Form 941 Rev July Employer's Quarterly Federal Tax Return

What is the Form 941 Rev July Employer's Quarterly Federal Tax Return

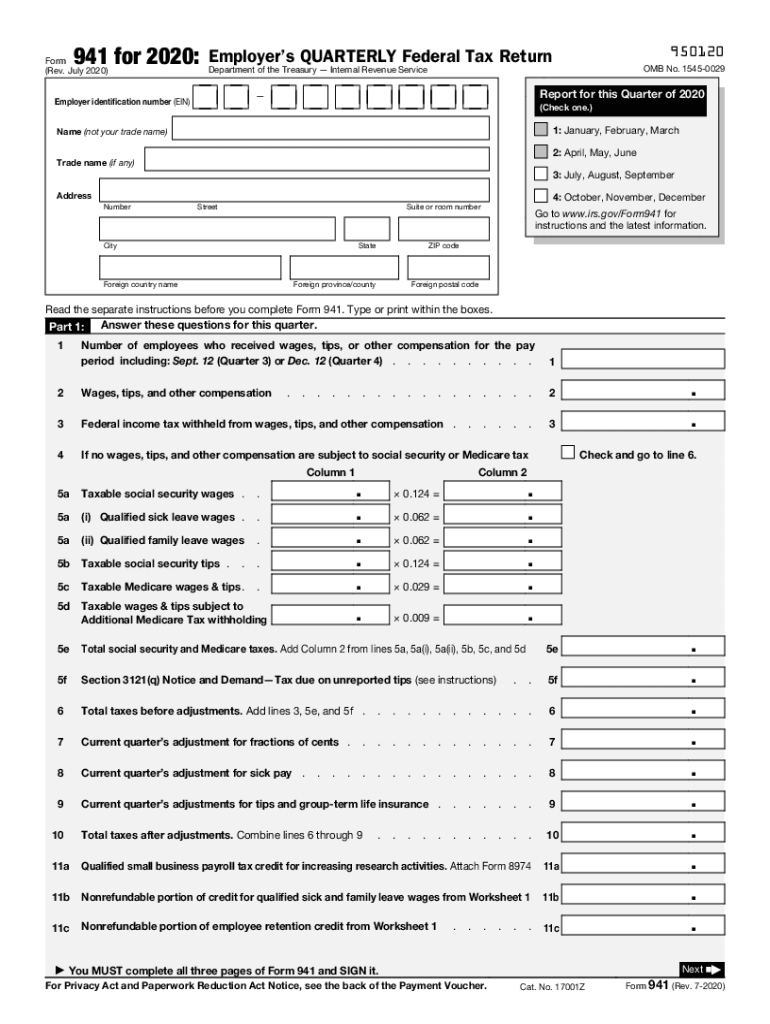

The Form 941 Rev July, also known as the Employer's Quarterly Federal Tax Return, is a crucial document for employers in the United States. It is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Businesses must file this form quarterly to ensure compliance with federal tax regulations. The form also helps employers calculate their tax liabilities and determine any tax credits they may be eligible for, such as the Employee Retention Credit.

Steps to Complete the Form 941 Rev July Employer's Quarterly Federal Tax Return

Completing the fillable 941 form for 2020 involves several key steps. First, gather all necessary information, including your Employer Identification Number (EIN), total wages paid, and taxes withheld. Next, accurately fill out each section of the form:

- Part 1: Report the number of employees and total wages paid.

- Part 2: Calculate the total taxes owed for the quarter.

- Part 3: Claim any adjustments or credits applicable to your business.

- Part 4: Provide information regarding your tax deposits.

After completing the form, review it for accuracy before submitting it to the IRS.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the fillable form 941 for 2020. The due dates for each quarter are as follows:

- First Quarter (January to March): Due by April 30, 2020

- Second Quarter (April to June): Due by July 31, 2020

- Third Quarter (July to September): Due by October 31, 2020

- Fourth Quarter (October to December): Due by January 31, 2021

Late submissions may incur penalties, so it is essential to file on time.

Legal Use of the Form 941 Rev July Employer's Quarterly Federal Tax Return

The fillable 941 form for 2020 is legally binding when completed and submitted according to IRS guidelines. It is essential for employers to ensure that all information provided is accurate and truthful, as discrepancies can lead to audits or penalties. The form must be signed by an authorized individual within the company, confirming the accuracy of the information reported.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the fillable form 941 for 2020. The form can be filed electronically through the IRS e-file system, which is often the fastest method. Alternatively, businesses can mail a paper copy of the form to the appropriate IRS address based on their location. In-person submissions are generally not available for Form 941, so electronic or mail options are recommended for compliance.

Key Elements of the Form 941 Rev July Employer's Quarterly Federal Tax Return

Understanding the key elements of the fillable 941 form for 2020 is essential for accurate reporting. Important sections include:

- Employer Identification Number (EIN): A unique identifier for your business.

- Wages and Tips: Total compensation paid to employees.

- Tax Liability: The total amount of federal taxes owed for the quarter.

- Adjustments: Any corrections or credits that apply to your tax situation.

Each element must be filled out accurately to ensure compliance with federal tax laws.

Quick guide on how to complete form 941 rev july 2020 employers quarterly federal tax return

Complete Form 941 Rev July Employer's Quarterly Federal Tax Return smoothly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 941 Rev July Employer's Quarterly Federal Tax Return on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 941 Rev July Employer's Quarterly Federal Tax Return without hassle

- Find Form 941 Rev July Employer's Quarterly Federal Tax Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this reason.

- Create your eSignature with the Sign tool, which takes moments and bears the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 941 Rev July Employer's Quarterly Federal Tax Return and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941 rev july 2020 employers quarterly federal tax return

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the fillable 941 form 2020 and why do I need it?

The fillable 941 form 2020 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It's essential for compliance with federal tax regulations. Using an electronic fillable version simplifies the process, allowing for easy submissions and record-keeping.

-

How can airSlate SignNow help me manage my fillable 941 form 2020?

AirSlate SignNow offers a user-friendly platform that allows you to electronically fill out, sign, and send your fillable 941 form 2020. With its intuitive interface, you can complete tax forms quickly and efficiently, streamlining your paperwork process. This ensures you stay organized and compliant with tax deadlines.

-

Is there a cost associated with using the fillable 941 form 2020 through airSlate SignNow?

While using the fillable 941 form 2020 itself is free as part of the IRS offerings, airSlate SignNow provides a subscription model that offers added benefits. These include unlimited document signing and storage options. The pricing is designed to be cost-effective for businesses of all sizes, making tax management more affordable.

-

Can I integrate airSlate SignNow with my current accounting software for fillable 941 form 2020?

Yes, airSlate SignNow integrates seamlessly with many popular accounting software programs. This integration allows for smooth data transfer and easy access to your fillable 941 form 2020. By connecting your tools, you can enhance productivity and ensure that all financial records are aligned.

-

What features does airSlate SignNow offer for my fillable 941 form 2020?

AirSlate SignNow includes features like customizable templates, a secure cloud storage system, and real-time collaboration tools. These features make it easier to work on your fillable 941 form 2020 with team members. Additionally, robust security ensures your sensitive information remains confidential.

-

How does eSigning the fillable 941 form 2020 work with airSlate SignNow?

eSigning the fillable 941 form 2020 with airSlate SignNow is simple and efficient. Once you complete your form, you can invite others to sign electronically, eliminating the need for physical documents. This not only speeds up the process but also enhances security and helps you maintain a digital trail.

-

What are the benefits of using airSlate SignNow for the fillable 941 form 2020?

Using airSlate SignNow for the fillable 941 form 2020 offers numerous benefits, including improved efficiency and reduced processing time. The platform’s features help ensure accuracy and compliance with tax regulations. Additionally, the cost-effective solution enables you to save time and resources.

Get more for Form 941 Rev July Employer's Quarterly Federal Tax Return

- Construction contract home sample form

- Request be list form

- Sample contract agreement form

- Affidavit in support of motion for writ of error coram nobis regarding default and default judgment taken against defendant who form

- Early termination of lease or rental agreement by mutual consent form

- Early termination clause for rental property for extroardinary events form

- Letter self employed 497331114 form

- Contract with book form

Find out other Form 941 Rev July Employer's Quarterly Federal Tax Return

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will