Form Os 114 2022-2026

What is the Form Os 114

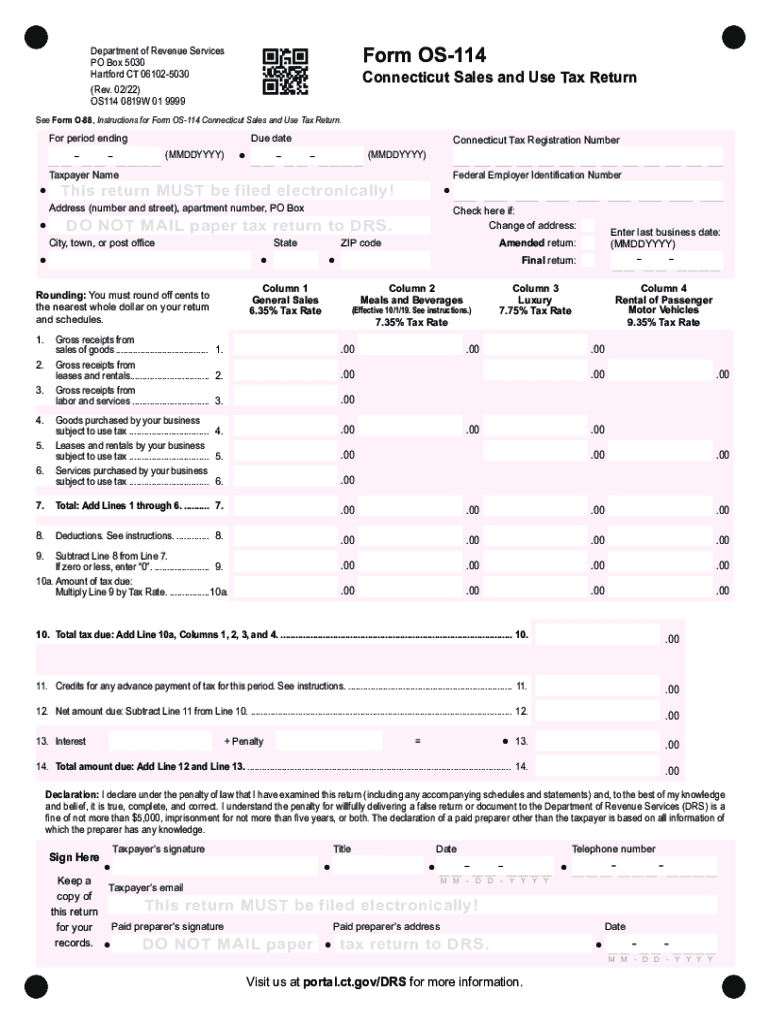

The Form Os 114 is a crucial document used for reporting sales and use tax in the state of Connecticut. This form is specifically designed for businesses and individuals who need to report their taxable sales, as well as any purchases subject to use tax. By accurately completing the Form Os 114, taxpayers ensure compliance with state tax regulations, which helps avoid penalties and interest associated with underreporting or late filing.

How to use the Form Os 114

Using the Form Os 114 involves several key steps. First, gather all necessary documentation related to your sales and purchases for the reporting period. This may include invoices, receipts, and any relevant financial records. Next, carefully fill out the form, ensuring that all sections are completed accurately. It's important to calculate your total taxable sales and any use tax owed. Once the form is filled out, you can submit it either electronically or by mail, depending on your preference and the guidelines provided by the Connecticut Department of Revenue Services.

Steps to complete the Form Os 114

Completing the Form Os 114 requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the Form Os 114 from the Connecticut Department of Revenue Services website.

- Fill in your business information, including name, address, and tax identification number.

- Report your total sales, including exempt sales and any adjustments.

- Calculate the use tax owed based on purchases made during the reporting period.

- Review the completed form for accuracy and ensure all required signatures are present.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Form Os 114

The Form Os 114 is legally binding when completed and submitted in accordance with Connecticut tax laws. To ensure its legal validity, taxpayers must provide accurate information and comply with all filing requirements. Electronic submissions are recognized under the Electronic Signatures in Global and National Commerce Act (ESIGN), meaning that eSigned documents hold the same legal weight as traditional paper forms. It is essential to maintain a copy of the submitted form for your records, as this may be required for future audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Form Os 114 are critical for compliance. Typically, the form must be submitted quarterly, with specific due dates set by the Connecticut Department of Revenue Services. For example, the due date for the first quarter may be April 30, while the second quarter is due July 31. It's important to check the official state calendar for any updates or changes to these deadlines to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form Os 114 can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file online through the Connecticut Department of Revenue Services' e-filing system, which provides a convenient and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate address listed on the form itself. For those who prefer in-person submission, visiting a local Department of Revenue Services office is also an option, though it is advisable to check for any required appointments or specific procedures.

Quick guide on how to complete form os 114

Complete Form Os 114 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal sustainable substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly and efficiently. Manage Form Os 114 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and eSign Form Os 114 without hassle

- Locate Form Os 114 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you'd like to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form Os 114 and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form os 114

Create this form in 5 minutes!

People also ask

-

What is the current Connecticut sales use tax rate?

The current Connecticut sales use tax rate is 6.35%. This rate applies to most goods and services sold in the state. It's important for businesses to accurately calculate this rate for compliance with state tax laws.

-

How does airSlate SignNow help businesses manage Connecticut sales use tax rate documentation?

AirSlate SignNow streamlines the process of document management, allowing businesses to easily create, sign, and send tax-related documents. This ensures that all paperwork regarding the Connecticut sales use tax rate is organized and easily accessible, minimizing the risk of errors.

-

Can airSlate SignNow integrate with my accounting software to track Connecticut sales use tax rate?

Yes, airSlate SignNow offers integrations with various accounting software solutions. This allows you to synchronize your sales records and accurately track the Connecticut sales use tax rate, ensuring compliance and simplification of your accounting processes.

-

What features does airSlate SignNow offer to simplify tax form signing related to the Connecticut sales use tax rate?

AirSlate SignNow provides easy document signing features, templates, and customizable workflows. These capabilities allow users to quickly prepare tax forms related to the Connecticut sales use tax rate, facilitating faster approvals and compliance.

-

Is airSlate SignNow cost-effective for businesses dealing with the Connecticut sales use tax rate?

Yes, airSlate SignNow is a cost-effective solution for businesses managing the Connecticut sales use tax rate. With flexible pricing plans and no hidden fees, businesses can efficiently handle their documentation needs without breaking the bank.

-

How does airSlate SignNow enhance compliance related to the Connecticut sales use tax rate?

By using airSlate SignNow, businesses can automate their document workflows and ensure that all necessary forms related to the Connecticut sales use tax rate are completed accurately. This automation reduces the risk of human error and helps maintain compliance with state regulations.

-

Can I access airSlate SignNow from anywhere to manage Connecticut sales use tax rate documents?

Absolutely! AirSlate SignNow is a cloud-based solution, allowing you to access your documents from any device with an internet connection. This flexibility is crucial for businesses managing documents related to the Connecticut sales use tax rate, especially for remote work scenarios.

Get more for Form Os 114

- Property manager agreement nebraska form

- Agreement for delayed or partial rent payments nebraska form

- Tenants maintenance repair request form nebraska

- Guaranty attachment to lease for guarantor or cosigner nebraska form

- Amendment to lease or rental agreement nebraska form

- Warning notice due to complaint from neighbors nebraska form

- Lease subordination agreement nebraska form

- Apartment rules and regulations nebraska form

Find out other Form Os 114

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy