Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return 2019

What is the California 541 Tax Form?

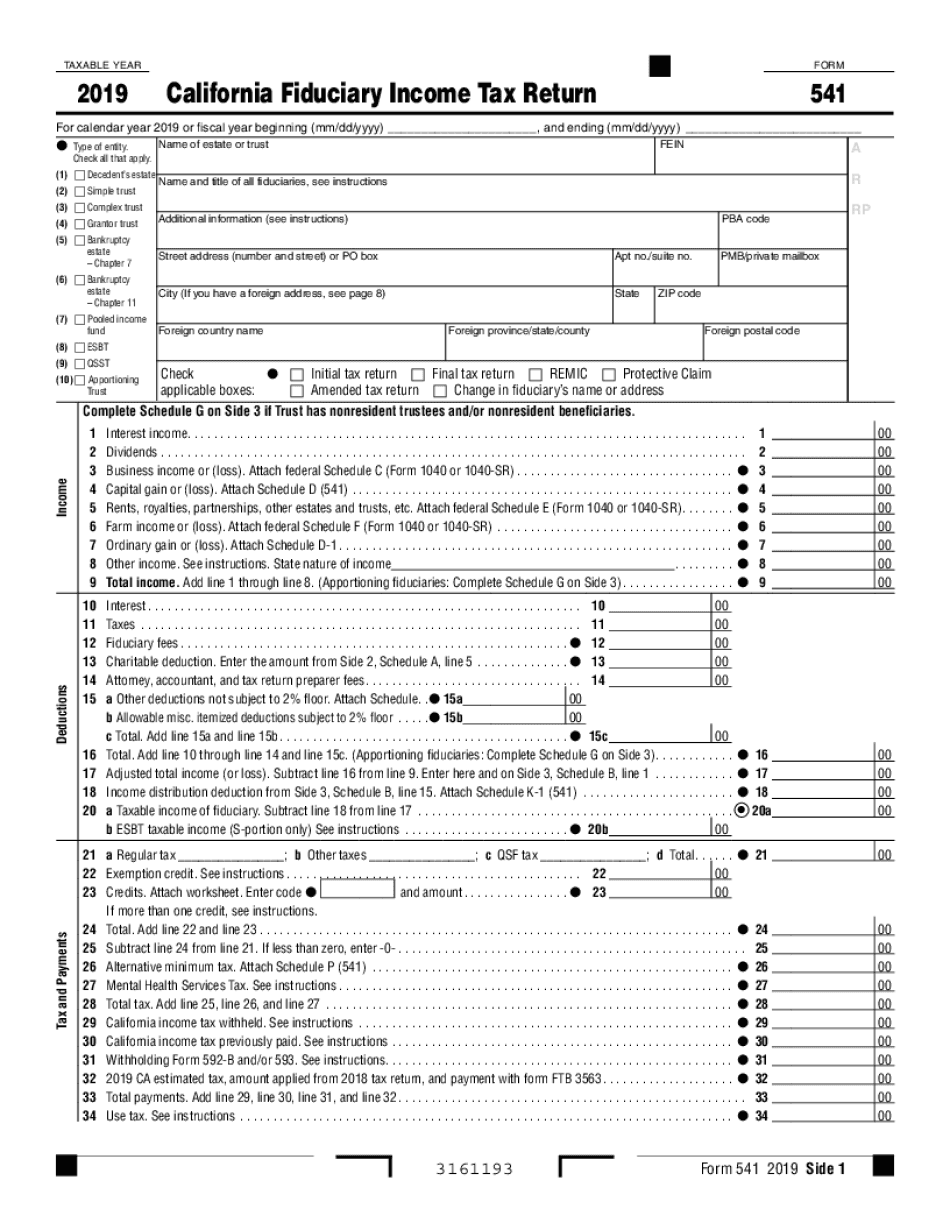

The California 541 tax form, officially known as the California Fiduciary Income Tax Return, is a crucial document for estates and trusts in the state of California. This form is used to report income, deductions, and taxes owed by estates and trusts. It is essential for fiduciaries who manage the assets of deceased individuals or those who have placed their assets in a trust. Properly completing this form ensures that the fiduciary meets their tax obligations and complies with California tax laws.

Steps to Complete the California 541 Tax Form

Filling out the California 541 tax form involves several steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, deduction records, and any other relevant information pertaining to the estate or trust. Next, follow these steps:

- Enter the fiduciary's information, including name, address, and taxpayer identification number.

- Report the income received by the estate or trust during the tax year.

- Detail any deductions that apply, such as administrative expenses or distributions to beneficiaries.

- Calculate the total tax owed based on the reported income and deductions.

- Sign and date the form, ensuring all information is accurate before submission.

How to Obtain the California 541 Tax Form

The California 541 tax form can be obtained through various channels. It is available online through the California Franchise Tax Board (FTB) website, where you can download a PDF version. Additionally, physical copies can be requested by contacting the FTB directly or visiting local tax offices. Ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the California 541 Tax Form

The California 541 tax form is legally binding when filled out correctly and submitted on time. It is essential for fiduciaries to understand that this form must be filed annually to report the income generated by the trust or estate. Failure to file or inaccuracies in reporting can lead to penalties and interest charges. Utilizing a reliable digital solution for eSigning and submitting this form can enhance compliance and streamline the filing process.

Key Elements of the California 541 Tax Form

Several key elements must be included when completing the California 541 tax form. These include:

- Fiduciary information: Name, address, and identification number.

- Income details: All sources of income received by the estate or trust.

- Deductions: Eligible expenses that can reduce taxable income.

- Distributions: Any amounts distributed to beneficiaries during the tax year.

- Signature: The fiduciary must sign the form to certify its accuracy.

Filing Deadlines for the California 541 Tax Form

Filing deadlines for the California 541 tax form are crucial for compliance. Typically, the form is due on the 15th day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year basis, this means the form is due by April 15. It is advisable to file early to avoid any potential issues with late submissions, which can incur penalties.

Quick guide on how to complete 2019 form 541 california fiduciary income tax return 2019 form 541 california fiduciary income tax return

Easily prepare Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Handle Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return on any platform using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

Effortlessly modify and eSign Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return

- Obtain Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of the documents or conceal sensitive information using the specific tools provided by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your adjustments.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, inefficient form searching, or errors that require creating new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 541 california fiduciary income tax return 2019 form 541 california fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 541 california fiduciary income tax return 2019 form 541 california fiduciary income tax return

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the California 541 tax form?

The California 541 tax form is used by fiduciaries to report income and calculate tax liabilities for estates and trusts in the state of California. It is important for accurately reporting income earned by the estate or trust. Understanding this form is essential for compliance and ensuring proper tax filing.

-

How can airSlate SignNow assist with the California 541 tax form?

airSlate SignNow streamlines the process of signing and sending the California 541 tax form electronically. With secure eSignature capabilities, you can ensure timely completions and submissions of this important document. This can save you time and enhance compliance.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that best fits your usage and budget, ensuring you get the right tools to handle the California 541 tax form efficiently without breaking the bank.

-

Are there any integrations available with airSlate SignNow for tax forms?

Yes, airSlate SignNow offers integrations with various accounting and tax software to help manage documents like the California 541 tax form seamlessly. This makes it easier to access, eSign, and store important tax-related documents within your existing system.

-

What features does airSlate SignNow provide for eSigning the California 541 tax form?

AirSlate SignNow provides a range of features, including secure eSignatures, document templates, and automated workflows tailored for documents like the California 541 tax form. These features enhance efficiency and ensure all signatures are collected timely and securely.

-

How does airSlate SignNow ensure the security of the California 541 tax form?

AirSlate SignNow prioritizes security by using encryption protocols and providing secure storage for documents, including the California 541 tax form. This ensures that sensitive information remains confidential while facilitating smooth transactions.

-

Can airSlate SignNow help track the status of the California 541 tax form?

Yes, airSlate SignNow allows you to track the status of the California 541 tax form throughout the signing process. This feature ensures you are updated on whether the document has been viewed, signed, or completed, allowing for better management of deadlines.

Get more for Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497427509 form

- Lease with property 497427510 form

- Utah notice form

- Utah landlord tenant form

- Business credit application utah form

- Authorization to release industrial accident division records utah form

- Individual credit application utah form

- Interrogatories to plaintiff for motor vehicle occurrence utah form

Find out other Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document