Lake County Ohio Homestead Application 2016

What is the Lake County Ohio Homestead Application

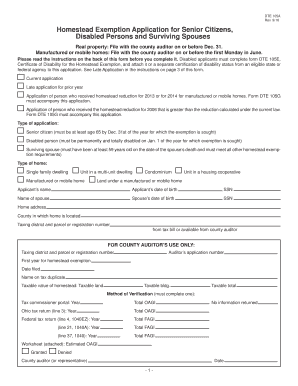

The Lake County Ohio Homestead Application is a form designed to provide property tax relief to eligible homeowners. This application allows qualifying individuals, including seniors and disabled persons, to receive reductions on their property taxes. The program aims to ease the financial burden on homeowners by lowering the taxable value of their primary residence. Understanding the specifics of this application is crucial for those seeking to benefit from the homestead exemption.

Eligibility Criteria

To qualify for the Lake County Ohio Homestead Application, applicants must meet certain criteria. Generally, applicants must be at least sixty-five years old or permanently and totally disabled. Additionally, the applicant must own and occupy the property as their primary residence. Income limits may also apply, which can affect eligibility for the exemption. It is essential for applicants to review these criteria carefully to ensure they meet all requirements before submitting their application.

Steps to Complete the Lake County Ohio Homestead Application

Completing the Lake County Ohio Homestead Application involves several steps. First, gather all necessary documentation, including proof of age or disability, income statements, and property ownership details. Next, fill out the application form accurately, ensuring all information is complete and correct. After completing the form, submit it to the appropriate county office. It is advisable to keep a copy of the application for personal records. Following these steps can help streamline the application process and ensure timely submission.

Required Documents

When applying for the Lake County Ohio Homestead Application, specific documents are required to verify eligibility. These typically include:

- Proof of age or disability, such as a birth certificate or disability award letter

- Income documentation, including tax returns or pay stubs

- Proof of property ownership, such as a deed or title

Having these documents ready can facilitate a smoother application process and help avoid delays in approval.

Form Submission Methods

The Lake County Ohio Homestead Application can be submitted through various methods to accommodate different preferences. Homeowners can choose to submit the application online, by mail, or in person at their local county office. Each method has its own advantages, such as convenience for online submissions or direct assistance when submitting in person. It is important to select the method that best suits individual needs and ensure that the application is submitted before the deadline.

Legal Use of the Lake County Ohio Homestead Application

The legal use of the Lake County Ohio Homestead Application is governed by state laws and regulations. This application serves as a formal request for property tax relief, and its completion must adhere to specific legal requirements. Submitting false information or failing to comply with the guidelines can result in penalties or denial of the exemption. Understanding the legal implications of the application is essential for applicants to ensure compliance and protect their interests.

Quick guide on how to complete lake county ohio homestead application

Easily Prepare Lake County Ohio Homestead Application on Any Device

Digital document management has gained signNow traction among organizations and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents rapidly without any hindrances. Manage Lake County Ohio Homestead Application on any device using the airSlate SignNow apps available for Android or iOS and simplify any document-related procedure today.

The Most Efficient Way to Alter and eSign Lake County Ohio Homestead Application Effortlessly

- Find Lake County Ohio Homestead Application and click Get Form to commence.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form—by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Edit and eSign Lake County Ohio Homestead Application to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lake county ohio homestead application

Create this form in 5 minutes!

How to create an eSignature for the lake county ohio homestead application

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Ohio homestead exemption application?

The Ohio homestead exemption application allows eligible homeowners to reduce their property taxes on their primary residence. By applying for this exemption, you can benefit from a decrease in the assessed value of your home, ultimately lowering your tax bill. This application is available to Ohio residents aged 65 and older or those who are permanently disabled.

-

How do I apply for the Ohio homestead exemption?

To apply for the Ohio homestead exemption application, you need to complete the designated form and submit it to your county auditor's office. You can usually find the application online through your local government’s website. Ensure that you meet the eligibility requirements and attach any necessary documentation to streamline the process.

-

Is there a cost associated with the Ohio homestead exemption application?

There is no cost to submit the Ohio homestead exemption application itself. However, you may need to consider other related administrative fees if you need assistance from a service or to obtain any documentation required for submission. Overall, applying for this exemption is a free process aimed at benefiting Ohio homeowners.

-

What documents do I need for the Ohio homestead exemption application?

For the Ohio homestead exemption application, you typically need to provide proof of your age, disability status, and ownership of the property. This may include documents like a driver's license, tax returns, or medical records depending on your specific situation. Ensure that all documents are current and clearly verify your eligibility.

-

What are the benefits of the Ohio homestead exemption?

The primary benefit of the Ohio homestead exemption is the reduction in property taxes, which can be signNow for eligible homeowners. This exemption helps to ease financial burdens and ensures that those on fixed incomes or experiencing disabilities can maintain their homes. Additionally, it provides a sense of security knowing that their living situation is protected financially.

-

Can I apply for the Ohio homestead exemption online?

Yes, many counties in Ohio allow residents to submit the Ohio homestead exemption application online for convenience. Check your local county auditor’s website to see if they offer this service. Online applications typically have a user-friendly interface to simplify the submission process.

-

How often do I need to renew my Ohio homestead exemption?

Once your Ohio homestead exemption application is approved, it typically does not need to be renewed annually. However, it’s important to report any changes in ownership or eligibility status to your county auditor, as these changes may affect your exemption status. Always check with local authorities for specific guidelines to stay compliant.

Get more for Lake County Ohio Homestead Application

- Utah husband wife 497427419 form

- Warranty deed from husband and wife to corporation utah form

- Utah divorce contested 497427421 form

- Subcontractors request for notice of preliminary notice received individual form

- Utah husband wife 497427424 form

- Warranty deed from husband and wife to llc utah form

- Utah satisfaction of judgment utah form

- Suppliers ampamp subcontractors guide utah state construction form

Find out other Lake County Ohio Homestead Application

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation