Form ST 100 10 I320Quarterly Schedule FR Instructions Sales 2020

What is the Form ST 100 10 I320Quarterly Schedule FR Instructions Sales

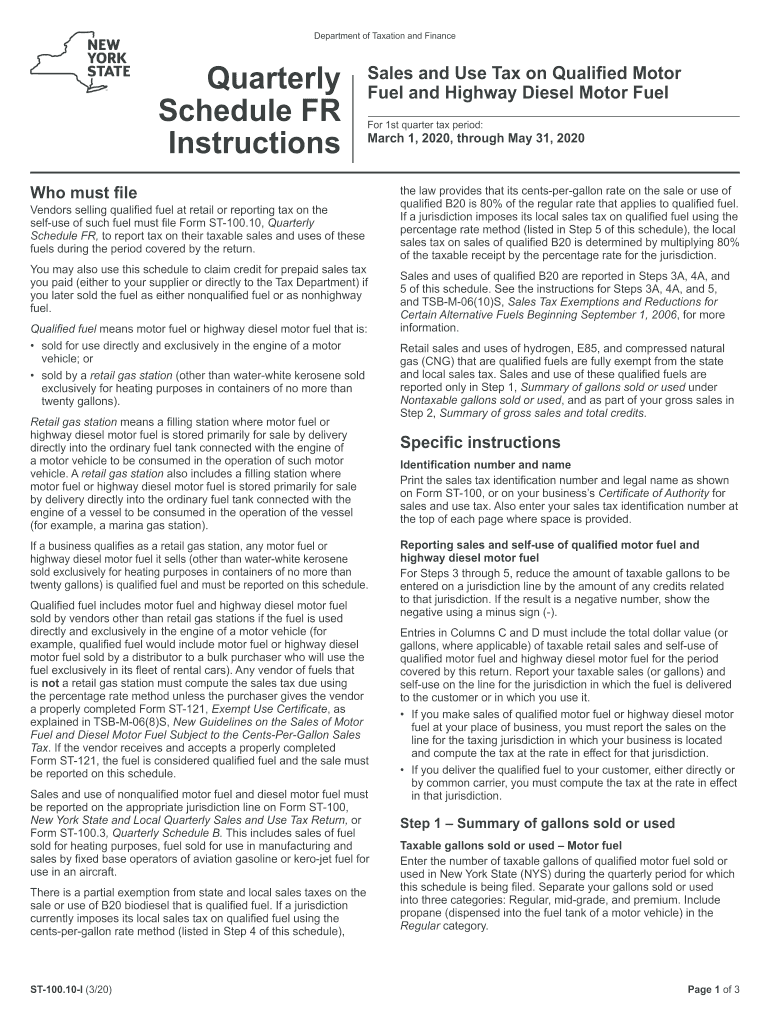

The Form ST 100 10 I320Quarterly Schedule FR Instructions Sales is a tax document used primarily by businesses in the United States to report sales and use tax information on a quarterly basis. This form is essential for ensuring compliance with state tax regulations, allowing businesses to accurately calculate and remit the appropriate taxes owed based on their sales activities. The form is specifically tailored for sales tax reporting, making it a critical component of financial management for companies engaged in selling goods or services.

How to use the Form ST 100 10 I320Quarterly Schedule FR Instructions Sales

Using the Form ST 100 10 I320Quarterly Schedule FR Instructions Sales involves several key steps. First, businesses must gather all necessary sales data for the reporting period, including total sales, exempt sales, and any applicable deductions. Next, the form must be filled out accurately, ensuring that all figures are correctly calculated and reported. Once completed, the form can be submitted to the appropriate state tax authority, either electronically or by mail, depending on the state’s requirements. It is crucial to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Form ST 100 10 I320Quarterly Schedule FR Instructions Sales

Completing the Form ST 100 10 I320Quarterly Schedule FR Instructions Sales requires careful attention to detail. Follow these steps:

- Collect sales data for the quarter, including total sales, taxable sales, and exempt sales.

- Calculate the total sales tax due based on the applicable state rate.

