Llc Tax Form

What is the LLC Tax?

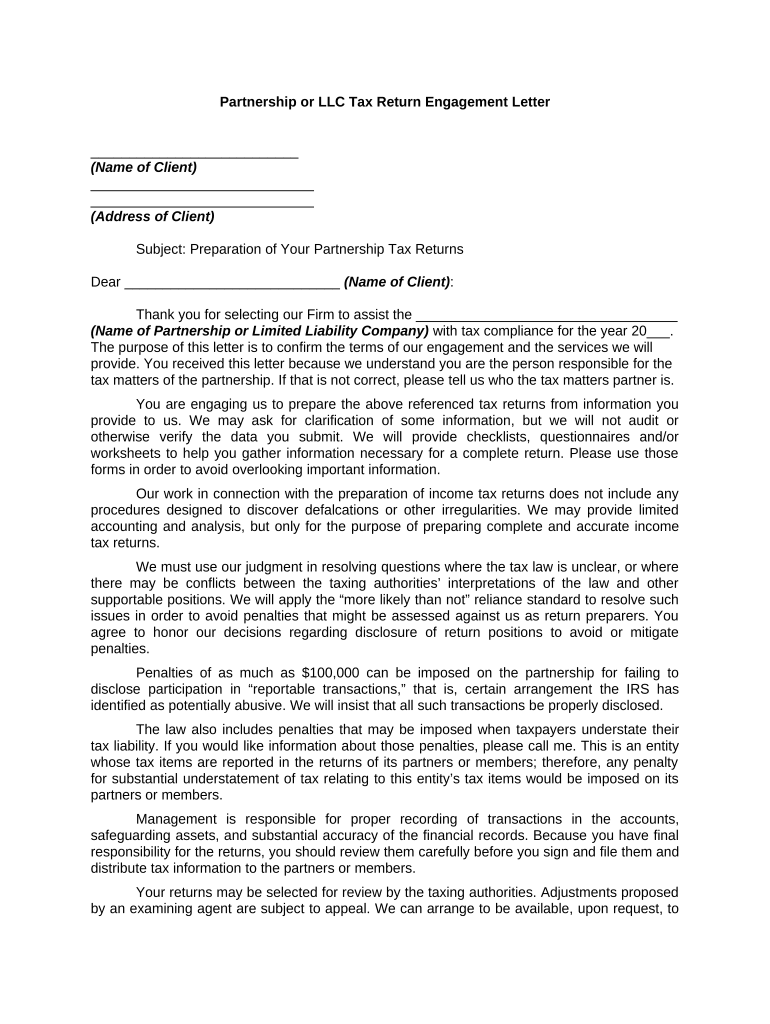

The LLC tax refers to the tax obligations that Limited Liability Companies (LLCs) must fulfill under U.S. tax law. An LLC can be taxed as a sole proprietorship, partnership, or corporation, depending on the number of members and the elections made by the entity. This flexibility allows LLCs to choose the tax structure that best fits their business needs. For instance, a single-member LLC is typically treated as a disregarded entity, meaning the income is reported on the owner's personal tax return. Conversely, a multi-member LLC is generally treated as a partnership, requiring the filing of Form 1065, U.S. Return of Partnership Income.

Steps to Complete the LLC Tax

Completing the LLC tax involves several key steps to ensure compliance with IRS regulations. First, determine the tax classification of your LLC. This classification will dictate which forms you need to file. Next, gather all necessary financial records, including income statements, expense reports, and any other relevant documentation. After that, complete the appropriate tax forms based on your LLC’s classification. For example, single-member LLCs will use Schedule C, while multi-member LLCs will use Form 1065. Finally, review your completed forms for accuracy and submit them by the designated deadlines.

Required Documents

When filing taxes for an LLC, specific documents are essential to ensure a smooth process. Required documents typically include:

- Financial statements, including income and expense reports.

- Previous year’s tax return, if applicable.

- Form 1065 or Schedule C, depending on the LLC's classification.

- Any supporting documents for deductions or credits claimed.

Having these documents ready will help streamline the filing process and ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines for LLC taxes is crucial to avoid penalties. For most LLCs classified as partnerships, the deadline to file Form 1065 is March 15 of the following year. Single-member LLCs that file as sole proprietors must submit their taxes by April 15. If these dates fall on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check the IRS website for any updates or changes to these deadlines each tax year.

IRS Guidelines

The IRS provides specific guidelines for LLC taxation that must be followed to ensure compliance. These guidelines cover various aspects, including how to report income, allowable deductions, and the requirements for filing different forms. It is essential to familiarize yourself with these guidelines to avoid potential issues during tax season. The IRS also offers resources and publications that can assist LLC owners in understanding their tax obligations and ensuring proper compliance.

Legal Use of the LLC Tax

The legal use of the LLC tax framework ensures that businesses operate within the confines of U.S. tax law. LLCs must adhere to the tax classification they choose and file the appropriate forms accordingly. This legal structure provides liability protection for owners while also allowing for flexible tax treatment. Compliance with tax regulations is critical, as failure to do so can result in penalties and loss of the limited liability status that LLCs enjoy.

Quick guide on how to complete llc tax

Prepare Llc Tax easily on any device

Web document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and eSign your documents swiftly and without complications. Manage Llc Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Llc Tax effortlessly

- Obtain Llc Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to share your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require reprinting new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Edit and eSign Llc Tax to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample tax engagement letter 2020?

A sample tax engagement letter 2020 is a template designed to outline the agreement between a tax professional and their client for tax-related services. It helps define the scope of work, fees, and responsibilities of both parties. This document ensures transparency and can enhance the trust between clients and tax professionals.

-

How can I create a sample tax engagement letter 2020 using airSlate SignNow?

With airSlate SignNow, you can easily create a sample tax engagement letter 2020 by utilizing our user-friendly document editor. Simply select a template or start from scratch, add the necessary fields, and customize the content to suit your specific needs. Once completed, you can send it out for eSignature within minutes.

-

What are the benefits of using airSlate SignNow for a sample tax engagement letter 2020?

Using airSlate SignNow for a sample tax engagement letter 2020 provides numerous benefits, including quick document creation, secure eSigning, and easy storage of completed agreements. Additionally, you can automate reminders and track the signing process, ensuring efficient document management and enhanced professionalism.

-

Are there any costs associated with using a sample tax engagement letter 2020 on airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to fit different business needs, including access to a sample tax engagement letter 2020. Depending on your chosen plan, you can take advantage of various features while managing costs effectively. It's advisable to check our website for the latest pricing details.

-

Can I integrate other software with airSlate SignNow for my tax engagement letter needs?

Yes, airSlate SignNow supports various integrations with popular software tools like CRM systems and accounting software, enhancing your workflow for managing a sample tax engagement letter 2020. These integrations allow for seamless data transfer, ensuring that your tax documents are always up-to-date and accessible. Check our integrations page to see all available options.

-

Is my information secure when using airSlate SignNow for a sample tax engagement letter 2020?

Absolutely! airSlate SignNow employs advanced security measures to protect your information when creating or managing a sample tax engagement letter 2020. This includes data encryption, secure servers, and compliance with industry standards to ensure that your documents remain confidential and secure throughout the signing process.

-

Can I customize my sample tax engagement letter 2020 template?

Yes, airSlate SignNow allows you to fully customize your sample tax engagement letter 2020 template to match your branding and preferences. You can modify text, add logos, and adjust layouts to ensure that your document reflects your professional image. Customization makes your tax engagement letters more personalized and relevant to your clients.

Get more for Llc Tax

Find out other Llc Tax

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast