Mc 210 S I 2008-2026

What is the MC 210 S I?

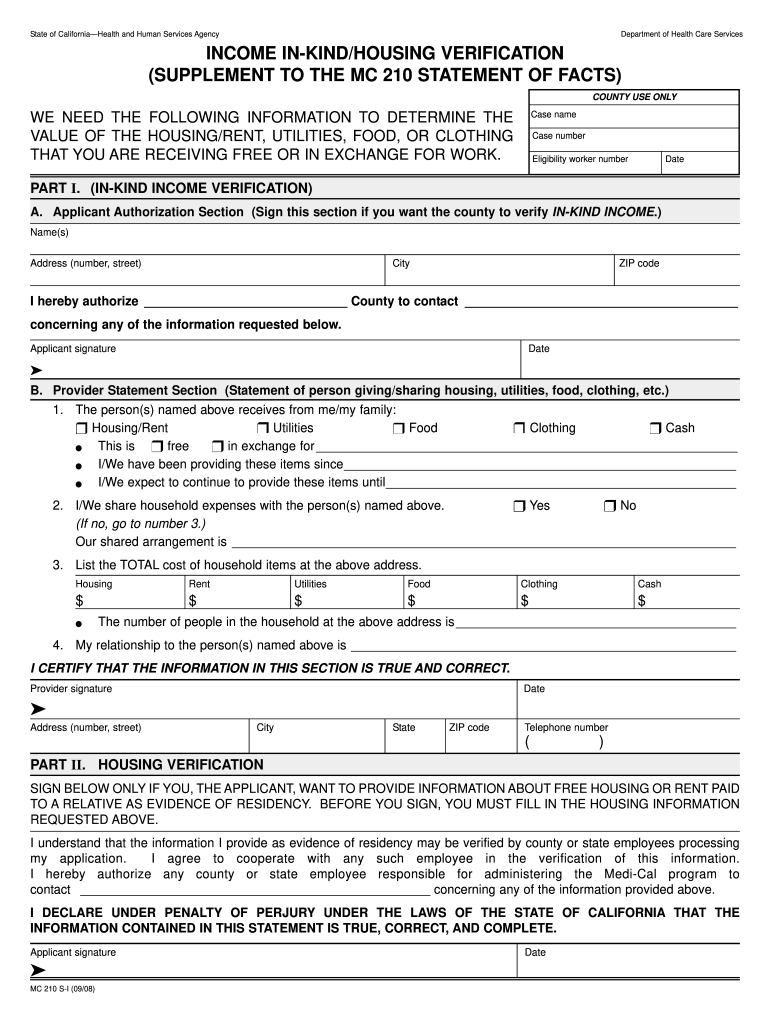

The MC 210 S I form is an essential document used primarily for educational income deduction verification. This form helps organizations verify the income of individuals who are applying for housing assistance or other benefits. It is particularly important for ensuring that applicants meet the necessary income criteria set forth by various housing programs. The MC 210 S I form is designed to capture detailed information about the applicant's income sources, including wages, benefits, and any in-kind contributions.

How to Use the MC 210 S I

Using the MC 210 S I form involves several key steps. First, gather all necessary documentation related to income, such as pay stubs, tax returns, and any other relevant financial records. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to provide truthful and comprehensive information, as any discrepancies may lead to delays or denials in processing. Once the form is completed, it should be submitted to the appropriate agency or organization responsible for processing housing assistance applications.

Steps to Complete the MC 210 S I

Completing the MC 210 S I form requires attention to detail. Follow these steps for a successful submission:

- Gather all relevant income documentation, including pay stubs and tax documents.

- Fill out personal information, including name, address, and contact details.

- Provide detailed information about all sources of income, including wages, benefits, and any in-kind contributions.

- Review the completed form for accuracy and completeness.

- Submit the form to the designated agency or organization, following their specific submission guidelines.

Legal Use of the MC 210 S I

The MC 210 S I form must be used in compliance with applicable laws and regulations. It is crucial that the information provided is accurate and truthful to avoid legal repercussions. Organizations that utilize this form are typically required to maintain confidentiality and protect the personal information of applicants. Additionally, the form must adhere to any state-specific regulations regarding income verification and housing assistance.

Eligibility Criteria

Eligibility for using the MC 210 S I form generally depends on the specific housing assistance program. Applicants must typically demonstrate financial need and meet certain income thresholds. It is essential to review the criteria set forth by the administering agency to ensure that all requirements are met. Individuals seeking assistance should be prepared to provide documentation that verifies their income and any other relevant financial information.

Required Documents

To successfully complete the MC 210 S I form, applicants should prepare the following documents:

- Recent pay stubs or proof of income.

- Tax returns from the previous year.

- Documentation of any government benefits received.

- Records of any in-kind contributions, such as housing or food assistance.

Form Submission Methods

The MC 210 S I form can typically be submitted through various methods, depending on the requirements of the receiving agency. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate office.

- In-person submission at a local agency office.

Quick guide on how to complete income in kind verification form

Utilize the simpler method for managing your Mc 210 S I

The traditional methods of filling out and endorsing paperwork consume an excessively lengthy duration compared to contemporary document management options. Previously, you would seek the relevant social forms, print them, fill in all the information, and dispatch them via postal service. Now, you can obtain, fill out, and sign your Mc 210 S I all within a single browser tab using airSlate SignNow. Preparing your Mc 210 S I has never been easier.

Steps to finalize your Mc 210 S I with airSlate SignNow

- Navigate to the relevant category page and locate your state-specific Mc 210 S I. Alternatively, utilize the search function.

- Verify that the version of the form is accurate by previewing it.

- Click Get form and enter editing mode.

- Fill in your document with the necessary details using the editing tools.

- Examine the included information and click the Sign tool to validate your form.

- Select the most suitable method to create your signature: generate it, draw your signature, or upload its image.

- Click DONE to preserve changes.

- Download the document to your device or proceed to Sharing settings to send it electronically.

Robust online tools such as airSlate SignNow facilitate the completion and submission of your forms. Give it a try to discover the actual duration document management and approval processes are intended to take. You will save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How do I fill out the MHT-CET MBA exam application form in detail?

DTE Maharashtra has discharged MHT CET 2018 application form as on January 18 in online mode, can be filled by competitors by following the means said in how to fill MHT CET application frame 2018. Applicants who need to enlist themselves for the selection test should take after the means as given in how to fill MHT CET 2018 application form to maintain a strategic distance from oversights and entire method to go smooth and bother free. The means to fill the application type of MHT CET 2018 incorporates enlistment, filling of required subtle elements, transferring of filtered reports, instalment and affirmation page download. Hopefuls are required to fill the application type of MHT CET 2018 painstakingly to stay away from dismissal by the specialists. It is essential to take the application shape filling methodology of MHT CET genuinely on the grounds that exclusive those hopefuls who will present their structures effectively will get concede cards. Such applicants who will have legitimate MHT CET 2018 concede cards will be permitted to show up in the exam.Competitors must read the means offered underneath to fill and submit MHT CET 2018 application frame in a sorted-out way:Stage 1 – RegistrationApplicants should enrol themselves and give the required details. Candidate should concur whether he or she is an Indian resident or not.Proceeding onward, they will be required to fill the accompanying individual subtle elements:Full name (as showing up on the announcement of characteristics of SSC tenth or proportional exam), Father’s name, Mother’s first name, Last name, Gender, Contact Information, Address for correspondence, House No/Street, Area Name, Town/City , State, District, Pin code, Country, Mobile Number, Primary Email Id (Email will be sent to this email ID), Alternate Email Id (Parent’s Email ID, if accessible), Contact Telephone No. (with STD Code), Permanent Residence in Village/Town/City, Domicile of Maharashtra/Disputed Maharashtra Karnataka Border (MKB)/Outside Maharashtra, Reservation, Category of competitor (Caste perceived in Maharashtra state), Candidates having a place with SC, ST, VJ(A), NT(B), NT(C), NT(D), OBC and SBC classes must have their individual standing authentications, Candidates having a place with Non Creamy Layer (NCL) should create substantial testament upto March 31, 2019, Other DetailsRegardless of whether the candidate has a place with – PWD class or not (competitors qualified who are qualified under this classification ought to have under 40% incapacity), visually impaired, low vision. Orthopedically debilitated and competitors influenced with Cerebral Palsy and Dyslexia, who are not in a situation to compose, can benefit a copyist/author for the MHT-CET 2018 examRegardless of whether the applicant is a J&K vagrant or notReligionOther placement tests that applicant has enrolled for (JEE Main/NEET/None)Add up to Annual Family IncomeAadhaar NumberFinancial balance DetailsName of the record holder according to Bank recordName of the BankName of the Bank BranchKind of Account (Savings/Current)Financial balance NumberIFSC CodePoints of interest of HSC (twelfth/Equivalent Examination)Regardless of whether hopeful has passed/showed up for confirmation in Pharmacy (just for Biology applicants)Place from where hopeful has finished HSC (twelfth)/proportional exam showing up/Passed from school/Jr. School arranged (Maharashtra/Outside Maharashtra)Subtle elements required for MHT-CET 2018Subjects for CET examination (Physics, Chemistry, Mathematics, Biology)Dialect for the exam (English, Marathi, Urdu)Enter secret keyCompetitors should make a secret word (least 8 and most extreme 15 characters and should have one capitalized, one lower case and one numeric)In the wake of entering the secret key, competitors should affirm it. This secret word will be utilized for future logins.Statement by the hopefulApplicants should read the revelation composed and after that tap on “I Agree”Applicants need to enter the security key as gave and after that tap on “Next” catchStage 2 – Confirmation and SubmissionIn the wake of filling the previously mentioned subtle elements, hopefuls will have the capacity to check the data filled and alter certain things in the application frame.Applicants can backpedal and change or alter the accompanying particulars (as noticeable in green shading) before accommodation:Exam focusSubjects pickedDialect of the examIndividual with handicap choiceIn any case, there are particulars (as unmistakable in blue shading) that can’t be altered at this stage once submitted:Father’s nameLast nameDate of birthVersatile numberEmail IDSubsequent to rolling out the improvements, if required, hopefuls should present the shape.Stage 3 – Application number gotApplicants will get a message on the screen in regards to effective enlistment for MHT CET 2018 with their application number. A similar number will be sent to them gave email ID. Competitors can see and check their entered data in this progression.Stage 4 – Edit and Upload photo and markApplicants will have the capacity to alter the points of interest they have filled in the application frame. In any case, regardless they won’t have the capacity to alter their full name, father’s name, last name, date of birth, versatile number and email ID. In the event that candidates would prefer not to alter any points of interest, they can move to the subsequent stage of transferring their photo and mark in the arrangement recommended by the experts.Stage 5 – Uploading photo and markApplicants should transfer their current identification estimate shading photo and mark in the configuration given in the table underneath. On the off chance that, applicants are not ready to transfer the right photographs/marks, they should reload the right records and afterward transfer.Stage 6 – VerificationCompetitors will get a message on their screens with respect to fruitful transferring of photo and mark. They will likewise have the capacity to see a connection saying ” Click here to make payment “. Applicants should tap on the connection to enter the instalment entryway.Stage 7 – Payment gatewayHopefuls will have the capacity to see every one of the subtle elements filled by them alongside their transferred photo and mark on their screens. The application expense sum will likewise be noticeable in this progression, which they should pay in the wake of perusing the revelation. It is to noticed that competitors will have the capacity to change their subjects they are applying for.Applicants will have the capacity to influence application to charge payment through credit/check card, net saving money, plastic (ATM PIN), wallets and then some. They should influence instalment of the application to sum with comfort charge and expense.After instalment of utilisation charge, competitors will have the capacity to see a message on their screen with respect to accomplishment of exchange. Applicants must remove a print from this page.Stage 8 – Acknowledgment pageCompetitors must take a print from the affirmation page and keep it securely for some time later.Hope this Helps!!

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

What is the capacity column in the ITR-1 last page?

In case the return is being filed by you in a representative capacity, then for verification purpose this column inserted by income tax department. If you himself verify your return the mention Self in Capacity Column.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the income in kind verification form

How to make an electronic signature for your Income In Kind Verification Form in the online mode

How to create an eSignature for the Income In Kind Verification Form in Google Chrome

How to make an eSignature for signing the Income In Kind Verification Form in Gmail

How to make an electronic signature for the Income In Kind Verification Form straight from your mobile device

How to generate an electronic signature for the Income In Kind Verification Form on iOS

How to generate an eSignature for the Income In Kind Verification Form on Android

People also ask

-

What is the Mc 210 S I and how does it work?

The Mc 210 S I is a versatile solution designed for businesses to streamline their document signing processes. With its user-friendly interface, it allows users to send, eSign, and manage documents efficiently. By leveraging the Mc 210 S I, businesses can reduce turnaround times and enhance their workflow.

-

What are the key features of the Mc 210 S I?

The Mc 210 S I offers a range of features including customizable templates, secure eSigning, and real-time tracking of document statuses. These features empower users to enhance their document management processes and ensure compliance with legal standards. Additionally, the Mc 210 S I integrates seamlessly with various business applications for added convenience.

-

How much does the Mc 210 S I cost?

Pricing for the Mc 210 S I varies based on the subscription plan chosen, catering to businesses of all sizes. Users can select from monthly or annual plans to find the best fit for their needs. The Mc 210 S I is designed to be a cost-effective solution, providing excellent value for its extensive features.

-

Can the Mc 210 S I integrate with other software?

Yes, the Mc 210 S I offers robust integration capabilities with popular software applications such as CRM systems, cloud storage services, and project management tools. This flexibility allows businesses to incorporate the Mc 210 S I into their existing workflows seamlessly, enhancing productivity and collaboration.

-

What are the benefits of using the Mc 210 S I for document management?

Using the Mc 210 S I for document management provides numerous benefits, including increased efficiency, reduced paper waste, and enhanced security for sensitive documents. Its intuitive design makes it easy for teams to adopt, while its advanced tracking features ensure accountability throughout the signing process. Overall, the Mc 210 S I supports businesses in achieving their digital transformation goals.

-

Is the Mc 210 S I secure for sensitive documents?

Absolutely, the Mc 210 S I prioritizes security with features such as encryption, secure access controls, and audit trails. These measures ensure that sensitive documents are protected throughout the signing process. Businesses can trust the Mc 210 S I to handle their confidential information safely and in compliance with legal regulations.

-

How can I get started with the Mc 210 S I?

Getting started with the Mc 210 S I is simple. Interested users can sign up for a free trial on the airSlate SignNow website, allowing them to explore its features without any commitment. Once satisfied, users can choose a subscription plan that best suits their needs and start utilizing the Mc 210 S I for their document signing.

Get more for Mc 210 S I

- Psychological testing request form providers amerigroup

- Infertility injectable medication precertification form

- Pharmacy prior authorization form medical necessity health net

- Order a testdiagnostic laboratoriesadx national jewish form

- Printable client intake form for zoning appeal development application

- Anthem mediblue hmo national united brokers nub form

- Clinic yes form

- Please click here to download adobe acrobat form

Find out other Mc 210 S I

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT