Form 1099B PDF Attention Copy a of This Form is Provided

Understanding the 1099-S Form

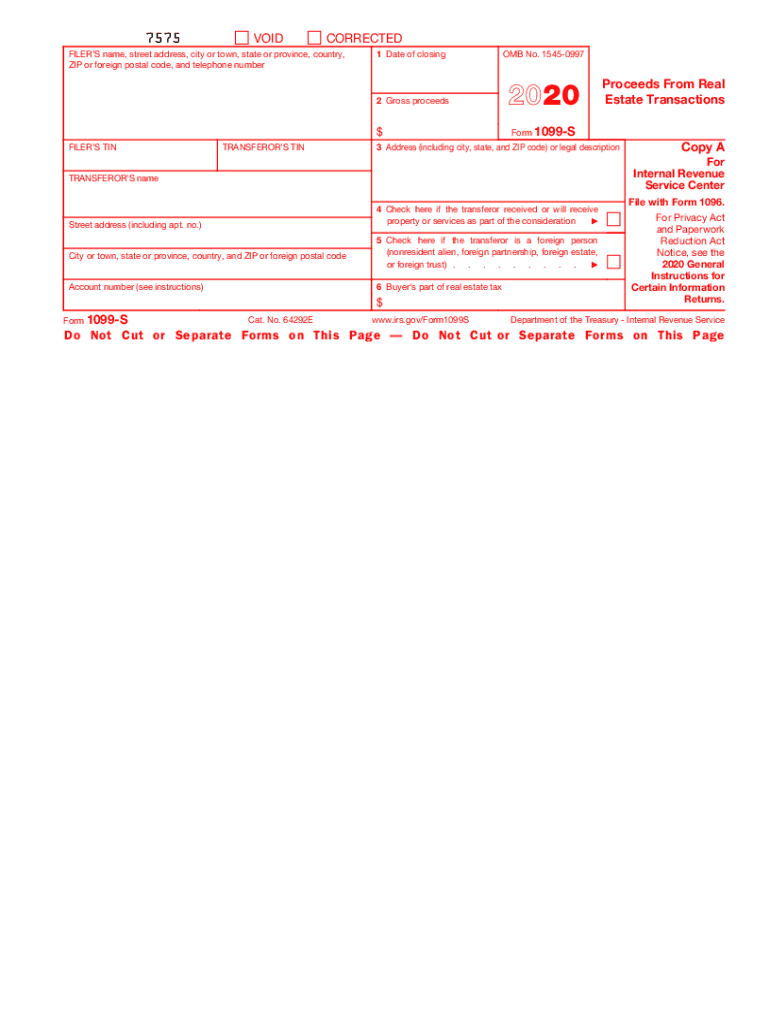

The 1099-S form is used to report the sale or exchange of real estate. This form is essential for both buyers and sellers in real estate transactions, as it provides the IRS with information about the proceeds from the sale. When filling out the 1099-S, it is important to ensure that all details are accurate, including the seller's name, address, and the transaction amount. This form plays a crucial role in tax reporting and compliance, making it vital for all parties involved in real estate transactions.

Steps to Complete the 1099-S Form

Completing the 1099-S form requires careful attention to detail. Here are the key steps:

- Gather necessary information: Collect details such as the seller's name, address, and taxpayer identification number.

- Document the sale: Record the date of the sale, the gross proceeds, and any applicable adjustments.

- Fill out the form: Enter the collected information accurately on the 1099-S form.

- Submit the form: Ensure that the completed form is sent to the IRS and provided to the seller by the deadline.

Filing Deadlines for the 1099-S Form

Timely filing of the 1099-S form is crucial to avoid penalties. The deadline for submitting the form to the IRS is typically the last day of February if filing by paper, or March 31 if filing electronically. Additionally, a copy must be provided to the seller by January 31. Staying aware of these deadlines helps ensure compliance with IRS regulations.

IRS Guidelines for the 1099-S Form

The IRS provides specific guidelines for completing and filing the 1099-S form. It is important to follow these guidelines to ensure accuracy and compliance. Key points include:

- Ensure all information is complete and accurate.

- Use the correct form version for the tax year.

- Retain copies of the filed form for your records.

Legal Use of the 1099-S Form

The 1099-S form is legally binding when completed correctly. It serves as a formal record of the transaction and is used by the IRS to track real estate sales. Failure to file or inaccuracies can lead to penalties. Understanding the legal implications of the 1099-S form is essential for compliance and protecting your interests in real estate transactions.

Who Issues the 1099-S Form

The 1099-S form is typically issued by the settlement agent or the person responsible for closing the real estate transaction. This includes title companies, attorneys, or real estate brokers. It is their responsibility to ensure that the form is filled out correctly and submitted to the IRS, as well as providing a copy to the seller.

Quick guide on how to complete form 1099bpdf attention copy a of this form is provided

Complete Form 1099B pdf Attention Copy A Of This Form Is Provided effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and electronically sign your documents quickly and without issues. Handle Form 1099B pdf Attention Copy A Of This Form Is Provided on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 1099B pdf Attention Copy A Of This Form Is Provided with ease

- Obtain Form 1099B pdf Attention Copy A Of This Form Is Provided and then select Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to preserve your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Modify and electronically sign Form 1099B pdf Attention Copy A Of This Form Is Provided and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099bpdf attention copy a of this form is provided

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the 1099s 2020 form, and who needs to file it?

The 1099s 2020 form is a tax document that reports income from non-employment sources. Businesses that have paid independent contractors or freelancers needing to report payments of $600 or more must file this form. airSlate SignNow simplifies the eSigning of 1099s 2020 forms, ensuring compliance and accuracy in your filing process.

-

How can airSlate SignNow help me with the 1099s 2020 form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your 1099s 2020 forms electronically. This streamlines the process, reduces paper usage, and speeds up the filing time, making tax season less stressful for businesses. You can track document status and receive notifications when forms are signed.

-

Is airSlate SignNow a cost-effective solution for sending 1099s 2020 forms?

Yes, airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes, ensuring you have a cost-effective solution for sending 1099s 2020 forms. With minimal setup costs and no hidden fees, you can save time and money while streamlining your document management. It's an economical choice for efficient eSigning.

-

What security measures does airSlate SignNow implement for 1099s 2020 forms?

Security is a priority at airSlate SignNow, especially with sensitive documents like the 1099s 2020 form. The platform utilizes encryption, secure cloud storage, and advanced user authentication to protect your information. You can securely eSign and send documents without compromising data integrity.

-

Can I integrate airSlate SignNow with my accounting software for 1099s 2020 forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software systems, allowing for easy management of 1099s 2020 forms and associated documents. This integration ensures that your tax documents are easily accessible and up-to-date, streamlining your accounting processes.

-

How do I ensure my 1099s 2020 forms are compliant using airSlate SignNow?

airSlate SignNow provides features and templates that adhere to IRS guidelines for the 1099s 2020 form. By using our platform, you can be confident that your forms are correctly filled out and comply with current regulations. Additionally, our customer support team is available to assist with any compliance queries.

-

What features does airSlate SignNow offer for managing 1099s 2020 forms?

airSlate SignNow offers several features, including customizable templates for 1099s 2020 forms, bulk sending capabilities, and status tracking of document signing. These tools enhance your efficiency in managing important tax documents, allowing you to focus on your core business functions.

Get more for Form 1099B pdf Attention Copy A Of This Form Is Provided

- Employment agreement general manager form

- Irreparable harm 497331029 form

- Alimony 497331030 form

- Medical treatment authorization form

- Daycare agreement contract form

- Lease of concession space in department store form

- Agreement sales representative 497331034 form

- Commercial security agreement pdf form

Find out other Form 1099B pdf Attention Copy A Of This Form Is Provided

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple