Form Au 724 2020

What is the Form Au 724

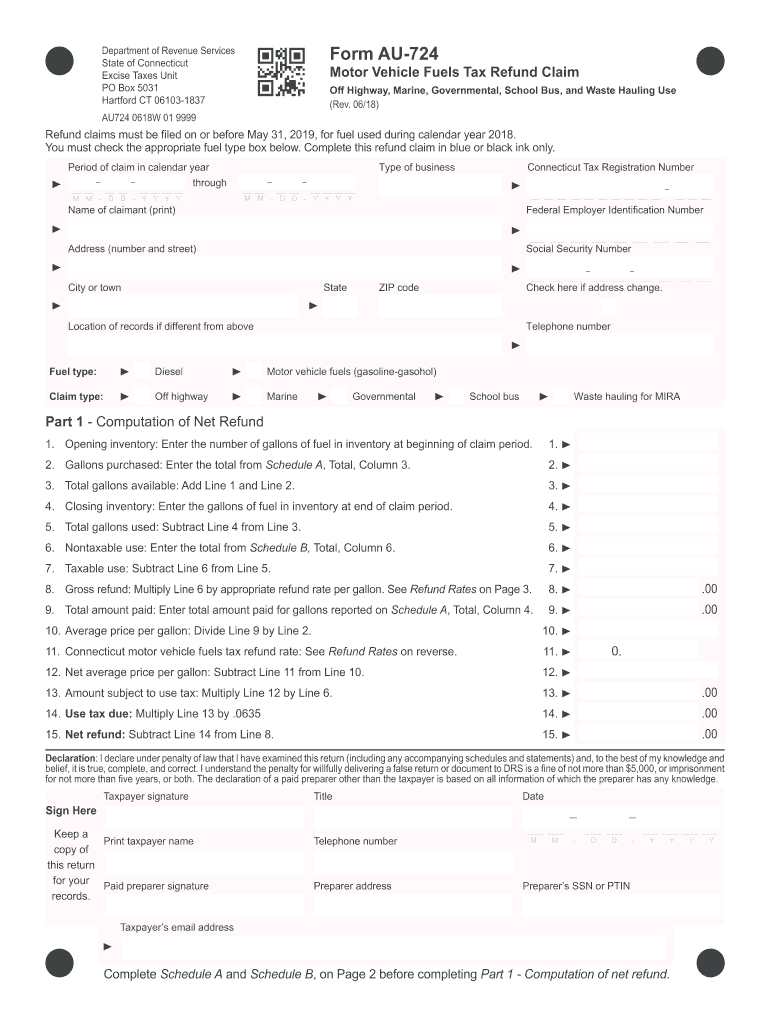

The Form Au 724 is a document used in Connecticut for reporting and remitting fuel taxes. Specifically, it is utilized by businesses and individuals involved in the distribution or sale of motor fuels within the state. This form helps ensure compliance with state tax regulations related to fuel consumption and is essential for maintaining accurate records of fuel transactions.

How to Use the Form Au 724

Using the Form Au 724 involves several steps to ensure accurate completion and compliance with state regulations. First, gather all necessary information regarding your fuel purchases, sales, and any applicable tax exemptions. Next, fill out the form by providing details such as the type of fuel, quantity, and tax rate. Ensure that all figures are accurate and reflect your records. Finally, submit the completed form by the designated deadline to avoid penalties.

Steps to Complete the Form Au 724

Completing the Form Au 724 requires careful attention to detail. Follow these steps:

- Collect all relevant documentation, including invoices and receipts related to fuel transactions.

- Enter your business information at the top of the form, including your name, address, and tax identification number.

- List each type of fuel sold or distributed, along with the corresponding quantities and tax amounts.

- Calculate the total tax owed based on the information provided.

- Review the form for accuracy, ensuring that all entries are correct and complete.

- Sign and date the form before submission.

Legal Use of the Form Au 724

The legal use of the Form Au 724 is governed by Connecticut state tax laws. To be considered valid, the form must be completed accurately and submitted by the specified deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. It is essential to maintain proper records and ensure that all information reported on the form is truthful and complete.

Form Submission Methods

The Form Au 724 can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through the Connecticut Department of Revenue Services website.

- Mailing a physical copy of the completed form to the appropriate state office.

- In-person delivery at designated state tax offices, if preferred.

Filing Deadlines / Important Dates

Filing deadlines for the Form Au 724 are crucial for compliance. Typically, the form must be submitted quarterly, with specific due dates set by the Connecticut Department of Revenue Services. It is important to stay informed about these deadlines to avoid late fees and penalties. Mark your calendar for the end of each quarter to ensure timely submission.

Quick guide on how to complete form au 724

Complete Form Au 724 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form Au 724 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and eSign Form Au 724 with ease

- Find Form Au 724 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Au 724 while ensuring efficient communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form au 724

Create this form in 5 minutes!

How to create an eSignature for the form au 724

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the au 724 form and why is it important?

The au 724 form is a crucial document for businesses that need a streamlined process for signing and managing documents. It enables electronic signatures, making it easier to obtain approvals and complete transactions. Utilizing the au 724 form enhances efficiency and minimizes paperwork.

-

How does airSlate SignNow integrate with the au 724 form?

airSlate SignNow allows seamless integration with the au 724 form, enabling users to easily create, send, and manage this document within their workflows. By using our platform, you can quickly gather electronic signatures and track the document's progress. This integration is designed to simplify your document management process.

-

What are the pricing options for using the au 724 form with airSlate SignNow?

Our pricing plans for using the au 724 form with airSlate SignNow are designed to cater to businesses of all sizes. We offer flexible subscription options that include essential features for document signing and management. Visit our pricing page to find the plan that suits your needs for handling the au 724 form.

-

How can the au 724 form improve my business's workflow?

Using the au 724 form with airSlate SignNow can signNowly enhance your business's workflow by automating document signing processes. This leads to faster approvals and reduces time spent on administrative tasks. The convenience of eSigning the au 724 form from any device contributes to overall productivity.

-

Can I customize the au 724 form in airSlate SignNow?

Yes, airSlate SignNow provides options to customize the au 724 form according to your business's specific needs. You can add your logo, set signing fields, and incorporate other branding elements. Customization ensures that the au 724 form reflects your company's identity and meets compliance standards.

-

What security features does airSlate SignNow offer for the au 724 form?

airSlate SignNow prioritizes the security of your documents, including the au 724 form, with robust encryption and compliance with industry standards. We implement secure cloud storage and authentication measures to protect sensitive information. This ensures that your documents are safe throughout the signing process.

-

Is it easy to track the status of the au 724 form sent through airSlate SignNow?

Absolutely! When you send the au 724 form using airSlate SignNow, you can easily track its status in real-time. Our platform provides notifications and updates on when the document is viewed, signed, or completed, allowing you to stay updated on your document's progress.

Get more for Form Au 724

- Foundation contract for contractor virginia form

- Plumbing contract for contractor virginia form

- Brick mason contract for contractor virginia form

- Roofing contract for contractor virginia form

- Electrical contract for contractor virginia form

- Sheetrock drywall contract for contractor virginia form

- Flooring contract for contractor virginia form

- Virginia contract deed form

Find out other Form Au 724

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy