Do Not Use Grayed Out Fields 2020

Understanding the Do Not Use Grayed Out Fields

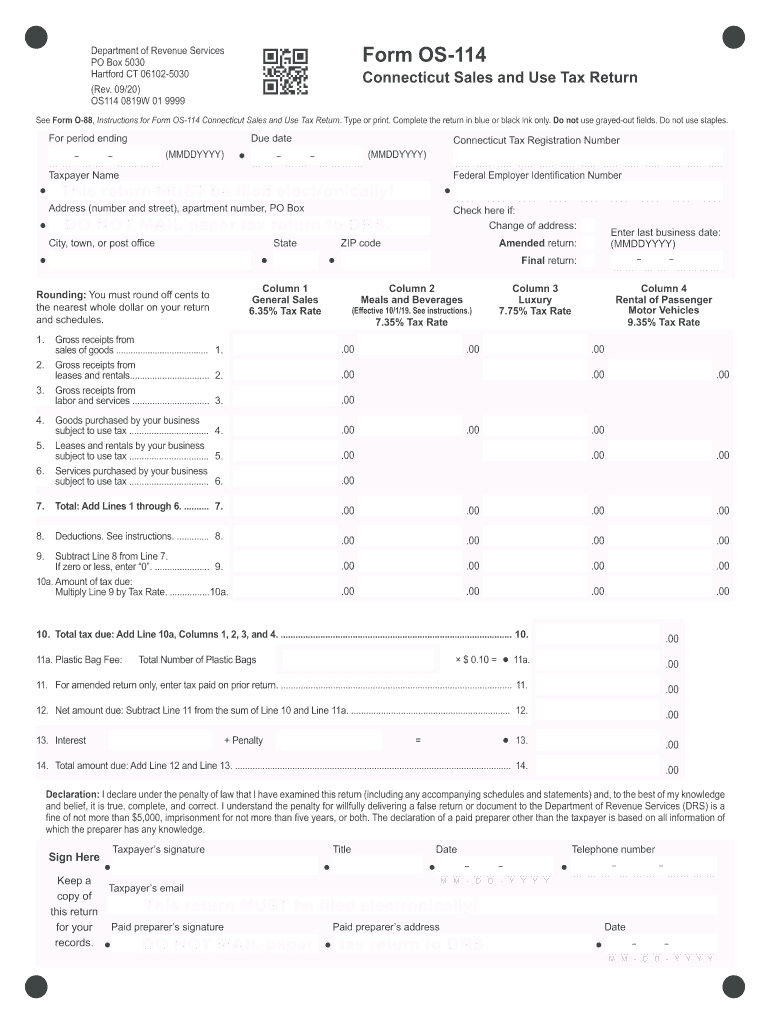

The Do Not Use Grayed Out Fields on the CT Department of Revenue Services Form OS-114 indicate sections that are not applicable to your specific filing situation. These fields are intentionally disabled to prevent any alterations or entries that could lead to errors in the completion of the form. Recognizing which fields are grayed out helps streamline the filing process and ensures compliance with the form's requirements.

How to Use the Do Not Use Grayed Out Fields

When filling out the OS-114 form, it is essential to focus only on the active fields. The grayed out sections should be ignored, as they are not meant for user input. If you encounter a grayed out field, check the accompanying instructions or guidance provided with the form to understand why that section is disabled. This practice helps avoid confusion and ensures that you are only completing the necessary parts of the form.

Steps to Complete the Do Not Use Grayed Out Fields

To effectively navigate the OS-114 form, follow these steps:

- Review the entire form to identify which fields are active and which are grayed out.

- Focus on providing accurate information in the active fields only.

- Consult the instructions for any clarifications regarding the grayed out sections.

- Double-check your entries in the active fields before submission to ensure accuracy.

Legal Use of the Do Not Use Grayed Out Fields

The grayed out fields on the OS-114 form are designed to comply with legal standards set by the Connecticut Department of Revenue Services. By adhering to these guidelines and avoiding input in the disabled sections, you help maintain the integrity of the form. This adherence is crucial for ensuring that your submission is valid and recognized by the state.

Form Submission Methods

The OS-114 form can be submitted through various methods, including online filing, mail, or in-person submission. When using the online method, ensure that you are filling out the form in a secure environment. Grayed out fields will not affect your submission, as only the active fields will be processed. If submitting by mail or in person, ensure that you have completed all necessary sections and that no grayed out fields are mistakenly filled.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the OS-114 form to avoid penalties. The deadlines may vary based on the specific tax period you are filing for. Make sure to check the Connecticut Department of Revenue Services' official guidelines for the most accurate and up-to-date information regarding important dates related to the form.

Quick guide on how to complete do not use grayed out fields

Complete Do Not Use Grayed out Fields effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Do Not Use Grayed out Fields on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to modify and eSign Do Not Use Grayed out Fields with ease

- Obtain Do Not Use Grayed out Fields and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Identify important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your document: via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Do Not Use Grayed out Fields to ensure excellent communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do not use grayed out fields

Create this form in 5 minutes!

How to create an eSignature for the do not use grayed out fields

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the ct department of revenue services form 0s 114?

The ct department of revenue services form 0s 114 is a specific form used for various tax-related purposes in Connecticut. It requires accurate completion to ensure compliance with state regulations. Using airSlate SignNow can simplify the process of filling out and submitting this form.

-

How can airSlate SignNow help with the ct department of revenue services form 0s 114?

airSlate SignNow offers an intuitive platform to easily fill out the ct department of revenue services form 0s 114. With features like templates and eSignature capabilities, you can streamline document management and ensure timely submission of your forms.

-

Is there a cost associated with using airSlate SignNow for the ct department of revenue services form 0s 114?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. These plans provide affordable access to features that simplify the completion and submission of forms like the ct department of revenue services form 0s 114.

-

Can I integrate airSlate SignNow with other software for the ct department of revenue services form 0s 114?

Absolutely! airSlate SignNow integrates seamlessly with numerous software applications, enhancing your workflow for tasks like managing the ct department of revenue services form 0s 114. This integration eliminates manual data entry and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for the ct department of revenue services form 0s 114?

Using airSlate SignNow to manage the ct department of revenue services form 0s 114 offers benefits such as increased accuracy and reduced turnaround time. The eSignature feature ensures you obtain necessary approvals quickly, helping you stay compliant with state regulations.

-

Is it easy to eSign the ct department of revenue services form 0s 114 with airSlate SignNow?

Yes, eSigning the ct department of revenue services form 0s 114 with airSlate SignNow is extremely user-friendly. The platform guides you through the signing process, allowing multiple parties to sign legally and securely in just a few clicks.

-

How can I ensure the security of my ct department of revenue services form 0s 114 when using airSlate SignNow?

airSlate SignNow prioritizes security with industry-standard encryption and secure storage practices. By using this platform for the ct department of revenue services form 0s 114, you can rest assured that your documents are protected and only accessible to authorized users.

Get more for Do Not Use Grayed out Fields

- Residential cleaning contract for contractor utah form

- Concrete mason contract for contractor utah form

- Demolition contract for contractor utah form

- Framing contract for contractor utah form

- Security contract for contractor utah form

- Insulation contract for contractor utah form

- Paving contract for contractor utah form

- Site work contract for contractor utah form

Find out other Do Not Use Grayed out Fields

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free