Form 1099 MISC Miscellaneous Income

What is the Form 1099 MISC Miscellaneous Income

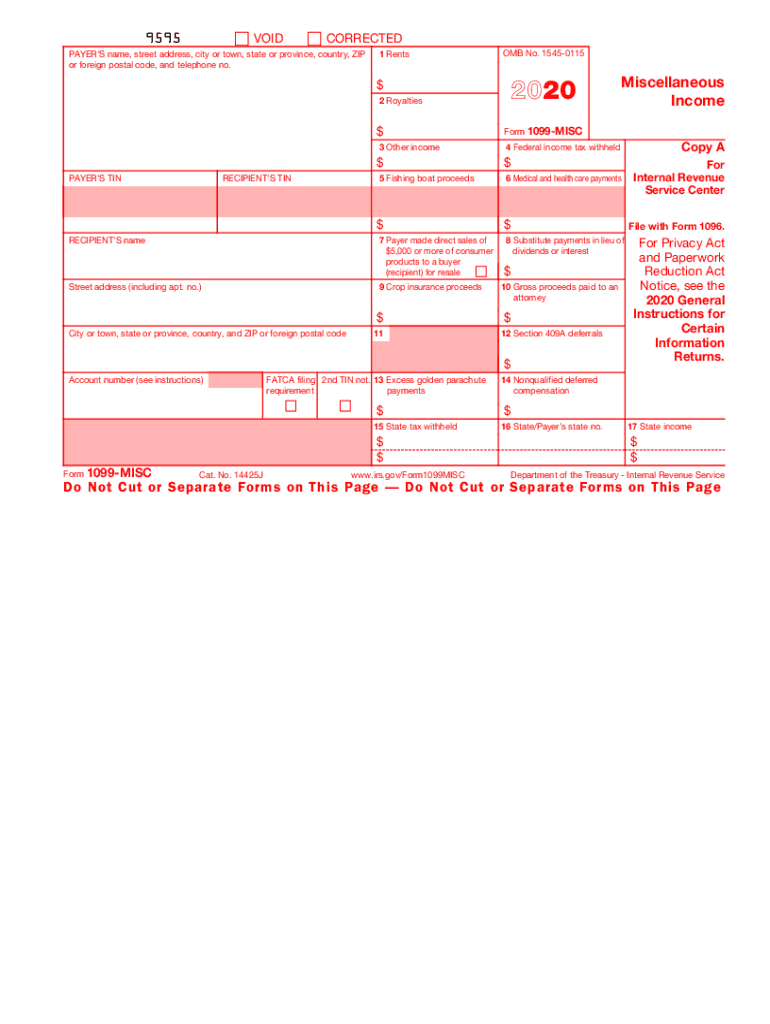

The Form 1099 MISC is a tax document used in the United States to report miscellaneous income. This form is typically issued by businesses to report payments made to non-employees, such as independent contractors, freelancers, and other service providers. The income reported on this form can include rents, royalties, prizes, awards, and other types of payments that do not fall under standard wages or salaries. Understanding the purpose of the Form 1099 MISC is essential for both payers and recipients to ensure accurate tax reporting and compliance with IRS regulations.

How to use the Form 1099 MISC Miscellaneous Income

Using the Form 1099 MISC involves several steps. First, the payer must collect the necessary information from the payee, including their name, address, and taxpayer identification number (TIN). Once this information is gathered, the payer completes the form by entering the total amount paid in the appropriate boxes. After completing the form, the payer must send a copy to the IRS and provide a copy to the payee by the required deadline. It is important for recipients to keep their copies for tax filing purposes, as the income reported on the 1099 MISC must be included in their tax returns.

Steps to complete the Form 1099 MISC Miscellaneous Income

Completing the Form 1099 MISC requires careful attention to detail. Here are the steps involved:

- Gather the payee's information, including their full name, address, and TIN.

- Determine the total amount paid to the payee during the tax year.

- Fill out the form, entering the payee's information and the total amount in the designated boxes.

- Check the box that corresponds to the type of payment made, such as rents or royalties.

- Sign and date the form, if required, and make copies for your records.

- Submit the completed form to the IRS and provide a copy to the payee by the deadline.

Legal use of the Form 1099 MISC Miscellaneous Income

The legal use of the Form 1099 MISC is governed by IRS regulations. This form must be issued for any payments made that meet the reporting threshold, which is typically $600 or more for services rendered. Failure to issue the form when required can lead to penalties for the payer. Additionally, recipients of the form must accurately report the income on their tax returns to avoid issues with the IRS. Understanding the legal implications of using the Form 1099 MISC is crucial for compliance and to avoid potential audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 MISC are critical for both payers and recipients. The form must be sent to the IRS by January thirty-first of the year following the tax year in which the payments were made. If the form is filed electronically, the deadline may extend to March second. Additionally, payers must provide a copy to the payee by the same January thirty-first deadline. Keeping track of these dates is essential to ensure compliance and avoid penalties.

Who Issues the Form

The Form 1099 MISC is typically issued by businesses or individuals who make payments to non-employees. This includes corporations, partnerships, and sole proprietors who hire independent contractors or freelancers. It is the responsibility of the payer to ensure that the form is accurately completed and submitted to both the IRS and the payee. Understanding who is responsible for issuing the form helps clarify the obligations of both parties in the reporting process.

Quick guide on how to complete 2020 form 1099 misc miscellaneous income

Complete Form 1099 MISC Miscellaneous Income effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 1099 MISC Miscellaneous Income on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Form 1099 MISC Miscellaneous Income with ease

- Find Form 1099 MISC Miscellaneous Income and click on Get Form to initiate the process.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1099 MISC Miscellaneous Income and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1099 misc miscellaneous income

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the W9 form 2020 and why is it important?

The W9 form 2020 is an IRS document used by businesses to request a taxpayer's identification number and certification. This form is crucial for reporting income paid to contractors and freelancers. Completing the W9 form 2020 accurately ensures compliance with tax regulations and prevents future issues with the IRS.

-

How can airSlate SignNow help with the W9 form 2020?

AirSlate SignNow provides a user-friendly platform to easily fill out, send, and eSign the W9 form 2020. Our solution streamlines the document management process, ensuring that you can collect signatures quickly and securely. With templates for the W9 form 2020, you can save time and enhance accuracy.

-

Is there a cost associated with using airSlate SignNow for the W9 form 2020?

AirSlate SignNow offers competitive pricing plans that cater to various business needs, including features for managing the W9 form 2020. Our subscription model ensures you only pay for the services you use, making it a cost-effective solution. We also provide a free trial, so you can experience the benefits before committing.

-

What features does airSlate SignNow offer for managing the W9 form 2020?

AirSlate SignNow provides various features such as document templates, customizable fields, and secure eSignature options for the W9 form 2020. Additionally, our platform allows for real-time tracking of document status and automatic reminders for outstanding signatures. These features enhance efficiency and ensure compliance.

-

Can I integrate airSlate SignNow with other software for handling the W9 form 2020?

Yes, airSlate SignNow offers seamless integrations with various software, making it easy to manage the W9 form 2020 alongside your existing tools. Integrations with accounting software, CRMs, and more can streamline your workflow. This ensures that your financial documents, including the W9 form 2020, are always up-to-date and easily accessible.

-

How does airSlate SignNow ensure the security of the W9 form 2020?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to protect your data while filling out and sending the W9 form 2020. Additionally, our platform complies with industry standards for security and privacy, providing peace of mind to our users.

-

Can I access the W9 form 2020 on mobile devices with airSlate SignNow?

Absolutely! AirSlate SignNow is optimized for mobile use, allowing you to fill out, send, and eSign the W9 form 2020 from anywhere. This mobile accessibility ensures you can manage your documents on the go, making it easy to collaborate and keep your workflow moving.

Get more for Form 1099 MISC Miscellaneous Income

- Tx provisions form

- Tx application form

- Motion to dismiss traffic ticket form

- Individual credit application texas form

- Interrogatories to plaintiff for motor vehicle occurrence texas form

- Tx accident 497327612 form

- Llc notices resolutions and other operations forms package texas

- Notice of dishonored check criminal keywords bad check bounced check texas form

Find out other Form 1099 MISC Miscellaneous Income

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online