Learn About Homestead Exemption South CarolinaSENIOR PROPERTY TAX HOMESTEAD EXEMPTIONHomestead Exemption Frequently Asked Questi 2021-2026

Understanding the Ohio Homestead Exemption

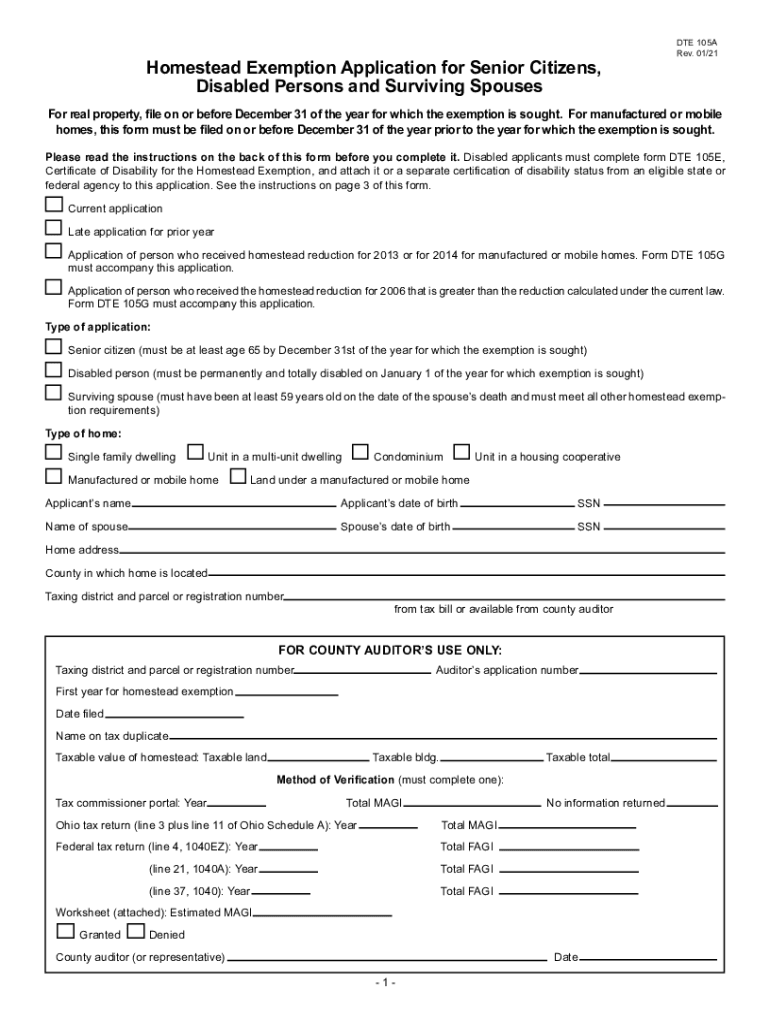

The Ohio homestead exemption provides property tax relief to eligible homeowners. This exemption reduces the taxable value of a home, leading to lower property taxes. Homeowners must apply for this exemption through the Ohio Department of Taxation, using the appropriate form. The exemption is available for primary residences and can benefit seniors, disabled individuals, and surviving spouses of veterans.

Eligibility Criteria for the Homestead Exemption

To qualify for the Ohio homestead exemption, applicants must meet specific criteria. Homeowners must own and occupy their home as their principal place of residence. Additionally, applicants must be at least sixty-five years old, permanently and totally disabled, or a surviving spouse of a veteran who was receiving the exemption at the time of their death. Income limits may also apply, which can affect eligibility.

Required Documents for Application

When applying for the Ohio homestead exemption, certain documents are necessary to support the application. Homeowners should prepare the following:

- Proof of age or disability, such as a birth certificate or disability documentation.

- Documentation of ownership, like a deed or property tax statement.

- Income verification, which may include tax returns or income statements.

Steps to Complete the Ohio Homestead Exemption Application

Filling out the Ohio homestead exemption application involves several straightforward steps:

- Obtain the DTE 105A form from the Ohio Department of Taxation website or your local county auditor's office.

- Fill out the form with accurate information regarding your property and personal details.

- Attach any required documentation to support your application.

- Submit the completed application to your county auditor's office by the deadline.

Form Submission Methods

The Ohio homestead exemption application can be submitted in various ways. Homeowners may choose to:

- Submit the application online through the Ohio Department of Taxation's website.

- Mail the completed form and documents to the local county auditor's office.

- Deliver the application in person at the county auditor's office.

Approval Time for the Homestead Exemption Application

The approval time for the Ohio homestead exemption application can vary. Typically, homeowners can expect to receive notification of approval or denial within a few weeks after submission. It is advisable to follow up with the county auditor's office if there are any delays or if additional information is needed.

Quick guide on how to complete learn about homestead exemption south carolinasenior property tax homestead exemptionhomestead exemption frequently asked

Complete Learn About Homestead Exemption South CarolinaSENIOR PROPERTY TAX HOMESTEAD EXEMPTIONHomestead Exemption Frequently Asked Questi effortlessly on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage Learn About Homestead Exemption South CarolinaSENIOR PROPERTY TAX HOMESTEAD EXEMPTIONHomestead Exemption Frequently Asked Questi on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign Learn About Homestead Exemption South CarolinaSENIOR PROPERTY TAX HOMESTEAD EXEMPTIONHomestead Exemption Frequently Asked Questi with ease

- Obtain Learn About Homestead Exemption South CarolinaSENIOR PROPERTY TAX HOMESTEAD EXEMPTIONHomestead Exemption Frequently Asked Questi and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Learn About Homestead Exemption South CarolinaSENIOR PROPERTY TAX HOMESTEAD EXEMPTIONHomestead Exemption Frequently Asked Questi to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct learn about homestead exemption south carolinasenior property tax homestead exemptionhomestead exemption frequently asked

Create this form in 5 minutes!

How to create an eSignature for the learn about homestead exemption south carolinasenior property tax homestead exemptionhomestead exemption frequently asked

How to create an e-signature for a PDF in the online mode

How to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an e-signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Ohio homestead exemption application process?

The Ohio homestead exemption application process involves filling out a specific application form available on the Ohio Department of Taxation website. Applicants must provide proof of residency and income information to qualify for the exemption. By utilizing the Ohio homestead exemption application, you may obtain signNow property tax savings.

-

Who is eligible for the Ohio homestead exemption application?

Eligibility for the Ohio homestead exemption application is primarily for homeowners who are 65 years or older, or those who are permanently disabled. Additionally, you must have owned and occupied your home for the previous year to qualify. It’s important to check the specific requirements based on your county for accurate eligibility.

-

Are there any fees associated with submitting the Ohio homestead exemption application?

No, there are typically no fees associated with submitting the Ohio homestead exemption application. The application process is designed to be accessible, allowing homeowners to secure financial relief without incurring additional costs. Ensure that all required documentation is submitted accurately for a smooth application process.

-

What benefits does the Ohio homestead exemption application offer?

The Ohio homestead exemption application provides signNow property tax reductions for eligible homeowners. By successfully applying, you can protect a portion of your home’s value from property taxes, which can lead to substantial savings. This is especially beneficial for seniors and disabled individuals seeking to maintain their homes.

-

How long does it take to process the Ohio homestead exemption application?

The processing time for the Ohio homestead exemption application can vary by county, but it typically takes a few weeks to a couple of months. Applicants should ensure that all required documentation is complete to avoid delays. Once approved, you will receive confirmation, and your property tax relief will commence.

-

Can I reapply for the Ohio homestead exemption application every year?

Yes, homeowners are required to reapply for the Ohio homestead exemption application annually in most cases. If your circumstances change, such as income or property status, it's essential to submit a new application. However, if your status remains unchanged, you often do not need to reapply every year.

-

How can I check the status of my Ohio homestead exemption application?

To check the status of your Ohio homestead exemption application, you can contact your local county auditor's office directly. They can provide you with the most current information regarding your application status. Some counties may also offer online portals for tracking applications.

Get more for Learn About Homestead Exemption South CarolinaSENIOR PROPERTY TAX HOMESTEAD EXEMPTIONHomestead Exemption Frequently Asked Questi

- Warranty deed individual to a limited liability company colorado form

- Warranty deed from individual to husband and wife as joint tenants with the right of survivorship colorado form

- Warranty deed from individual individuals or husband and wife to trust colorado form

- Quitclaim deed for individual to two individuals as joint tenants colorado form

- Quitclaim deed for individual to husband and wife as joint tenants colorado form

- Colorado mortgage form

- Quitclaim deed for corporation to municipality colorado form

- Ucc1 statement form

Find out other Learn About Homestead Exemption South CarolinaSENIOR PROPERTY TAX HOMESTEAD EXEMPTIONHomestead Exemption Frequently Asked Questi

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word