Florida Dept of Revenue ????Forms and Publications 2020

Understanding Florida Tax Forms

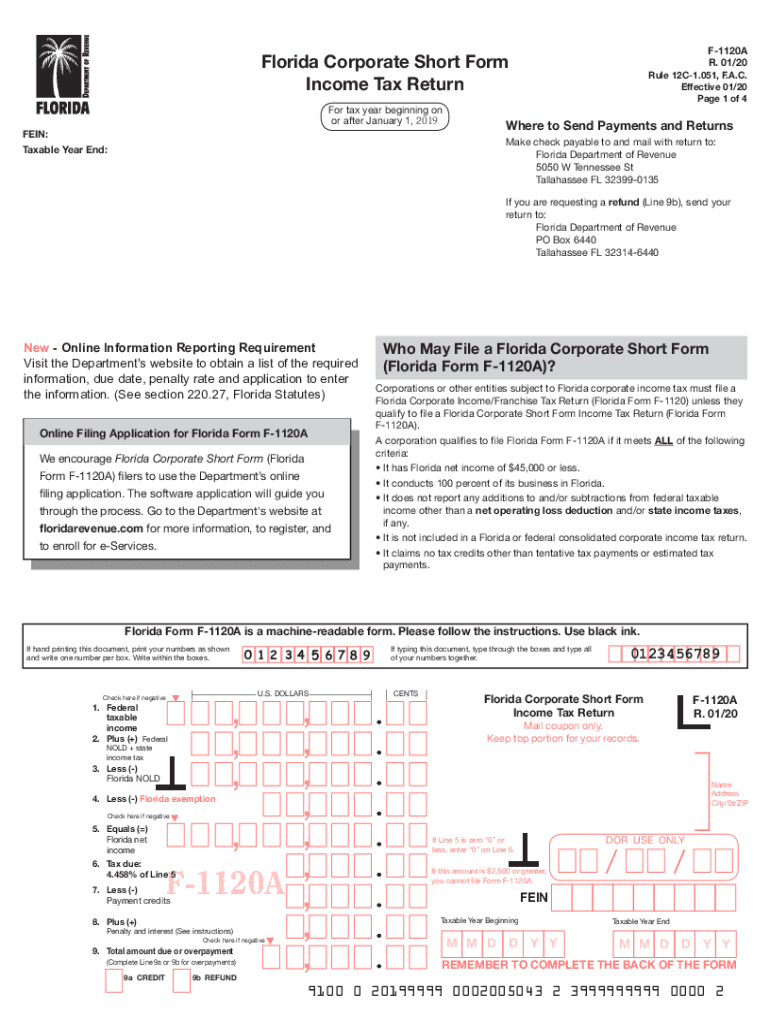

Florida tax forms are essential documents required for various tax-related processes, including income reporting, corporate taxation, and sales tax compliance. The Florida Department of Revenue provides a comprehensive range of forms to meet the needs of individual taxpayers, businesses, and organizations. These forms include the corporate short form tax return, the 1120A corporate form, and many others tailored to specific tax situations.

Steps to Complete Florida Tax Forms

Completing Florida tax forms involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as income statements, expense records, and prior tax returns. Next, select the appropriate form based on your tax situation, whether it’s for personal income, corporate taxes, or sales tax. Carefully fill out the form, ensuring all information is accurate and complete. Finally, review the form for any errors before submitting it to the Florida Department of Revenue.

Legal Use of Florida Tax Forms

Florida tax forms must be completed and submitted in accordance with state laws and regulations. Proper use of these forms ensures that taxpayers fulfill their legal obligations and avoid penalties. Electronic signatures on Florida tax forms are legally binding, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Utilizing a secure eSignature platform can help ensure compliance and enhance the legitimacy of submitted documents.

Filing Deadlines and Important Dates

Timely filing of Florida tax forms is crucial to avoid penalties and interest. The deadlines for submitting various forms can vary based on the type of tax and the taxpayer's status. For instance, corporate tax returns are typically due on the first day of the fourth month following the end of the fiscal year. It is important to stay informed about specific deadlines for each form to ensure compliance and avoid unnecessary complications.

Form Submission Methods

Florida tax forms can be submitted through multiple methods, including online, by mail, or in person. Electronic filing is often the most efficient option, allowing for quicker processing and confirmation of receipt. When filing by mail, ensure that the forms are sent to the correct address and consider using certified mail for tracking purposes. In-person submissions may be made at designated Florida Department of Revenue offices, providing an opportunity to ask questions and receive assistance.

Required Documents for Florida Tax Forms

When completing Florida tax forms, several supporting documents are typically required. These may include proof of income, such as W-2s or 1099s, documentation of deductions and credits, and any prior year tax returns. Having these documents ready can streamline the process and help ensure that all necessary information is included on the forms, reducing the likelihood of errors or delays.

Quick guide on how to complete florida dept of revenue forms and publications

Accomplish Florida Dept Of Revenue ????Forms And Publications effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents swiftly without any delays. Handle Florida Dept Of Revenue ????Forms And Publications across any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

Steps to edit and electronically sign Florida Dept Of Revenue ????Forms And Publications with ease

- Locate Florida Dept Of Revenue ????Forms And Publications and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive data with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign Florida Dept Of Revenue ????Forms And Publications to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida dept of revenue forms and publications

Create this form in 5 minutes!

How to create an eSignature for the florida dept of revenue forms and publications

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What are Florida tax forms and why are they important?

Florida tax forms are official documents that residents and businesses in Florida use to report their income and calculate their tax obligations. They are vital for compliance with Florida tax laws and ensure that you pay the correct amount, avoiding potential penalties.

-

How can airSlate SignNow help with Florida tax forms?

airSlate SignNow streamlines the process of completing and signing Florida tax forms electronically. With its user-friendly interface, businesses can easily send, receive, and eSign these forms, saving time and reducing the need for physical paperwork.

-

Is airSlate SignNow's pricing competitive for handling Florida tax forms?

Yes, airSlate SignNow offers cost-effective pricing options tailored to various business needs. By investing in our solution, you not only save on printing and mailing costs associated with Florida tax forms, but you also improve efficiency and reduce turnaround times.

-

What features does airSlate SignNow provide for managing Florida tax forms?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure cloud storage to effectively manage Florida tax forms. These features ensure that all documents are easily accessible and can be securely signed by all parties involved.

-

Can airSlate SignNow integrate with other accounting software for Florida tax forms?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage your Florida tax forms directly from your preferred applications. This integration ensures all your data is centralized and simplifies the tax filing process.

-

Are Florida tax forms secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and authentication methods to protect all your Florida tax forms and sensitive information, ensuring that your documents remain confidential and secure throughout the signing process.

-

Can I use airSlate SignNow for multiple types of Florida tax forms?

Certainly! airSlate SignNow supports a wide range of Florida tax forms, including personal income tax returns, business returns, and other state-specific documents. This versatility allows you to manage all your tax-related paperwork in one convenient platform.

Get more for Florida Dept Of Revenue ????Forms And Publications

Find out other Florida Dept Of Revenue ????Forms And Publications

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe