Senior Citizen Must Be at Least Age 65 by December 31st of the Year for Which the Exemption is Sought 2019

Eligibility Criteria for the Ohio Homestead Exemption

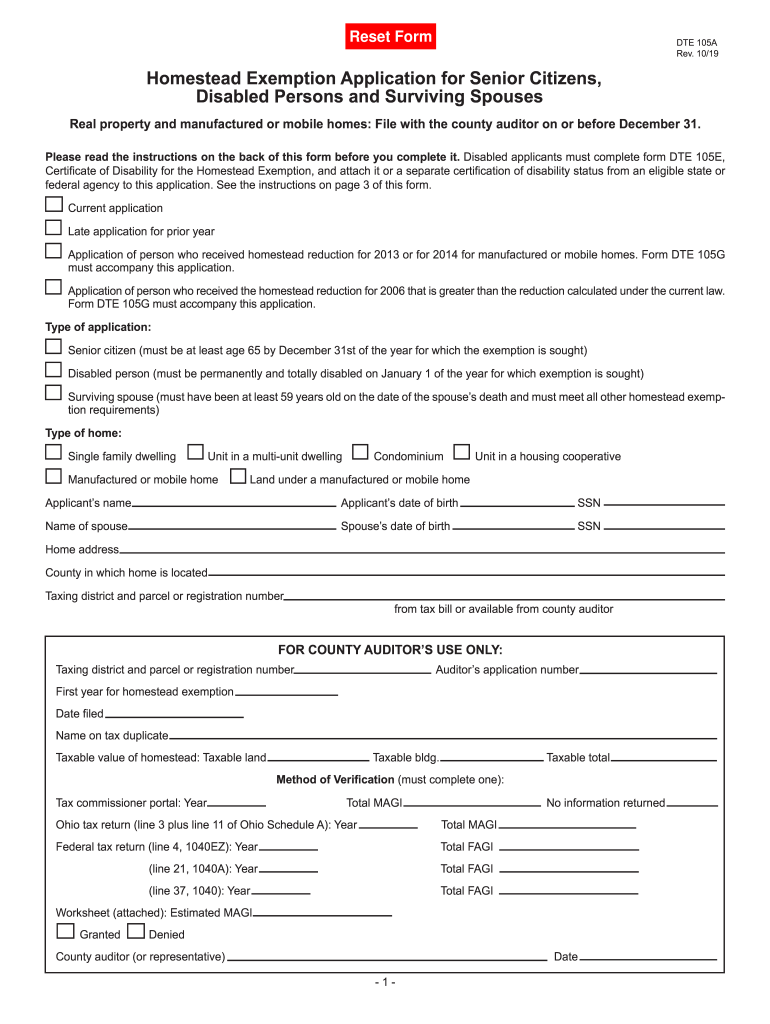

The Ohio homestead exemption application is designed to provide property tax relief to eligible homeowners. To qualify, applicants must meet specific criteria. One key requirement is that the applicant must be at least age sixty-five by December thirty-first of the year for which the exemption is sought. Additionally, the applicant must own and occupy the property as their principal residence. This exemption is also available to individuals who are permanently and totally disabled, regardless of age. Understanding these criteria is essential for a successful application.

Required Documents for Submission

When applying for the Ohio homestead exemption, certain documents are necessary to support your application. Applicants must provide proof of age, such as a birth certificate or driver's license, to confirm eligibility. Additionally, documentation proving ownership and occupancy of the property is required. This can include a deed or property tax statement. If applying based on disability, relevant medical documentation must also be submitted. Ensuring all required documents are included can expedite the approval process.

Application Process and Approval Time

The application process for the Ohio homestead exemption involves several steps. First, applicants must complete the homestead exemption application form, known as DTE 105A. This form can be obtained from the Ohio Department of Taxation or local county auditor's office. Once completed, the application should be submitted to the appropriate county auditor. The approval time may vary, but applicants can typically expect a response within a few weeks. It is important to apply before the deadline, which is usually set for the first Monday in June of the tax year.

Form Submission Methods

Applicants have multiple options for submitting the Ohio homestead exemption application. The form can be submitted online through the Ohio Department of Taxation's website, providing a convenient and efficient method. Alternatively, applicants may choose to mail the completed form to their local county auditor's office. In-person submissions are also accepted, allowing applicants to receive immediate assistance if needed. Understanding these submission methods can help streamline the application process.

Legal Use of the Ohio Homestead Exemption

The Ohio homestead exemption is legally binding once approved, providing significant tax relief to eligible homeowners. It is essential for applicants to ensure that all information provided is accurate and truthful, as any discrepancies could lead to penalties or denial of the exemption. The exemption applies to the property taxes assessed on the primary residence and can result in substantial savings. Homeowners should be aware of the legal implications of the exemption and maintain compliance with all requirements.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for applicants seeking the Ohio homestead exemption. The application must be submitted by the first Monday in June for the exemption to take effect for that tax year. Late applications may not be considered until the following year. Homeowners should mark their calendars and ensure that all necessary documents are prepared in advance to avoid missing these important dates.

Quick guide on how to complete senior citizen must be at least age 65 by december 31st of the year for which the exemption is sought

Effortlessly Prepare Senior Citizen must Be At Least Age 65 By December 31st Of The Year For Which The Exemption Is Sought on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Senior Citizen must Be At Least Age 65 By December 31st Of The Year For Which The Exemption Is Sought on any device with the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to Edit and eSign Senior Citizen must Be At Least Age 65 By December 31st Of The Year For Which The Exemption Is Sought with Ease

- Obtain Senior Citizen must Be At Least Age 65 By December 31st Of The Year For Which The Exemption Is Sought and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you select. Modify and eSign Senior Citizen must Be At Least Age 65 By December 31st Of The Year For Which The Exemption Is Sought and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct senior citizen must be at least age 65 by december 31st of the year for which the exemption is sought

Create this form in 5 minutes!

How to create an eSignature for the senior citizen must be at least age 65 by december 31st of the year for which the exemption is sought

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Ohio homestead exemption application?

The Ohio homestead exemption application is a program designed to provide property tax relief to eligible homeowners in Ohio. By applying for this exemption, qualified individuals can reduce their taxable value on their primary residence, which can lead to signNow savings. It is important to understand the eligibility criteria to maximize the benefits of this program.

-

How do I complete the Ohio homestead exemption application?

To complete the Ohio homestead exemption application, you can visit the Ohio Department of Taxation's website and download the necessary forms. Ensure you have all required documentation, such as proof of age or disability if applicable. After filling out the application, submit it to your local county auditor's office for processing.

-

What are the eligibility requirements for the Ohio homestead exemption application?

Eligibility for the Ohio homestead exemption application generally includes being a homeowner, being at least 65 years old or having a qualifying disability, and residing in the property as your primary residence. It’s essential to review specific local guidelines, as additional conditions may apply depending on your county. Submitting your application timely is crucial to ensuring you receive benefits.

-

Is there a cost associated with the Ohio homestead exemption application?

There is no application fee for the Ohio homestead exemption application; it is free for eligible homeowners. However, you might incur costs if you need to obtain supporting documents such as tax records or identification. Overall, applying for this exemption can save you money on your property taxes, making it a worthwhile process.

-

How long does it take to process the Ohio homestead exemption application?

Processing times for the Ohio homestead exemption application can vary by county, but it generally takes anywhere from a few weeks to a couple of months. Once your application is submitted, your county auditor’s office will review it and notify you of their decision. Keeping track of your application status can help ensure everything is on time.

-

Can I use airSlate SignNow to facilitate my Ohio homestead exemption application?

Yes, airSlate SignNow can simplify the process of completing and submitting your Ohio homestead exemption application. With features like electronic signatures and document management, you can easily prepare all necessary forms and ensure they are securely submitted. This can help you streamline the application process and keep everything organized.

-

What if my Ohio homestead exemption application is denied?

If your Ohio homestead exemption application is denied, you will receive a notice explaining the reason for the denial. You can appeal the decision, which typically involves providing additional information or clarification to your county auditor's office. Understanding the cause of denial is critical for a successful follow-up application.

Get more for Senior Citizen must Be At Least Age 65 By December 31st Of The Year For Which The Exemption Is Sought

Find out other Senior Citizen must Be At Least Age 65 By December 31st Of The Year For Which The Exemption Is Sought

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template