Form 541 2017

What is the Form 541

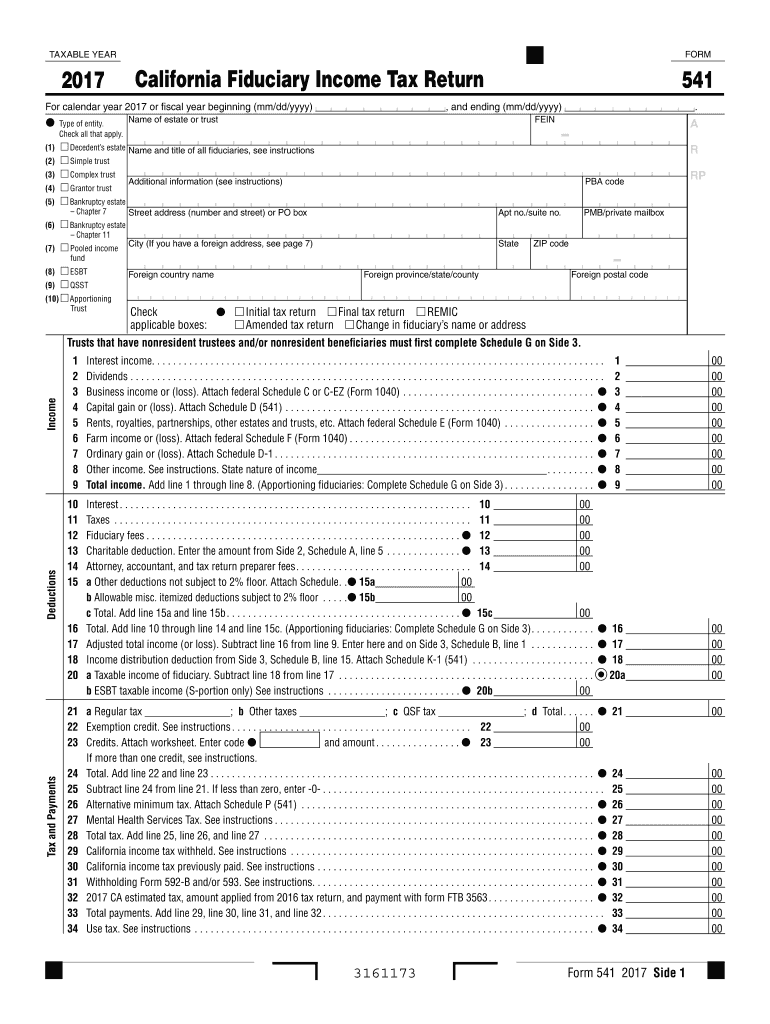

The Form 541 is a tax document used in the United States for reporting income, specifically for fiduciaries of estates and trusts. This form allows fiduciaries to report income earned by the estate or trust, deductions, and any distributions made to beneficiaries. It is essential for ensuring compliance with IRS regulations and for accurately reflecting the financial activities of the estate or trust during the tax year. Understanding the purpose and requirements of Form 541 is crucial for fiduciaries to fulfill their tax obligations effectively.

How to use the Form 541

Using Form 541 involves several steps to ensure accurate reporting. First, gather all necessary financial information related to the estate or trust, including income statements, deduction records, and details of distributions to beneficiaries. Next, complete the form by entering the required information in the designated fields. It is important to review the instructions provided by the IRS for any specific requirements or calculations. After filling out the form, it must be signed by the fiduciary before submission. Utilizing an eSignature solution can streamline this process and enhance security.

Steps to complete the Form 541

Completing Form 541 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income records, deductions, and beneficiary information.

- Begin filling out the form by entering the name and address of the estate or trust.

- Report the income earned by the estate or trust in the appropriate sections.

- List any deductions that apply, ensuring they meet IRS criteria.

- Detail any distributions made to beneficiaries, including their names and amounts.

- Review the completed form for accuracy and completeness.

- Sign the form as the fiduciary before submitting it to the IRS.

Key elements of the Form 541

Form 541 contains several key elements that are essential for accurate reporting. These include:

- Identification Information: Name, address, and taxpayer identification number of the estate or trust.

- Income Reporting: Sections for reporting various types of income, including interest, dividends, and capital gains.

- Deductions: Areas to claim eligible deductions, such as administrative expenses and taxes paid.

- Distributions: A section for detailing distributions made to beneficiaries, which can affect their individual tax returns.

- Signature Line: A place for the fiduciary to sign and date the form, confirming its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for Form 541 are crucial for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this typically means April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to stay informed about any changes to these deadlines, especially in light of potential extensions or modifications by the IRS.

Digital vs. Paper Version

The digital version of Form 541 offers several advantages over the traditional paper version. Completing the form online can enhance accuracy through automated calculations and error checks. Additionally, digital submission allows for quicker processing times and reduces the risk of lost documents. Using a secure eSignature platform can further streamline the signing and submission process, ensuring that the form is filed on time while maintaining compliance with IRS regulations.

Quick guide on how to complete form 541 2017

Your assistance manual on how to prepare your Form 541

If you’re wondering how to fill out and submit your Form 541, here are some concise instructions on how to make tax filing simpler.

Initially, you just need to create your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to adjust, draft, and finalize your income tax forms seamlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and revert to tweak responses as necessary. Streamline your tax management with sophisticated PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Form 541 in just a few minutes:

- Create your account and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Form 541 in our editor.

- Complete the necessary fillable fields with your information (text, figures, checkmarks).

- Employ the Signature Tool to add your legally-recognized eSignature (if needed).

- Review your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can increase return errors and delay refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 541 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the form 541 2017

How to create an eSignature for your Form 541 2017 online

How to make an eSignature for your Form 541 2017 in Google Chrome

How to make an electronic signature for putting it on the Form 541 2017 in Gmail

How to create an electronic signature for the Form 541 2017 straight from your smart phone

How to create an eSignature for the Form 541 2017 on iOS

How to make an electronic signature for the Form 541 2017 on Android

People also ask

-

What is Form 541, and how can airSlate SignNow help with it?

Form 541 is a tax form used by fiduciaries to report income, deductions, and credits for estates and trusts. With airSlate SignNow, you can easily eSign and manage your Form 541 documents, ensuring a smooth and efficient filing process. Our platform simplifies the preparation and submission of important forms like Form 541, providing a user-friendly experience.

-

How much does it cost to use airSlate SignNow for submitting Form 541?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. Our plans are cost-effective, allowing you to choose one that fits your budget while providing comprehensive features for managing documents like Form 541. You can start with a free trial to see how airSlate SignNow can streamline your Form 541 process.

-

What features does airSlate SignNow offer for managing Form 541?

airSlate SignNow provides a range of features designed to simplify the management of Form 541. These include customizable templates, secure electronic signatures, and real-time tracking of document status. With these tools, you can efficiently prepare, send, and get your Form 541 signed, all in one place.

-

Can I integrate airSlate SignNow with other software for Form 541 processing?

Yes, airSlate SignNow offers seamless integrations with popular software applications, making it easy to incorporate your Form 541 into your existing workflow. Whether you use CRM systems, cloud storage, or accounting software, our integrations ensure that your Form 541 processing is efficient and streamlined.

-

What are the benefits of using airSlate SignNow for Form 541 submissions?

Using airSlate SignNow for your Form 541 submissions provides numerous benefits, including reduced paperwork, faster turnaround times, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible, allowing you to focus on more critical tasks while we handle the details of your Form 541.

-

Is airSlate SignNow compliant with regulations for Form 541?

Absolutely! airSlate SignNow prioritizes compliance with industry regulations, ensuring that your Form 541 submissions meet all necessary legal requirements. Our platform employs advanced security measures to protect your data and maintain the integrity of your documents.

-

How can I get support if I have questions about Form 541 and airSlate SignNow?

If you have questions about Form 541 or using airSlate SignNow, our dedicated support team is here to help. You can access our extensive knowledge base for resources or contact our customer service representatives for personalized assistance. We're committed to providing you with the support you need for your Form 541 submissions.

Get more for Form 541

- Chapter 15 building vocabulary the new deal form

- Applicant information form

- Dol 671 form

- Redwood falls baseball tournament registration form make checks payable to rayba p

- Da form 5383

- Notice of estate administration form delaware county co delaware pa

- Realtor referral form pdf

- Aquarium maintenance contract template form

Find out other Form 541

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application