Louisiana Solar Tax Credit 2017

What is the Louisiana Solar Tax Credit

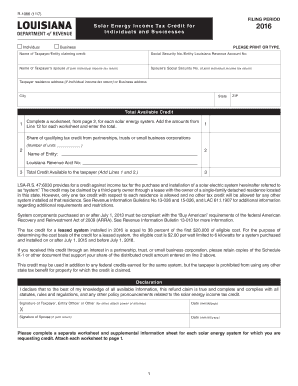

The Louisiana Solar Tax Credit is a financial incentive provided by the state to encourage residents and businesses to invest in solar energy systems. This credit allows taxpayers to deduct a percentage of the cost of installing solar panels from their state income taxes. The program aims to promote renewable energy usage, reduce electricity costs, and support environmental sustainability. Taxpayers can benefit from this credit by making a significant investment in solar technology, which can lead to long-term savings on energy bills.

How to use the Louisiana Solar Tax Credit

To utilize the Louisiana Solar Tax Credit, taxpayers must first install a solar energy system that meets state requirements. After installation, they can claim the credit on their state income tax return by completing the appropriate forms. It is essential to retain all receipts and documentation related to the installation, as these will be required for verification. The credit can be claimed in the year the system is installed, allowing taxpayers to reduce their tax liability significantly.

Eligibility Criteria

Eligibility for the Louisiana Solar Tax Credit is generally based on the type of solar energy system installed and the taxpayer's income tax liability. To qualify, the solar system must be installed on residential or commercial properties within Louisiana. Additionally, the system must meet specific performance standards set by the state. Taxpayers should ensure they have sufficient tax liability to benefit from the credit, as it cannot be refunded or carried forward to future years.

Steps to complete the Louisiana Solar Tax Credit

Completing the Louisiana Solar Tax Credit involves several key steps:

- Install a qualifying solar energy system on your property.

- Gather all necessary documentation, including receipts and installation contracts.

- Complete the required tax forms, ensuring all information is accurate.

- Submit the forms with your state income tax return by the filing deadline.

- Retain copies of all submitted documents for your records.

Required Documents

To claim the Louisiana Solar Tax Credit, taxpayers must provide specific documents, including:

- Receipts for the purchase and installation of the solar energy system.

- Proof of payment, such as invoices or bank statements.

- Completed tax forms related to the credit.

- Any additional documentation requested by the state tax authority.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines to successfully claim the Louisiana Solar Tax Credit. The credit can be claimed for the tax year in which the solar system was installed. Typically, state income tax returns are due on May fifteenth of each year. It is crucial to submit all required forms and documentation by this date to avoid missing out on the credit.

Quick guide on how to complete louisiana solar tax credit

Effortlessly prepare Louisiana Solar Tax Credit on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Handle Louisiana Solar Tax Credit on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Louisiana Solar Tax Credit effortlessly

- Find Louisiana Solar Tax Credit and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Louisiana Solar Tax Credit and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisiana solar tax credit

Create this form in 5 minutes!

How to create an eSignature for the louisiana solar tax credit

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Louisiana solar tax credit?

The Louisiana solar tax credit is a financial incentive provided by the state to encourage residents and businesses to invest in solar energy systems. This credit allows you to receive a percentage of your solar installation costs back on your state taxes, signNowly lowering your overall expenses.

-

How can I qualify for the Louisiana solar tax credit?

To qualify for the Louisiana solar tax credit, you must install a solar energy system that meets state regulations and standards. Additionally, the installation must be completed by a licensed contractor, and you must file the appropriate forms with your state tax return to claim the credit.

-

Is the Louisiana solar tax credit available for both residential and commercial installations?

Yes, the Louisiana solar tax credit is available for both residential and commercial solar energy systems. This encourages a diverse range of customers to invest in solar technology and reduce their energy costs, benefiting both homes and businesses in the state.

-

How much can I save with the Louisiana solar tax credit?

The Louisiana solar tax credit offers signNow savings, allowing you to receive 26% of your solar installation costs back as a tax credit. This can translate to substantial financial relief, making solar energy more affordable for homeowners and businesses alike.

-

What are the benefits of using airSlate SignNow for solar tax credit documentation?

Using airSlate SignNow simplifies the process of generating, sending, and signing documents related to your Louisiana solar tax credit application. Our user-friendly platform allows you to manage important documents securely and efficiently, reducing paperwork hassle and speeding up your tax credit claims.

-

Can I combine the Louisiana solar tax credit with federal solar incentives?

Yes, you can combine the Louisiana solar tax credit with federal solar incentives to maximize your savings. By taking advantage of both credits, you can signNowly lower the cost of your solar installation and effectively enhance your return on investment.

-

What types of solar technologies qualify for the Louisiana solar tax credit?

The Louisiana solar tax credit applies to various solar technologies, primarily solar photovoltaic (PV) systems and solar water heating systems. To qualify, the installation must be for a system that generates energy from sunlight and meets state guidelines.

Get more for Louisiana Solar Tax Credit

- Guaranty attachment to lease for guarantor or cosigner utah form

- Utah lease form

- Warning notice due to complaint from neighbors utah form

- Lease subordination agreement utah form

- Apartment rules and regulations utah form

- Agreed cancellation of lease utah form

- Amendment of residential lease utah form

- Agreement for payment of unpaid rent utah form

Find out other Louisiana Solar Tax Credit

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free