Form Nr301 2012-2026

What is the Form Nr301

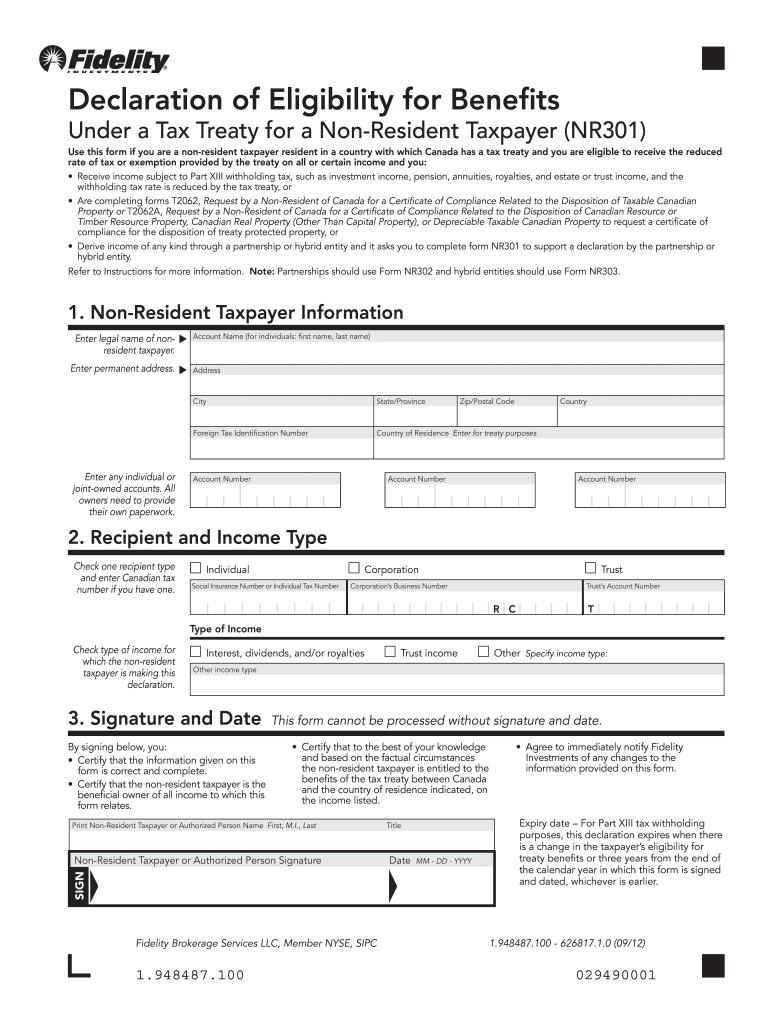

The NR301 form is a tax document used by non-resident individuals and entities to claim benefits under the Canada-United States Income Tax Treaty. This form allows taxpayers to certify their residency and eligibility for reduced withholding tax rates on certain types of income, such as dividends, interest, and royalties. By completing the NR301, individuals can ensure they are not subject to higher tax rates than those specified in the treaty, promoting fair taxation between the two countries.

How to use the Form Nr301

To use the NR301 form effectively, taxpayers must first determine their eligibility under the Canada-U.S. tax treaty. Once eligibility is confirmed, the form should be filled out accurately, providing necessary personal information, including name, address, and taxpayer identification numbers. After completing the form, it must be submitted to the withholding agent or payer, who will use it to apply the appropriate tax rates. It is important to retain a copy of the submitted form for personal records and future reference.

Steps to complete the Form Nr301

Completing the NR301 form involves several key steps:

- Gather necessary information, including your personal details and tax identification numbers.

- Identify the specific income types for which you are claiming treaty benefits.

- Fill out the form, ensuring all sections are completed accurately.

- Sign and date the form to certify the information provided is correct.

- Submit the form to the relevant withholding agent or payer.

Following these steps helps ensure that the form is completed correctly and that you can benefit from the treaty provisions.

Legal use of the Form Nr301

The NR301 form is legally recognized under the Canada-U.S. Income Tax Treaty, which outlines the rights and obligations of taxpayers from both countries. To ensure legal compliance, it is essential to complete the form accurately and truthfully. Misrepresentation or failure to provide correct information may result in penalties or denial of treaty benefits. The form must be submitted to the appropriate parties, and it is advisable to keep a copy for your records as proof of your claim.

Eligibility Criteria

To be eligible to use the NR301 form, taxpayers must meet specific criteria outlined in the Canada-U.S. Income Tax Treaty. Generally, this includes being a resident of one of the two countries and receiving income that qualifies for treaty benefits, such as dividends, interest, or royalties. Additionally, taxpayers must provide evidence of their residency status, which may include tax identification numbers or other documentation as required by the withholding agent.

Required Documents

When completing the NR301 form, it is important to have certain documents on hand to support your claims. These may include:

- Proof of residency, such as a tax identification number or residency certificate.

- Documentation of the income types you are receiving, such as dividend statements or interest income records.

- Any prior correspondence with tax authorities regarding your residency status or treaty eligibility.

Having these documents ready can facilitate a smoother completion process and ensure compliance with tax regulations.

Form Submission Methods

The NR301 form can be submitted through various methods, depending on the requirements of the withholding agent or payer. Common submission methods include:

- Online submission, if the payer offers a digital platform for form processing.

- Mailing a physical copy of the completed form to the payer's designated address.

- In-person submission, if applicable, at the payer's office or tax office.

It is essential to verify the preferred submission method with the relevant parties to ensure timely processing of the form.

Quick guide on how to complete form nr301

Easily Prepare Form Nr301 on Any Device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow supplies all the tools you need to create, edit, and eSign your documents promptly without hesitation. Manage Form Nr301 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The Easiest Way to Edit and eSign Form Nr301 Effortlessly

- Find Form Nr301 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from your preferred device. Edit and eSign Form Nr301 and ensure exemplary communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form nr301

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the NR301 form?

The NR301 form is used by non-resident taxpayers in the U.S. to claim tax treaty benefits. This form helps in determining the withholding tax rate applicable to certain types of income. Completing the NR301 form accurately is essential to ensure you receive the appropriate tax rate.

-

How can airSlate SignNow help with the NR301 form?

airSlate SignNow allows you to easily eSign and send the NR301 form securely online. Our platform streamlines the process, enabling you to complete and manage your tax forms efficiently from any location. This simplifies your tax compliance efforts, especially when dealing with international paperwork.

-

Is there a cost associated with using airSlate SignNow for the NR301 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs. You can choose from different subscription options, each providing access to features that simplify the completion of forms like the NR301. The investment you make can help save time and improve efficiency in managing your documents.

-

What features does airSlate SignNow offer for the NR301 form?

airSlate SignNow includes features such as customizable templates, secure eSignature options, and real-time tracking for the NR301 form. Additionally, you can store documents safely and access them from anywhere. These features ensure a smooth and professional signing experience.

-

Can I integrate airSlate SignNow with other applications for handling the NR301 form?

Absolutely! airSlate SignNow offers integrations with numerous applications, making it easy to manage the NR301 form alongside your existing tools. You can connect with CRM systems, cloud storage services, and more to facilitate a seamless document workflow.

-

What are the benefits of using airSlate SignNow for tax forms like the NR301?

Using airSlate SignNow for the NR301 form enhances your workflow by providing a user-friendly interface and efficient document management. You benefit from reduced turnaround times and the assurance of document security. This helps you stay compliant with tax regulations while saving valuable time.

-

Is the NR301 form applicable for all non-residents in the U.S.?

The NR301 form is applicable only to non-residents who qualify for tax treaty benefits under U.S. law. It's essential to review the specific eligibility requirements based on your country of residence and the type of income. Utilizing airSlate SignNow ensures you can complete and submit the NR301 form easily.

Get more for Form Nr301

- Flooring contract for contractor nevada form

- Nevada deed form

- Notice of intent to enforce forfeiture provisions of contact for deed nevada form

- Final notice of forfeiture and request to vacate property under contract for deed nevada form

- Buyers request for accounting from seller under contract for deed nevada form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed nevada form

- General notice of default for contract for deed nevada form

- Nv disclosure 497320466 form

Find out other Form Nr301

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form