Florida Form Tax Return 2019

What is the Florida Form Tax Return

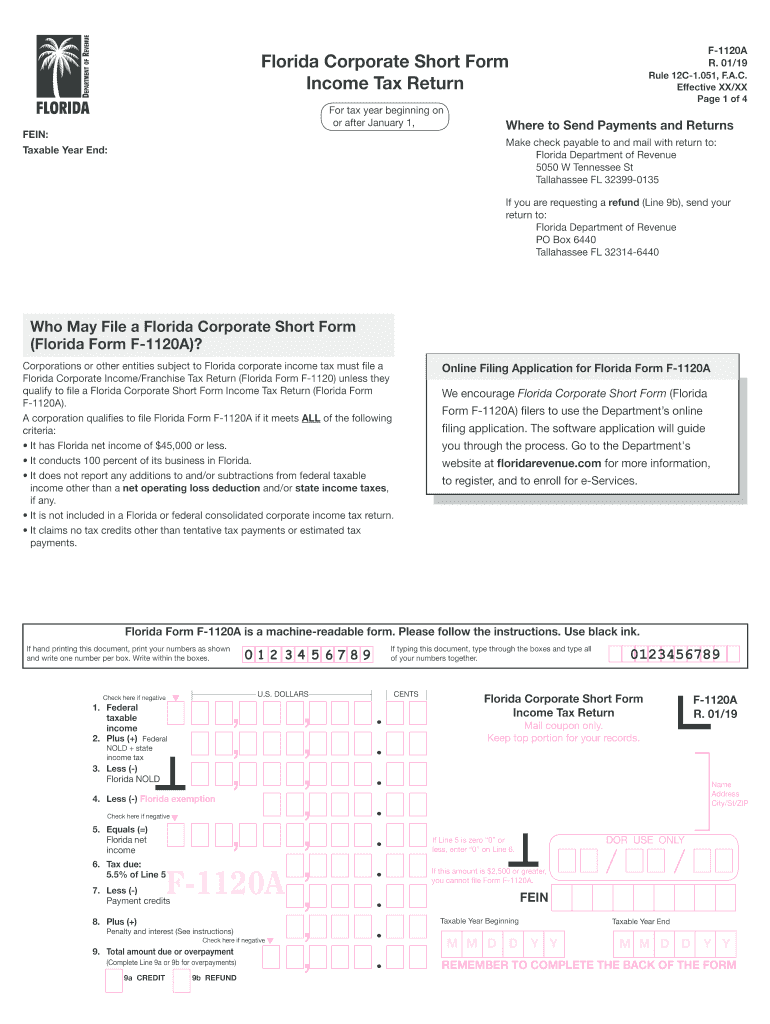

The Florida Form Tax Return, specifically the Florida F 1120A, is a corporate income tax return used by businesses operating in Florida. This form is essential for corporations to report their income, calculate their tax liability, and ensure compliance with state tax regulations. The F 1120A form is designed for corporations that meet specific criteria, allowing them to file their taxes efficiently and accurately.

Steps to complete the Florida Form Tax Return

Completing the Florida F 1120A involves several key steps:

- Gather necessary information: Collect all financial records, including income statements, balance sheets, and previous tax returns.

- Fill out the form: Input the required information accurately, including total income, deductions, and credits.

- Review the form: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Sign and date: Ensure that the form is signed by an authorized individual, as this is crucial for the form's validity.

Legal use of the Florida Form Tax Return

The Florida F 1120A is legally binding when completed and submitted in accordance with state regulations. To ensure its legal standing, the form must be signed and dated by an authorized representative of the corporation. Additionally, compliance with eSignature laws is essential when submitting the form electronically. Using a trusted eSignature solution can help maintain the integrity and legality of the submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Florida F 1120A. The due date for submitting the form is typically the first day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 1. It is important to file on time to avoid penalties and interest on any unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Florida F 1120A can be submitted through various methods, offering flexibility for corporations. These methods include:

- Online submission: Many corporations opt to file electronically through approved e-filing platforms, which can expedite processing.

- Mail: Corporations can also send a paper version of the form via postal service to the designated state tax office.

- In-person: Some may choose to deliver their forms directly to local tax offices for immediate processing.

Required Documents

When completing the Florida F 1120A, certain documents are necessary to support the information reported. These include:

- Income statements detailing revenue and expenses.

- Balance sheets reflecting the corporation's financial position.

- Documentation for any deductions or credits claimed.

- Prior year tax returns for reference.

Quick guide on how to complete florida form tax return

Easily create Florida Form Tax Return on any device

Online document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed paperwork, as you can locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to produce, edit, and eSign your documents quickly and without delays. Manage Florida Form Tax Return on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Florida Form Tax Return effortlessly

- Obtain Florida Form Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Florida Form Tax Return to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida form tax return

Create this form in 5 minutes!

How to create an eSignature for the florida form tax return

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Florida F 1120A and who needs to file it?

The Florida F 1120A is an income tax return form that businesses in Florida use to report their income and calculate tax liability. Corporations operating in Florida are required to file this form annually if they meet certain criteria. Understanding the Florida F 1120A is essential for ensuring compliance with state tax laws.

-

How can airSlate SignNow help with the Florida F 1120A filing process?

airSlate SignNow simplifies the filing process for the Florida F 1120A by enabling businesses to easily send and eSign necessary documents online. This eliminates the hassle of printing and mailing forms, making compliance quick and efficient. With its user-friendly interface, airSlate SignNow ensures that all documents are securely signed and stored.

-

What features does airSlate SignNow offer for managing Florida F 1120A documents?

airSlate SignNow offers features such as customizable templates, in-app document tracking, and secure storage, making it ideal for managing Florida F 1120A documents. Users can create, send, and receive signed documents seamlessly while maintaining compliance. Additionally, the platform provides integration capabilities with other financial software, enhancing workflow.

-

Is there a free trial for airSlate SignNow, and what pricing options are available?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for a limited time without any commitment. Pricing options vary based on the number of users and features needed, making it a cost-effective solution for those needing to manage the Florida F 1120A. Choose a plan that best fits your business size and needs.

-

What are the benefits of using airSlate SignNow for Florida F 1120A filings?

Using airSlate SignNow for Florida F 1120A filings offers key benefits such as improved efficiency and reduced turnaround time. Businesses can streamline their signature collection process and minimize paperwork, which saves valuable time. Additionally, the solution ensures that all documents are legally binding and compliant with regulations.

-

Can airSlate SignNow integrate with accounting software for Florida F 1120A?

Yes, airSlate SignNow can easily integrate with various accounting software solutions, making it easier to manage the Florida F 1120A and related documents. These integrations provide seamless data transfer, reducing the risk of errors and improving overall workflow. You can connect your existing tools with SignNow to create a unified approach to document management.

-

How secure is the information I send with airSlate SignNow for Florida F 1120A?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and follows industry-leading security practices to protect your information while processing the Florida F 1120A. Your documents and eSignatures are stored securely, ensuring that sensitive data remains confidential and compliant with regulations.

Get more for Florida Form Tax Return

Find out other Florida Form Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors