Appreciated Securities Transfer Giving to Stanford 2017

What is the Appreciated Securities Transfer Giving To Stanford

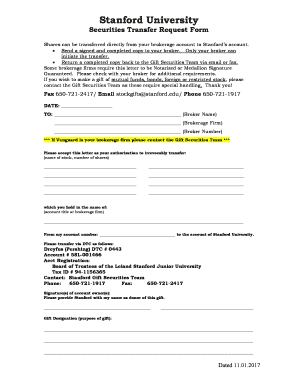

The Appreciated Securities Transfer Giving to Stanford form is a legal document used to facilitate the donation of appreciated securities to Stanford University. This type of transfer allows donors to contribute stocks, bonds, or mutual funds that have increased in value over time. By donating appreciated securities, individuals can potentially avoid capital gains taxes while also supporting the university's mission and programs. This form is essential for ensuring that the transfer is executed properly and in compliance with applicable laws and regulations.

Steps to complete the Appreciated Securities Transfer Giving To Stanford

Completing the Appreciated Securities Transfer Giving to Stanford form involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary information, including the name of the securities, their current value, and your account details.

- Fill out the form with accurate details about the securities being transferred and the intended recipient, Stanford University.

- Review the completed form for any errors or omissions.

- Sign the form electronically or physically, depending on your preference and the requirements of the institution.

- Submit the form according to the specified submission methods, ensuring it reaches the appropriate department at Stanford.

Legal use of the Appreciated Securities Transfer Giving To Stanford

The legal use of the Appreciated Securities Transfer Giving to Stanford form is governed by federal and state laws regarding charitable donations and securities transfers. It is crucial that the form is filled out accurately to meet legal requirements, including proper documentation of the donation for tax purposes. Compliance with the IRS guidelines for charitable contributions is essential to ensure that both the donor and Stanford University can benefit from the tax advantages associated with such transfers.

Required Documents

To successfully complete the Appreciated Securities Transfer Giving to Stanford, certain documents may be required. These typically include:

- The completed Appreciated Securities Transfer Giving to Stanford form.

- A recent statement of the securities to be transferred, showing their current value.

- Any additional documentation that may be required by Stanford University or financial institutions involved in the transfer.

How to use the Appreciated Securities Transfer Giving To Stanford

Using the Appreciated Securities Transfer Giving to Stanford form is straightforward. After gathering the necessary information and completing the form, donors can submit it electronically or via mail. It is important to ensure that all details are accurate to avoid delays in processing. This form not only facilitates the transfer of securities but also serves as a record for both the donor and Stanford University, confirming the donation for future reference.

IRS Guidelines

The IRS provides specific guidelines regarding the donation of appreciated securities. Donors should be aware of the following key points:

- Donors can typically deduct the fair market value of the securities on the date of the donation, provided they have been held for more than one year.

- Proper documentation, including the Appreciated Securities Transfer Giving to Stanford form, is necessary to substantiate the gift for tax purposes.

- Consultation with a tax advisor is recommended to ensure compliance with all IRS regulations and to maximize potential tax benefits.

Quick guide on how to complete appreciated securities transfer giving to stanford

Complete Appreciated Securities Transfer Giving To Stanford effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, as you can easily locate the appropriate form and securely store it online. airSlate SignNow furnishes you with all the resources necessary to create, edit, and eSign your documents promptly and without interruptions. Manage Appreciated Securities Transfer Giving To Stanford on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to modify and eSign Appreciated Securities Transfer Giving To Stanford seamlessly

- Find Appreciated Securities Transfer Giving To Stanford and click on Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your document, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Appreciated Securities Transfer Giving To Stanford ensuring superior communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct appreciated securities transfer giving to stanford

Create this form in 5 minutes!

How to create an eSignature for the appreciated securities transfer giving to stanford

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is appreciated securities transfer giving to Stanford?

Appreciated Securities Transfer Giving To Stanford refers to the process of donating stocks or other appreciated assets to benefit Stanford University. This method can offer potential tax advantages while supporting the institution's mission. By transferring these securities, you can make a signNow impact with your charitable contributions.

-

How can airSlate SignNow facilitate the appreciated securities transfer process?

With airSlate SignNow, you can easily send and eSign necessary documents to initiate your Appreciated Securities Transfer Giving To Stanford. Our platform simplifies paperwork and ensures that all transactions are securely handled. This efficiency enables you to focus more on your donation and less on administrative hurdles.

-

Are there any fees associated with using airSlate SignNow for securities transfers?

While airSlate SignNow offers competitive pricing for its services, there may be fees applicable based on the features you choose. However, utilizing our platform for Appreciated Securities Transfer Giving To Stanford can save you money by streamlining the process and reducing the potential costs of traditional methods. Be sure to check our pricing page for specific details.

-

What features does airSlate SignNow offer for appreciated securities transfer documents?

airSlate SignNow provides a range of features designed to enhance your experience with appreciated securities transfer documents. Features include secure eSigning, document templates tailored for donations, and real-time tracking of your documents. These tools help you manage your Appreciated Securities Transfer Giving To Stanford seamlessly.

-

What are the benefits of appreciating securities transfer giving to Stanford?

Donating appreciated securities to Stanford can provide signNow tax benefits, allowing donors to avoid capital gains taxes. Additionally, your contributions can fund vital programs and scholarships, making a lasting impact. Utilizing airSlate SignNow simplifies this process, ensuring your Appreciated Securities Transfer Giving To Stanford is efficient and effective.

-

Can I integrate airSlate SignNow with other platforms for better document management?

Yes, airSlate SignNow offers integrations with various platforms, including CRM systems and cloud storage solutions. This flexibility facilitates better document management during the appreciated securities transfer process. By integrating, you can streamline your Appreciated Securities Transfer Giving To Stanford experience further.

-

How do I start the appreciated securities transfer giving process with airSlate SignNow?

To begin your appreciated securities transfer giving process with airSlate SignNow, sign up for an account and explore our document templates specifically for donation purposes. You can then customize, send, and eSign your documents electronically. Our user-friendly interface will assist you every step of the way in your Appreciated Securities Transfer Giving To Stanford.

Get more for Appreciated Securities Transfer Giving To Stanford

Find out other Appreciated Securities Transfer Giving To Stanford

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile