Form OS 114 Portal Ct Gov 2021

What is the Form OS 114?

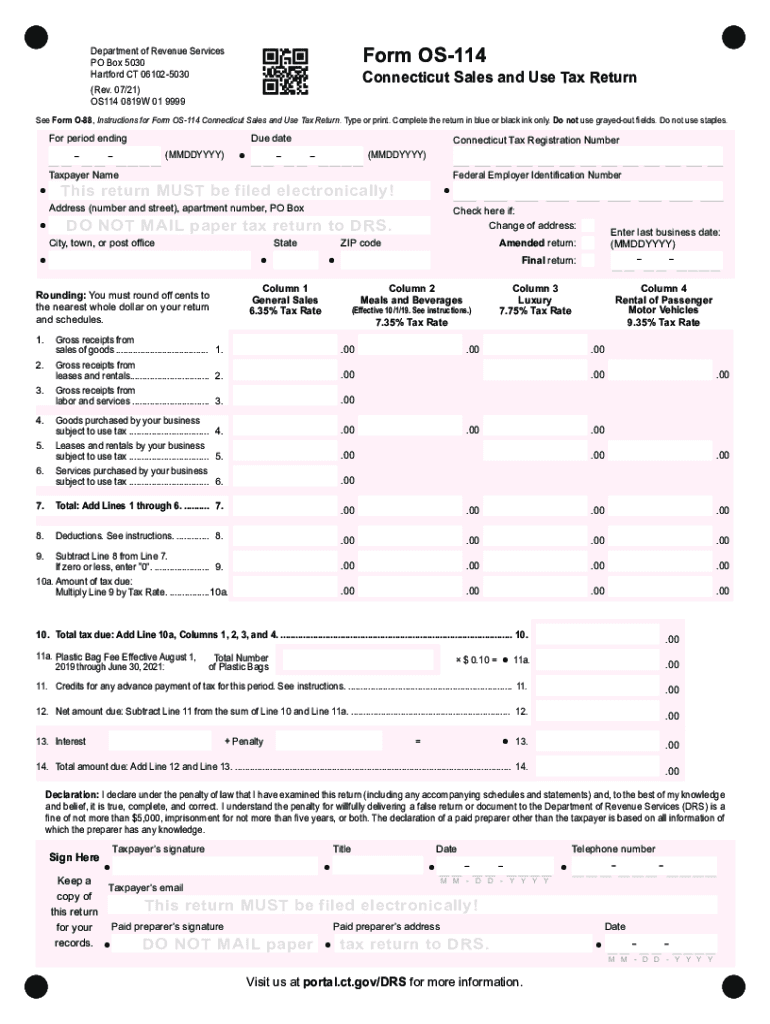

The Form OS 114 is the official Connecticut Sales and Use Tax Return form. This document is essential for businesses operating in Connecticut to report and pay sales tax collected from customers. The form captures various details, including the total sales, taxable sales, and the amount of tax due. Understanding the purpose and requirements of the OS 114 is crucial for compliance with state tax regulations.

Steps to Complete the Form OS 114

Completing the Form OS 114 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including invoices and receipts. Next, calculate the total sales and determine the taxable sales amount. Fill out the form by entering the required information in the appropriate fields, ensuring that all calculations are correct. Finally, review the completed form for accuracy before submission.

Legal Use of the Form OS 114

The Form OS 114 is legally binding when completed and submitted according to Connecticut state regulations. It must be signed by an authorized representative of the business, affirming the accuracy of the information provided. Compliance with eSignature laws, such as the ESIGN Act and UETA, ensures that electronically signed forms are valid and enforceable in court.

Form Submission Methods

The Form OS 114 can be submitted through various methods, including online submission via the Connecticut Department of Revenue Services website, mailing a paper copy to the designated address, or delivering it in person. Each method has specific guidelines and deadlines that must be adhered to for compliance.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Form OS 114 to avoid penalties. Generally, the form must be filed quarterly, with specific due dates determined by the Connecticut Department of Revenue Services. Keeping track of these dates ensures timely compliance and helps avoid late fees.

Required Documents

To complete the Form OS 114, businesses must have several documents on hand. These include sales records, previous tax returns, and any supporting documentation that verifies taxable sales. Accurate record-keeping is vital to ensure that all information reported on the form is correct and substantiated.

Penalties for Non-Compliance

Failure to file the Form OS 114 on time or inaccuracies in reporting can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate submissions.

Quick guide on how to complete form os 114 portalctgov

Finish Form OS 114 Portal ct gov effortlessly on any gadget

Internet-based document administration has gained traction among businesses and individuals. It serves as an ideal environment-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely preserve it online. airSlate SignNow provides all the tools you require to generate, modify, and eSign your documents swiftly without any delays. Manage Form OS 114 Portal ct gov on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form OS 114 Portal ct gov effortlessly

- Obtain Form OS 114 Portal ct gov and click on Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize important sections of the document or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Form OS 114 Portal ct gov and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form os 114 portalctgov

Create this form in 5 minutes!

How to create an eSignature for the form os 114 portalctgov

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is a CT sales tax form?

A CT sales tax form is a document used by businesses operating in Connecticut to report and remit sales tax to the state. It is essential for complying with state tax regulations and helps ensure that all taxable sales are documented accurately.

-

How can airSlate SignNow help with managing CT sales tax forms?

airSlate SignNow enables users to easily create, send, and eSign CT sales tax forms electronically. This streamlines the process, ensuring that your forms are completed correctly and submitted on time, reducing the risk of costly errors.

-

Is there a cost associated with using airSlate SignNow for CT sales tax forms?

AirSlate SignNow offers a variety of pricing plans, making it a cost-effective solution for businesses needing to manage CT sales tax forms. Plans are designed to fit different business sizes and needs, allowing you to choose the best option for your organization.

-

Are there any integrations available for managing CT sales tax forms?

Yes, airSlate SignNow integrates with various accounting and financial software, making it easier to manage CT sales tax forms. These integrations allow for seamless data transfer, reducing manual entry and improving overall efficiency in your tax reporting.

-

Can I store my CT sales tax forms securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for your CT sales tax forms and other important documents. This ensures that your files are protected, easily accessible, and organized for your future reference.

-

What features does airSlate SignNow offer for CT sales tax form management?

AirSlate SignNow offers features like templates, customizable fields, and automated reminders specifically for CT sales tax forms. These tools enhance your document workflow, making it simple to manage your forms efficiently and stay compliant with state regulations.

-

How can airSlate SignNow improve my business’s efficiency in handling CT sales tax forms?

By utilizing airSlate SignNow, your business can reduce the time spent on paperwork and focus on core activities. The efficiency gained from electronic signatures and document tracking helps streamline the entire process of handling CT sales tax forms.

Get more for Form OS 114 Portal ct gov

- Front matter the council of state governments form

- In the court of alabama 481195137 form

- Order of expungement alabama law enforcement agency form

- Form c 10f

- Court building b room 120 washington d form

- Asuntos civilestribunales del distrito de columbia dc courts form

- Affidavit in support of default and scra compliance form

- Motion for contempt domestic relations order dc courts form

Find out other Form OS 114 Portal ct gov

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document