APPLICATION for SALES TAX EXEMPTION under CODE SECTION 2020-2026

Understanding the application for sales tax exemption

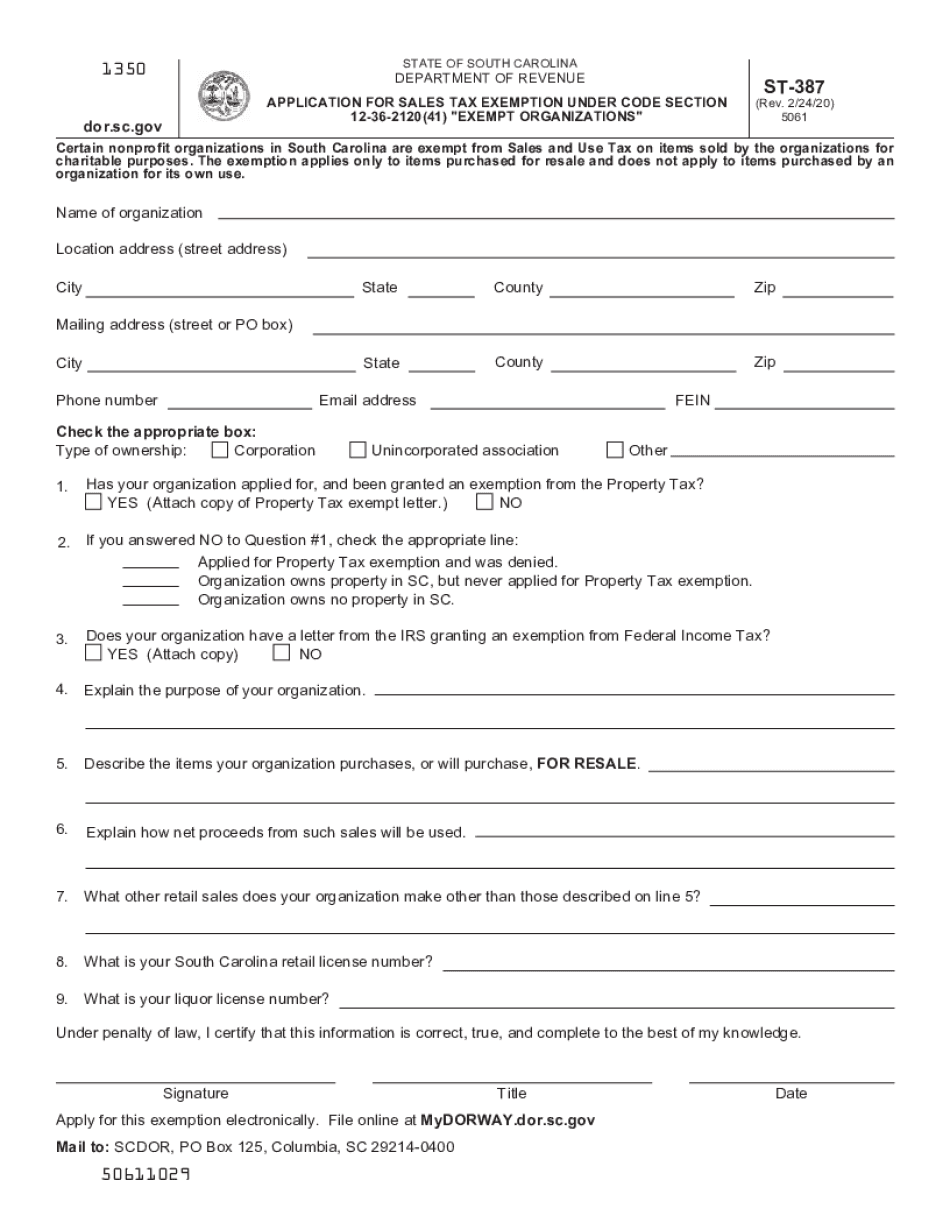

The application for sales tax exemption under Code Section is a crucial document for individuals and organizations seeking to avoid paying sales tax on certain purchases. This form is typically used by non-profit organizations, educational institutions, and government entities. By submitting the st 387 application exemption, eligible entities can claim exemption from sales tax, which can lead to significant cost savings. It is essential to understand the specific criteria and regulations governing eligibility to ensure compliance and avoid potential penalties.

Steps to complete the application for sales tax exemption

Completing the st 387 application exemption involves several key steps. First, gather all necessary documentation that supports your eligibility for exemption. This may include proof of non-profit status, tax identification numbers, and any relevant organizational bylaws. Next, accurately fill out the application form, ensuring that all information is complete and correct. After completing the form, review it for accuracy before submission. Finally, submit the application through the designated method, whether online, by mail, or in person, depending on state guidelines.

Eligibility criteria for the application for sales tax exemption

To qualify for the st 387 application exemption, applicants must meet specific eligibility criteria outlined by state regulations. Generally, this includes being a recognized non-profit organization, educational institution, or government agency. Additionally, the purchases for which exemption is sought must be directly related to the entity's exempt purpose. It is crucial to review state-specific guidelines to ensure that all requirements are met, as failure to comply can result in denial of the application.

Required documents for the application for sales tax exemption

When submitting the st 387 application exemption, applicants must provide several key documents to support their request. Commonly required documents include proof of tax-exempt status, such as a 501(c)(3) determination letter for non-profits, a copy of the organization’s bylaws, and any relevant financial statements. Additionally, applicants may need to include a detailed description of the intended use of the purchased items to demonstrate their eligibility for exemption. Ensuring that all required documents are included can help streamline the approval process.

Form submission methods for the application for sales tax exemption

The st 387 application exemption can typically be submitted through various methods, including online, by mail, or in person. The preferred method may vary by state, so it is essential to check local regulations for specific submission guidelines. Online submissions often provide a faster processing time, while mail submissions may require additional time for delivery and processing. In-person submissions can offer immediate confirmation of receipt but may require an appointment or specific hours of operation.

Key elements of the application for sales tax exemption

The st 387 application exemption includes several key elements that must be accurately completed for successful processing. This includes the applicant's name, address, and tax identification number, as well as a detailed description of the exempt purpose. Additionally, the form may require information about the specific purchases for which exemption is being claimed. Providing clear and complete information in these sections is vital for avoiding delays or rejections during the review process.

Quick guide on how to complete application for sales tax exemption under code section

Fill out APPLICATION FOR SALES TAX EXEMPTION UNDER CODE SECTION seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources required to draft, modify, and electronically sign your documents quickly without any hold-ups. Handle APPLICATION FOR SALES TAX EXEMPTION UNDER CODE SECTION on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign APPLICATION FOR SALES TAX EXEMPTION UNDER CODE SECTION with ease

- Locate APPLICATION FOR SALES TAX EXEMPTION UNDER CODE SECTION and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your edits.

- Choose how you wish to send your form, either by email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Modify and eSign APPLICATION FOR SALES TAX EXEMPTION UNDER CODE SECTION and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for sales tax exemption under code section

Create this form in 5 minutes!

How to create an eSignature for the application for sales tax exemption under code section

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the st 387 application exemption?

The st 387 application exemption is a special provision that allows qualified businesses to apply for tax exemptions related to specific transactions. Understanding this exemption can help businesses save on costs when using services like airSlate SignNow for document signing.

-

How does airSlate SignNow simplify the st 387 application exemption process?

airSlate SignNow streamlines the st 387 application exemption process by offering customizable templates and easy-to-use eSigning features. This ensures that businesses can quickly fill out forms and electronically sign documents, accelerating the exemption claim process.

-

Does airSlate SignNow charge any fees related to the st 387 application exemption?

airSlate SignNow offers competitive pricing, with no hidden fees specifically for the st 387 application exemption. Our user-friendly platform allows you to manage documents at an affordable rate, ensuring you get the most value for your investment.

-

What features of airSlate SignNow are beneficial for managing the st 387 application exemption?

Key features of airSlate SignNow that are beneficial for managing the st 387 application exemption include automated workflows, document templates, and secure cloud storage. These tools help in efficiently preparing and submitting your exemption applications with minimal hassle.

-

Can I integrate airSlate SignNow with other tools for the st 387 application exemption?

Yes, airSlate SignNow seamlessly integrates with various applications to support the st 387 application exemption process. This includes CRM systems, accounting software, and other business tools, allowing for a more cohesive workflow.

-

Is the st 387 application exemption applicable for all businesses using airSlate SignNow?

The st 387 application exemption is not universally applicable; it is specific to businesses that meet certain criteria outlined by state regulations. It’s essential to verify your eligibility before utilizing airSlate SignNow for these transactions.

-

What are the benefits of using airSlate SignNow for the st 387 application exemption?

Using airSlate SignNow for the st 387 application exemption offers numerous benefits, including time savings and enhanced compliance. Our platform ensures that all documents meet legal requirements, minimizing errors and reducing processing time.

Get more for APPLICATION FOR SALES TAX EXEMPTION UNDER CODE SECTION

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497428123 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement virginia form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase virginia form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants virginia form

- Virginia utility shut off form

- Letter landlord about sample form

- Virginia notice form

- Virginia 90 day form

Find out other APPLICATION FOR SALES TAX EXEMPTION UNDER CODE SECTION

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document