Residence on December 31, Form

What is the Residence On December 31

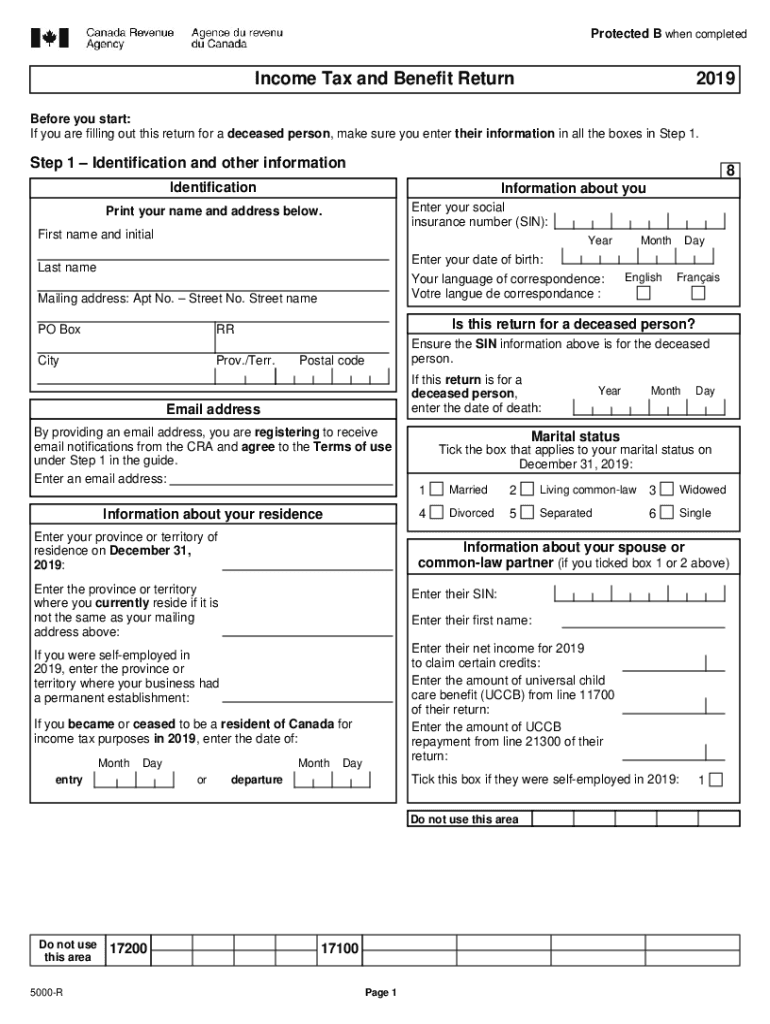

The Residence On December 31 refers to the property where an individual or entity resides at the end of the tax year. It is a critical factor in determining the tax obligations and benefits for residents, particularly for those filing the Missouri DOR 1041 return form. Understanding the status of your residence is essential for accurate tax reporting and compliance with state regulations.

How to use the Residence On December 31

To effectively use the Residence On December 31 for tax purposes, taxpayers must ensure that they accurately report their primary residence on the Missouri DOR 1041 return form. This involves confirming that the address listed is where the taxpayer lived on the last day of the tax year. Proper documentation, such as utility bills or lease agreements, may be necessary to substantiate residency claims.

Steps to complete the Residence On December 31

Completing the Residence On December 31 section of the Missouri DOR 1041 return form involves several steps:

- Identify your primary residence as of December 31.

- Gather supporting documents that confirm your residency.

- Accurately fill in the address on the form.

- Review the information for accuracy before submission.

Legal use of the Residence On December 31

The legal use of the Residence On December 31 is governed by state tax laws. It is vital for taxpayers to ensure that the residence is not only accurately reported but also compliant with any state-specific regulations. Misreporting residency can lead to penalties or issues with tax compliance.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Missouri DOR 1041 return form. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15. However, extensions may be available, and it is crucial to check for any state-specific changes to these deadlines.

Required Documents

When filling out the Missouri DOR 1041 return form, certain documents are required to support the information provided. These may include:

- Proof of residency, such as utility bills or lease agreements.

- Previous tax returns for reference.

- Documentation of income and deductions applicable to the return.

Eligibility Criteria

Eligibility to file the Missouri DOR 1041 return form is generally determined by factors such as residency status and income levels. Taxpayers must ensure they meet the criteria set forth by the Missouri Department of Revenue to avoid complications during the filing process.

Quick guide on how to complete residence on december 31

Effortlessly Prepare Residence On December 31, on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely keep it stored online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without interruptions. Handle Residence On December 31, on any device using the airSlate SignNow applications available for Android or iOS, and enhance any document-related process today.

How to Edit and eSign Residence On December 31, with Ease

- Find Residence On December 31, and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow simplifies all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Residence On December 31, to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the residence on december 31

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Missouri DOR 1041 return form fillable feature?

The Missouri DOR 1041 return form fillable feature allows users to easily complete and submit their tax forms online. With this feature, you can fill out the required fields directly in a digital format, ensuring accuracy and saving time.

-

How do I access the Missouri DOR 1041 return form fillable?

You can easily access the Missouri DOR 1041 return form fillable through the airSlate SignNow platform. Simply log in, navigate to the forms section, and select the Missouri 1041 form to start filling it out in an interactive format.

-

Is there a cost associated with using the Missouri DOR 1041 return form fillable?

Yes, using the Missouri DOR 1041 return form fillable may involve a subscription fee to utilize airSlate SignNow's services. However, users find that the cost is worthwhile for the convenience and efficiency it provides in managing tax documents.

-

Can I save my progress on the Missouri DOR 1041 return form fillable?

Absolutely! With airSlate SignNow, you can save your progress on the Missouri DOR 1041 return form fillable at any stage. This feature allows you to revisit and complete the form at your convenience without losing any information.

-

Are electronic signatures supported for the Missouri DOR 1041 return form fillable?

Yes, electronic signatures are fully supported for the Missouri DOR 1041 return form fillable. This means you can legally sign your tax documents digitally, streamlining the process of filing with the necessary authorities.

-

What integrations does airSlate SignNow offer for the Missouri DOR 1041 return form fillable?

airSlate SignNow provides various integrations with popular business tools like Google Drive, Dropbox, and Microsoft Office. This enhances the functionality of the Missouri DOR 1041 return form fillable by allowing easy access to your files and seamless document management.

-

How secure is my information when using the Missouri DOR 1041 return form fillable?

Your information is highly secure when using the Missouri DOR 1041 return form fillable on airSlate SignNow. The platform employs advanced encryption and security measures to protect your data throughout the document signing and filing process.

Get more for Residence On December 31,

Find out other Residence On December 31,

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document