- Fill in the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Form ST 100 10 I320Quarterly Schedule FR Instructions Sales

The legal use of the Form ST 100 10 I320Quarterly Schedule FR Instructions Sales is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted on time. Electronic submissions are typically accepted, provided they comply with state regulations regarding eSignature and electronic filing. It is important for businesses to understand the legal implications of their reporting to avoid potential fines or audits from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST 100 10 I320Quarterly Schedule FR Instructions Sales can vary by state. Generally, the form must be filed quarterly, with specific due dates often falling on the last day of the month following the end of each quarter. For example, the deadlines may be January 31, April 30, July 31, and October 31. Businesses should verify their state’s specific deadlines to ensure timely filing and compliance.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form ST 100 10 I320Quarterly Schedule FR Instructions Sales can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential audits by state tax authorities. In severe cases, businesses may face legal action or increased scrutiny in future filings. It is essential for businesses to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete form st 10010 i320quarterly schedule fr instructions sales

Complete Form ST 100 10 I320Quarterly Schedule FR Instructions Sales seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without any holdups. Manage Form ST 100 10 I320Quarterly Schedule FR Instructions Sales on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign Form ST 100 10 I320Quarterly Schedule FR Instructions Sales effortlessly

- Find Form ST 100 10 I320Quarterly Schedule FR Instructions Sales and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and press the Done button to finalize your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form ST 100 10 I320Quarterly Schedule FR Instructions Sales while ensuring excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 10010 i320quarterly schedule fr instructions sales

Create this form in 5 minutes!

How to create an eSignature for the form st 10010 i320quarterly schedule fr instructions sales

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Form ST 100 10 I320Quarterly Schedule FR Instructions Sales?

Form ST 100 10 I320Quarterly Schedule FR Instructions Sales is a specialized document that businesses use to report sales tax on a quarterly basis. It outlines the necessary instructions for accurately completing the form, ensuring compliance with state tax regulations. Utilizing airSlate SignNow allows for seamless completion and electronic signing of this important document.

-

How can airSlate SignNow help with Form ST 100 10 I320Quarterly Schedule FR Instructions Sales?

airSlate SignNow provides an easy-to-use platform to create, fill out, and eSign Form ST 100 10 I320Quarterly Schedule FR Instructions Sales. Using our solution helps streamline the process, reducing errors and saving time for businesses when filing their sales tax documents. Plus, you can access your forms from anywhere, ensuring flexibility and convenience.

-

What are the pricing options for using airSlate SignNow for Form ST 100 10 I320Quarterly Schedule FR Instructions Sales?

airSlate SignNow offers several pricing plans to fit the needs of diverse businesses, ranging from basic to advanced features. The plans are designed to be cost-effective, especially for teams who regularly handle Form ST 100 10 I320Quarterly Schedule FR Instructions Sales and other important documentation. For specific pricing details, you can visit our website or contact our sales team.

-

Are there any integrations available for using airSlate SignNow with Form ST 100 10 I320Quarterly Schedule FR Instructions Sales?

Yes, airSlate SignNow integrates seamlessly with numerous applications, including CRM systems and cloud storage services. These integrations allow businesses to easily manage their documents related to Form ST 100 10 I320Quarterly Schedule FR Instructions Sales without switching between multiple platforms. This enhances productivity and ensures that all necessary data is readily accessible.

-

What security measures does airSlate SignNow have for Form ST 100 10 I320Quarterly Schedule FR Instructions Sales?

Security is a top priority for airSlate SignNow. We employ industry-leading encryption and access control measures to protect your Form ST 100 10 I320Quarterly Schedule FR Instructions Sales and other sensitive documents. Additionally, audit trails provide accountability, allowing you to track who accessed or modified your documents.

-

Can I access my Form ST 100 10 I320Quarterly Schedule FR Instructions Sales documents from mobile devices?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to access and manage your Form ST 100 10 I320Quarterly Schedule FR Instructions Sales documents on the go. This mobile support ensures that you can prepare, sign, and send your forms anytime, anywhere, keeping your business efficient.

-

What benefits do I get from using airSlate SignNow for Form ST 100 10 I320Quarterly Schedule FR Instructions Sales?

Using airSlate SignNow to handle your Form ST 100 10 I320Quarterly Schedule FR Instructions Sales provides numerous benefits including time efficiency, reduced paperwork, and better compliance with tax regulations. You can also easily collaborate with team members and stakeholders, streamlining the overall review and approval process. All of this makes for a smoother experience in managing your sales tax documentation.

Get more for Form ST 100 10 I320Quarterly Schedule FR Instructions Sales

- Retirement agreement form

- Agreement meeting form

- Security agreement form 497336668

- Stock option agreement of quantum effect devices inc form

- Holding company form

- Bylaws of bankers trust corporation form

- Investment management agreement regarding the employment of morgan stanley dean witter advisors inc to render management and form

- Distribution agreement form

Find out other Form ST 100 10 I320Quarterly Schedule FR Instructions Sales

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple