IRS Form F 1120 Florida Corporate Tax Return 2023

What is the IRS Form F 1120 Florida Corporate Tax Return

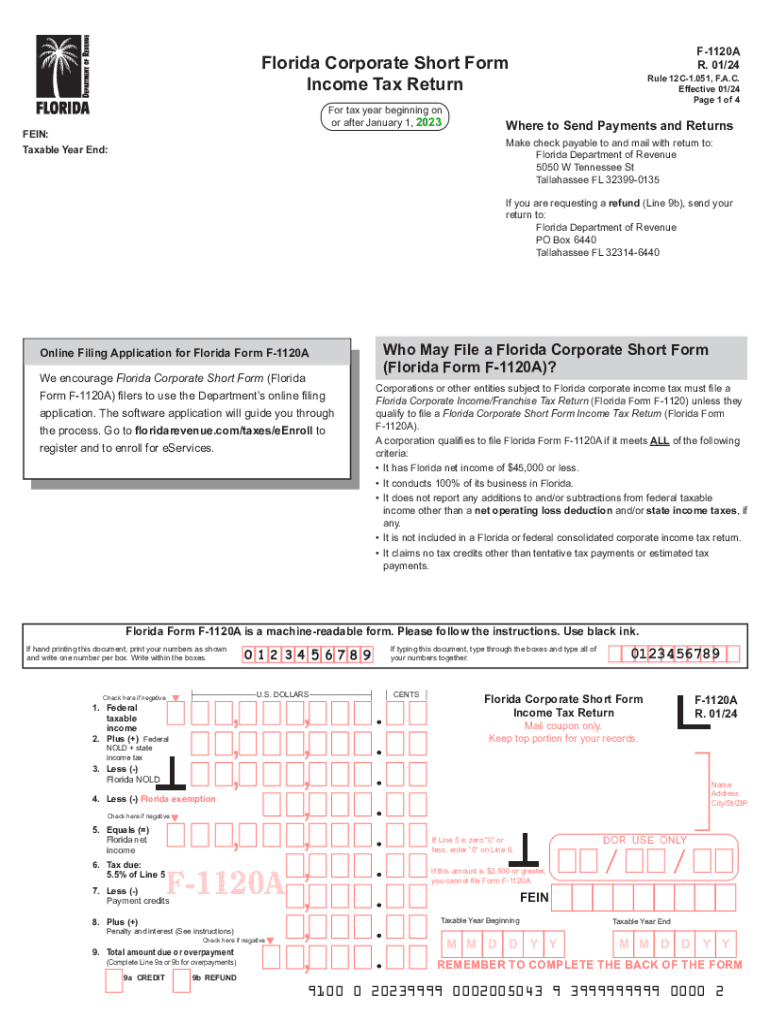

The IRS Form F 1120 is a critical document for corporations operating in Florida. This form is used to report the income, gains, losses, deductions, and credits of a corporation. It is essential for ensuring compliance with state tax regulations and for calculating the amount of corporate income tax owed to the Florida Department of Revenue. The F 1120 form is specifically designed for corporations, distinguishing it from other tax forms used by different entity types, such as partnerships or sole proprietorships.

Steps to complete the IRS Form F 1120 Florida Corporate Tax Return

Completing the IRS Form F 1120 involves several important steps:

- Gather financial records: Collect all relevant financial documents, including income statements, balance sheets, and records of expenses.

- Fill out the form: Begin by entering the corporation's name, address, and federal employer identification number (EIN) at the top of the form.

- Report income: Complete the sections detailing gross income, including sales revenue and any other income sources.

- Calculate deductions: List all allowable deductions, such as operating expenses, depreciation, and other deductions specific to the corporation.

- Determine tax liability: Use the information provided to calculate the total tax owed, taking into account any tax credits available to the corporation.

- Review and sign: Ensure all information is accurate and complete before signing and dating the form.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines for submitting the IRS Form F 1120. The due date for filing the form is typically the first day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this means the form is due by April fifteenth. Extensions may be available, but it is crucial to file for an extension before the original deadline to avoid penalties.

Required Documents

To complete the IRS Form F 1120, corporations need to gather several key documents:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received during the tax year.

- Documentation of all business expenses incurred.

- Previous tax returns, if applicable, for reference.

- Any supporting documents for deductions and credits claimed.

Legal use of the IRS Form F 1120 Florida Corporate Tax Return

The IRS Form F 1120 is legally required for corporations operating in Florida to report their income and pay the appropriate taxes. Failure to file this form can result in significant penalties, including fines and interest on unpaid taxes. It is important for corporations to ensure that the form is completed accurately and submitted on time to maintain compliance with state and federal tax laws.

Who Issues the Form

The IRS Form F 1120 is issued by the Florida Department of Revenue. This state agency is responsible for administering tax laws and ensuring that corporations comply with their tax obligations. The form is available through the Department of Revenue's official channels, and it is essential for corporations to obtain the most current version to ensure compliance with any updates or changes in tax law.

Quick guide on how to complete irs form f 1120 florida corporate tax return

Easily Prepare IRS Form F 1120 Florida Corporate Tax Return on Any Device

Managing documents online has gained traction among both companies and individuals. It presents an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources necessary to generate, modify, and eSign your documents swiftly without delays. Handle IRS Form F 1120 Florida Corporate Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to Modify and eSign IRS Form F 1120 Florida Corporate Tax Return Effortlessly

- Find IRS Form F 1120 Florida Corporate Tax Return and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or conceal sensitive data with the tools that airSlate SignNow offers specifically for that task.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred way to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the inconvenience of searching for forms, or the need to print new copies due to errors. airSlate SignNow meets all your document management needs with just a few clicks from any device you select. Adjust and eSign IRS Form F 1120 Florida Corporate Tax Return to maintain effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form f 1120 florida corporate tax return

Create this form in 5 minutes!

How to create an eSignature for the irs form f 1120 florida corporate tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f 1120a form, and why is it important for businesses?

The f 1120a form is designed for corporations to report their income, gains, losses, and tax liability. Using airSlate SignNow can simplify the process of electronically signing and submitting the f 1120a, ensuring compliance with IRS regulations while saving time and reducing errors.

-

How can airSlate SignNow help with the completion of the f 1120a?

airSlate SignNow offers an intuitive platform that allows users to easily fill out and eSign the f 1120a form online. With features like templates and guided workflows, businesses can ensure that all necessary fields are completed accurately, minimizing the risk of delays in processing.

-

What are the pricing options for using airSlate SignNow for f 1120a eSigning?

airSlate SignNow provides flexible pricing plans that cater to various business needs, including plans specifically designed for handling forms like the f 1120a. You can choose from monthly or annual subscriptions, ensuring that costs align with your budget while gaining access to comprehensive features.

-

Does airSlate SignNow integrate with other software for filing the f 1120a?

Yes, airSlate SignNow seamlessly integrates with various accounting and document management software, allowing businesses to streamline their processes related to the f 1120a form. This integration reduces manual data entry and enhances productivity, ensuring that your financial documents are readily accessible.

-

Are there any features specifically designed for handling the f 1120a in airSlate SignNow?

Absolutely! airSlate SignNow includes features such as reusable templates, advanced security options for sensitive information, and intuitive signing experiences tailored to the requirements of the f 1120a form. These enhancements make it easier for businesses to manage their filing obligations efficiently.

-

What benefits does airSlate SignNow offer when eSigning the f 1120a compared to traditional methods?

Using airSlate SignNow to eSign the f 1120a offers several benefits including speed, ease of use, and enhanced security. Unlike traditional methods that can be time-consuming and prone to errors, our platform promotes faster document turnaround while ensuring data integrity and compliance.

-

Can I track the status of my f 1120a form submissions in airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities that allow users to monitor the status of their f 1120a form submissions in real-time. This feature ensures that businesses stay informed about the progress of their documents, helping them to manage deadlines effectively.

Get more for IRS Form F 1120 Florida Corporate Tax Return

- Justia decree and order of acceptance of resignation of form

- Fill free fillable mpc441 notarized and verified consent form

- Photo video release minor doc templatepdffiller form

- Fillable online conservatorampampamp39s financial plan fax email form

- Massachusetts minor name change minor name change form

- Control number ma p007 pkg form

- Control number ma p009 pkg form

- Control number ma p019 pkg form

Find out other IRS Form F 1120 Florida Corporate Tax Return

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy