Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return 2023-2026

Understanding the 2014 Form 541 California Fiduciary Income Tax Return

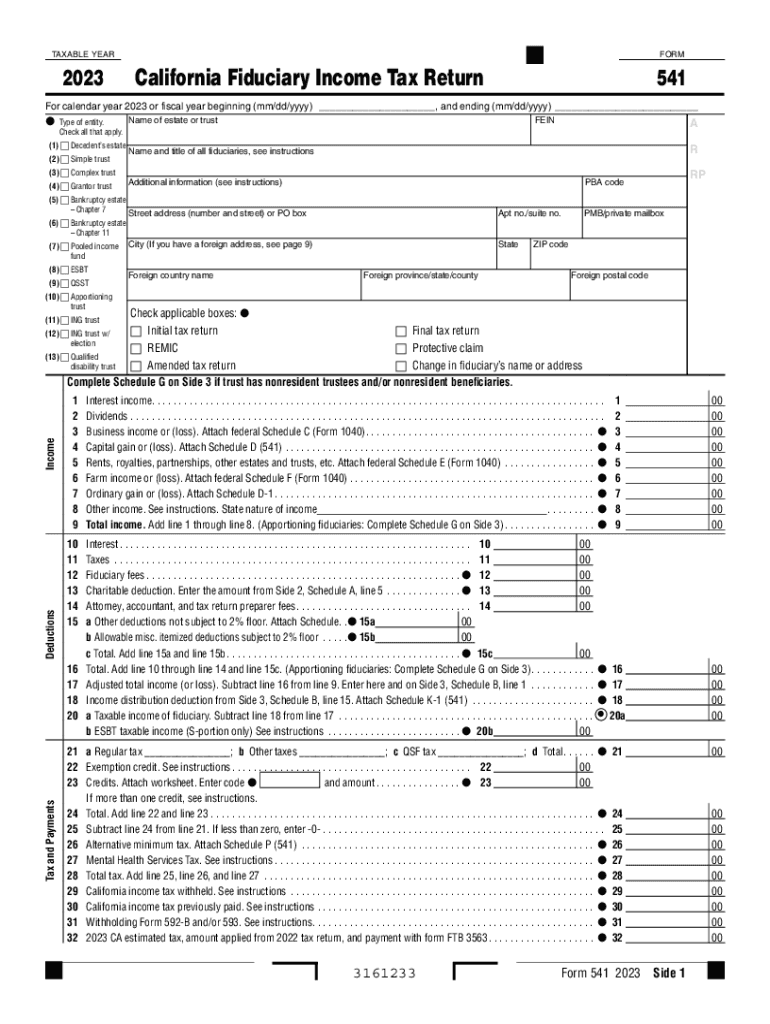

The 2014 Form 541 is the California Fiduciary Income Tax Return, designed for estates and trusts to report their income, deductions, and tax liabilities. This form is essential for fiduciaries managing assets on behalf of beneficiaries. It ensures that the income generated by the estate or trust is accurately reported to the California Franchise Tax Board (FTB).

Fiduciaries must file this form if the estate or trust has gross income of $600 or more, or if any beneficiary is a non-resident of California. The form captures various types of income, including interest, dividends, and capital gains, and allows for deductions related to the administration of the estate or trust.

Steps to Complete the 2014 Form 541

Completing the 2014 Form 541 involves several steps to ensure accurate reporting. Start by gathering all necessary financial documents, including records of income, expenses, and any distributions made to beneficiaries. Follow these steps:

- Begin with the basic information section, including the name and address of the estate or trust.

- Report all sources of income on the appropriate lines, ensuring to include interest, dividends, and rental income.

- Claim any allowable deductions, such as administrative expenses or distributions to beneficiaries.

- Calculate the total tax owed based on the taxable income.

- Sign and date the form, ensuring the fiduciary's signature is included.

Review the completed form for accuracy before submission to avoid potential penalties.

Obtaining the 2014 Form 541

The 2014 Form 541 can be obtained from the California Franchise Tax Board's official website. It is available in both printable and fillable formats, allowing for easy completion. For those who prefer a paper version, the form can also be requested by contacting the FTB directly. Ensure you have the correct version for the tax year to avoid any complications during filing.

Important Dates for Filing the 2014 Form 541

Filing deadlines are crucial for compliance. The 2014 Form 541 must typically be filed by the fifteenth day of the fourth month following the close of the tax year, which generally falls on April 15 for calendar year filers. If the fiduciary requires additional time, an extension can be requested, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Key Elements of the 2014 Form 541

The 2014 Form 541 includes several key elements that are essential for accurate reporting. These elements consist of:

- Identification details of the fiduciary, including name, address, and taxpayer identification number.

- Income reporting sections for various types of income.

- Deductions for expenses associated with the management of the estate or trust.

- Tax calculation based on the net income.

Understanding these elements is vital for ensuring that the form is completed correctly and that all applicable income and deductions are reported.

Legal Use of the 2014 Form 541

The legal use of the 2014 Form 541 is strictly for reporting income generated by estates and trusts. It is a requirement under California tax law for fiduciaries to file this return when certain income thresholds are met. Failure to file can result in penalties, including interest on unpaid taxes and potential legal action. It is crucial for fiduciaries to understand their responsibilities and ensure compliance with state tax regulations.

Examples of Scenarios Requiring the 2014 Form 541

There are various scenarios in which the 2014 Form 541 must be filed. For instance:

- An estate that generates $800 in interest income during the tax year must file the form.

- A trust that makes distributions to beneficiaries while also earning rental income will need to report this on Form 541.

- If a trust has a non-resident beneficiary, the fiduciary must file to report the income and any distributions made.

These examples illustrate the importance of the form in ensuring proper tax reporting for estates and trusts in California.

Create this form in 5 minutes or less

Find and fill out the correct form 541 california fiduciary income tax return form 541 california fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 541 california fiduciary income tax return form 541 california fiduciary income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2014 541 tax and how does it affect my business?

The 2014 541 tax refers to the tax form used by businesses to report income and expenses. Understanding this tax is crucial for compliance and can help you maximize deductions. Using airSlate SignNow can streamline the document signing process related to your 2014 541 tax filings.

-

How can airSlate SignNow help with the 2014 541 tax documentation?

airSlate SignNow simplifies the process of preparing and signing documents required for the 2014 541 tax. Our platform allows you to easily send, sign, and store important tax documents securely. This efficiency can save you time and reduce the risk of errors in your tax submissions.

-

What are the pricing options for airSlate SignNow when dealing with the 2014 541 tax?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solutions ensure that you can manage your 2014 541 tax documents without breaking the bank. You can choose a plan that fits your needs and budget while enjoying all the essential features.

-

Are there any features specifically designed for managing the 2014 541 tax?

Yes, airSlate SignNow includes features that are particularly beneficial for managing the 2014 541 tax. These features include customizable templates for tax forms, automated reminders for deadlines, and secure storage for all your tax-related documents. This ensures that you stay organized and compliant.

-

Can I integrate airSlate SignNow with other tools for my 2014 541 tax needs?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your 2014 541 tax documents. This integration allows for a smoother workflow, ensuring that all your financial data is in one place and easily accessible.

-

What benefits does airSlate SignNow provide for handling the 2014 541 tax?

Using airSlate SignNow for your 2014 541 tax offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, which is essential during tax season. Additionally, eSigning ensures that your documents are legally binding and compliant.

-

Is airSlate SignNow user-friendly for those unfamiliar with the 2014 541 tax?

Yes, airSlate SignNow is designed to be user-friendly, even for those who may not be familiar with the 2014 541 tax. Our intuitive interface guides users through the document signing process, making it accessible for everyone. Plus, our customer support team is always available to assist with any questions.

Get more for Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return

- Verdienstbescheinigung vorlage word form

- Dynamic risk assessment template form

- Pilots cafe ifr pdf form

- Fedex signature release form 63327251

- Taguig business permit application form 2022

- Mtn sponsorship application form

- Amendment of foreign registration statement llc foreign form

- Sample wage verification form the paralegal mentor

Find out other Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement