PDF Request for Taxpayer Identification Number and UMass Amherst 2018-2026

Understanding the W-9 Form

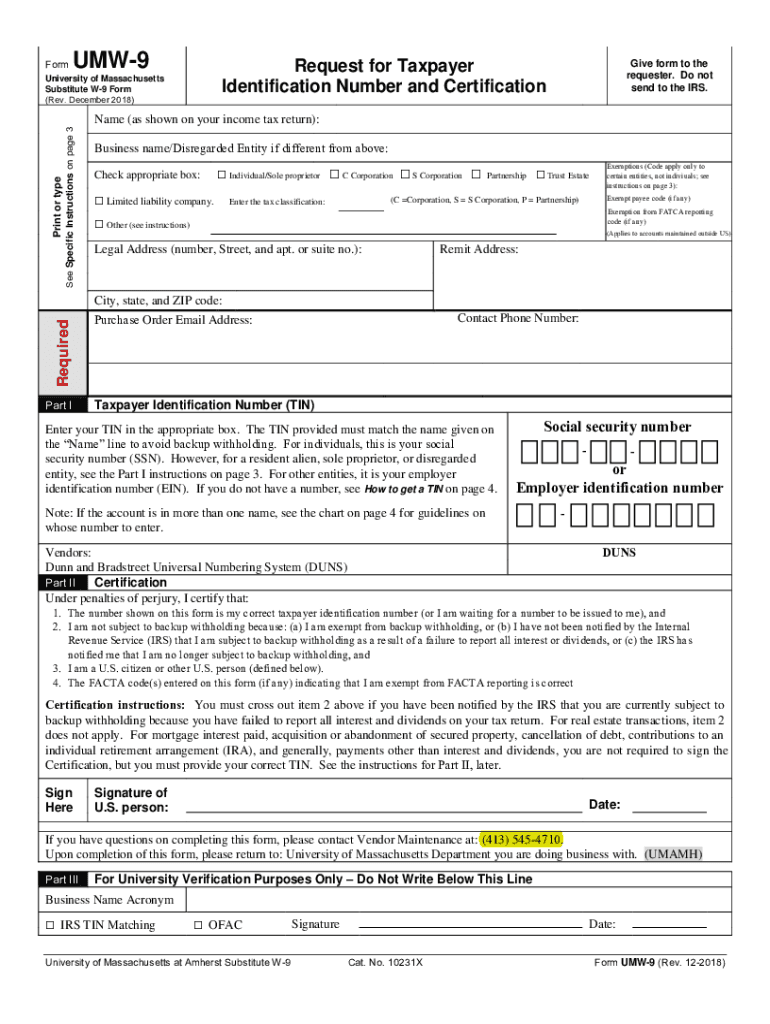

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a crucial document for individuals and businesses in the United States. It is commonly used by freelancers, contractors, and vendors to provide their taxpayer identification number (TIN) to clients or businesses that will report payments made to them to the IRS. The 2019 W-9 form is specifically designed for use during that tax year, ensuring compliance with IRS regulations.

Steps to Complete the 2019 W-9 Form

Filling out the 2019 W-9 form involves several straightforward steps:

- Provide your name: Enter your full legal name as it appears on your tax return.

- Business name (if applicable): If you operate under a different business name, include it here.

- Check the appropriate box: Indicate whether you are an individual, corporation, partnership, or another entity type.

- Enter your address: Fill in your street address, city, state, and ZIP code.

- Taxpayer Identification Number: Provide your Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: Sign and date the form to certify that the information provided is accurate.

Legal Use of the W-9 Form

The W-9 form is legally binding and must be completed accurately to avoid penalties. It is essential for the recipient to provide correct information, as it is used by the payer to report income to the IRS. Misrepresentation or failure to provide a W-9 when requested can lead to backup withholding and other tax complications.

IRS Guidelines for the W-9 Form

According to IRS guidelines, the W-9 form should be requested by any individual or business that is required to report payments made to you. The form must be completed and returned promptly to ensure compliance with tax regulations. The IRS does not require the W-9 to be submitted with tax returns, but it must be kept on file by the requester.

Filing Deadlines for the W-9 Form

While the W-9 form itself does not have a specific filing deadline, it is important to submit it to the requesting party as soon as possible. This ensures that they can accurately report payments made to you on their 1099 forms by the IRS deadline, which is typically January thirty-first of the following year.

Form Submission Methods

The completed W-9 form can be submitted in various ways, depending on the requester's preferences:

- Online submission: Many businesses allow electronic submission through secure portals.

- Email: You can send the completed form as a PDF attachment via email.

- Mail: Traditional mail is also an option, sending the form directly to the requester.

Quick guide on how to complete pdf request for taxpayer identification number and umass amherst

Easily prepare PDF Request For Taxpayer Identification Number And UMass Amherst on any device

Online document organization has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to access the correct format and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage PDF Request For Taxpayer Identification Number And UMass Amherst on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The simplest way to modify and eSign PDF Request For Taxpayer Identification Number And UMass Amherst without any hassle

- Locate PDF Request For Taxpayer Identification Number And UMass Amherst and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign PDF Request For Taxpayer Identification Number And UMass Amherst and ensure outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf request for taxpayer identification number and umass amherst

Create this form in 5 minutes!

How to create an eSignature for the pdf request for taxpayer identification number and umass amherst

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is a W9 form and why is it important?

A W9 form is a tax form used in the United States for request of taxpayer identification number and certification. It's crucial for businesses to collect this information from contractors and freelancers to ensure proper tax reporting. Using airSlate SignNow to manage your W9 forms can streamline the process, ensuring compliance and reducing the risk of errors.

-

How does airSlate SignNow simplify the W9 form process?

airSlate SignNow allows you to create, send, and eSign W9 forms electronically, which signNowly simplifies document management. You can track submissions and receive completed W9 forms in real-time, ensuring you have the information you need to maintain tax compliance. This efficiency saves time and enhances productivity for your business.

-

Is there a cost associated with using airSlate SignNow for W9 forms?

Yes, airSlate SignNow offers various pricing plans based on your business needs, allowing for flexibility when managing W9 forms. Each plan includes features like unlimited eSigning and document templates, making it a cost-effective solution for your tax documentation needs. You can choose a plan that suits your volume of W9 form requests.

-

Can I integrate airSlate SignNow with other applications for W9 forms?

Absolutely! airSlate SignNow provides integration capabilities with various applications, enhancing the workflow for managing W9 forms. You can connect it with platforms like Google Drive, Salesforce, and Zapier, making it easy to automate processes and streamline data management associated with W9 forms.

-

What security features does airSlate SignNow provide for W9 forms?

airSlate SignNow prioritizes your data security with encryption and secure cloud storage for W9 forms. All eSignatures are legally binding and comply with eIDAS and ESIGN Act standards, ensuring that your sensitive information is protected throughout the document lifecycle. You can have peace of mind when managing W9 forms securely.

-

How quickly can I get my W9 forms signed using airSlate SignNow?

Using airSlate SignNow, you can typically get W9 forms signed within minutes, thanks to its easy-to-use interface and efficient workflows. Recipients receive notifications to eSign immediately, reducing turnaround time and allowing you to collect necessary information faster. This speed is essential for maintaining timely tax reporting.

-

What features does airSlate SignNow offer specifically for managing W9 forms?

airSlate SignNow offers features such as custom templates for W9 forms, easy sharing options, and automated reminders for signers. You can also track the status of your documents in real-time, allowing for better organization and management of tax forms. These features help you efficiently handle the administrative burden of W9 forms.

Get more for PDF Request For Taxpayer Identification Number And UMass Amherst

Find out other PDF Request For Taxpayer Identification Number And UMass Amherst

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document