long position in bonds of similar credit quality and maturity, then portfolio modified duration captures most of the first order price volatility. But for general fixed-income portfolios, most of the price risk can arise from yields changing relative to one another.For example, consider a portfolio that buys one ten-year bond and shorts enough one-year bonds (say 8, but the exact number depends on interest rates) such that the net modified duration is zero. That is by no means a riskless portfolio.There are several approaches for quantifying risk in a fixed-income portfolio depending on the type of portfolio. You can model interest rate moves explicitly and include terms for other risks. One simple model is to decompose the yield curve into principle components and estimate the volatility of each component and the portfolio’s exposure to it. Or you can bootstrap a forward volatility surface.

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

Create this form in 5 minutes!

How to create an eSignature for the maturity of natwest fixed rate bond reinvestment application form

How to make an electronic signature for the Maturity Of Natwest Fixed Rate Bond Reinvestment Application Form in the online mode

How to create an electronic signature for the Maturity Of Natwest Fixed Rate Bond Reinvestment Application Form in Chrome

How to make an eSignature for putting it on the Maturity Of Natwest Fixed Rate Bond Reinvestment Application Form in Gmail

How to generate an electronic signature for the Maturity Of Natwest Fixed Rate Bond Reinvestment Application Form straight from your smart phone

How to create an electronic signature for the Maturity Of Natwest Fixed Rate Bond Reinvestment Application Form on iOS

How to generate an electronic signature for the Maturity Of Natwest Fixed Rate Bond Reinvestment Application Form on Android

People also ask

-

What is Natwest Frb and how does it relate to airSlate SignNow?

Natwest Frb refers to the financial services provided by NatWest Bank, which can be integrated with airSlate SignNow for secure electronic signing. By using airSlate SignNow alongside Natwest Frb, businesses can streamline their document signing processes, ensuring compliance and efficiency in financial transactions.

-

How can airSlate SignNow enhance my experience with Natwest Frb?

Using airSlate SignNow with Natwest Frb allows for a seamless workflow when managing contracts and agreements. You can easily send and eSign documents directly linked to your Natwest Frb account, saving time and reducing paperwork while increasing your overall productivity.

-

Is there a cost associated with using airSlate SignNow with Natwest Frb?

Yes, airSlate SignNow offers various pricing plans designed to suit different business needs. While the integration with Natwest Frb itself does not incur additional fees, you should consider your subscription plan for airSlate SignNow to fully utilize its features in conjunction with Natwest Frb.

-

What features does airSlate SignNow offer for Natwest Frb users?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure electronic signatures specifically tailored for users of Natwest Frb. These features enhance your document management experience, ensuring that all transactions are efficient and legally binding.

-

Can I integrate airSlate SignNow with other applications used alongside Natwest Frb?

Absolutely! airSlate SignNow offers extensive integrations with various applications commonly used in conjunction with Natwest Frb. This allows for a more comprehensive workflow, enabling you to manage documents efficiently while keeping your financial processes aligned.

-

What benefits can businesses expect when using airSlate SignNow with Natwest Frb?

Businesses can expect increased efficiency, reduced turnaround times, and improved compliance when using airSlate SignNow with Natwest Frb. The combination of secure eSigning and easy document management helps organizations maintain a competitive edge in their operations.

-

Is airSlate SignNow secure for transactions related to Natwest Frb?

Yes, airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, making it safe for transactions associated with Natwest Frb. You can confidently send and eSign sensitive documents, knowing that your data is protected.

Get more for Natwest Frb

- 4 redf construction mgr technical qualification questionnaire rev 4doc form

- Request to change primary care provider form

- Reproductive health questionnaire pdf form

- Patient resources ucla bariatric surgery los angeles ca form

- Connectyourcare fsa claim form flexible spending accounts claim form

- Star referral form

- Your hr service center university of mississippi medical center form

- Peak of ohio home form

Find out other Natwest Frb

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation