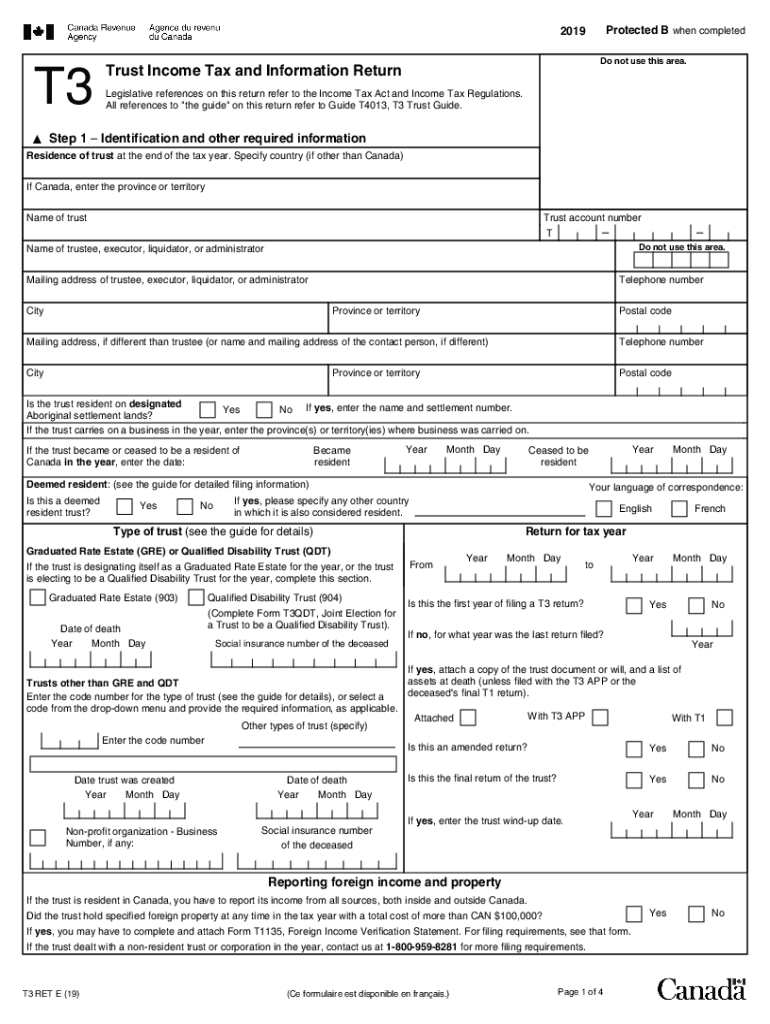

Form T3RET 'T3 Trust Income Tax and Information Return

What is the Form T3RET 'T3 Trust Income Tax And Information Return

The Form T3RET, also known as the T3 Trust Income Tax and Information Return, is a crucial document used for reporting income earned by trusts in the United States. This form is specifically designed for estates and trusts that generate income, ensuring compliance with federal tax regulations. The T3RET provides the Internal Revenue Service (IRS) with detailed information regarding the trust's income, deductions, and distributions to beneficiaries. Completing this form accurately is essential for maintaining the trust's legal standing and fulfilling tax obligations.

Steps to complete the Form T3RET 'T3 Trust Income Tax And Information Return

Completing the Form T3RET involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents related to the trust's income, including bank statements, investment income reports, and any other relevant financial records. Next, fill out the form with the trust's identifying information, including its name, address, and tax identification number. Report all sources of income, such as dividends, interest, and capital gains. Additionally, include any deductions the trust is eligible for, such as administrative expenses. Finally, ensure that the form is signed and dated by the trustee before submission.

Key elements of the Form T3RET 'T3 Trust Income Tax And Information Return

The Form T3RET includes several key elements that are critical for accurate reporting. These elements consist of the trust's income, which must be categorized by source; allowable deductions, which can reduce the taxable income; and distributions made to beneficiaries, which may affect their individual tax liabilities. It is important to provide detailed information for each category to ensure compliance with IRS regulations. Additionally, the form requires the trustee's signature, affirming that the information provided is accurate and complete.

Legal use of the Form T3RET 'T3 Trust Income Tax And Information Return

The legal use of the Form T3RET is paramount for trusts operating within the framework of U.S. tax law. This form serves as an official declaration of the trust's income and expenses, ensuring transparency and accountability. By filing the T3RET, trustees fulfill their fiduciary duty to report financial activities accurately. Failure to comply with the legal requirements associated with this form can result in penalties, including fines and interest on unpaid taxes. Thus, understanding the legal implications of the T3RET is essential for trustees managing trust assets.

Filing Deadlines / Important Dates

Filing deadlines for the Form T3RET are crucial to adhere to in order to avoid penalties. Typically, the form must be filed by the fifteenth day of the third month following the end of the trust's tax year. For trusts operating on a calendar year, this means the deadline is March 15. It is important for trustees to mark this date on their calendars and ensure that all necessary documentation is prepared in advance. Extensions may be available, but they must be requested properly to avoid complications.

Form Submission Methods (Online / Mail / In-Person)

The Form T3RET can be submitted through various methods, offering flexibility for trustees. The form can be filed electronically using authorized e-filing software, which may streamline the process and reduce the likelihood of errors. Alternatively, trustees may choose to print the completed form and submit it by mail to the appropriate IRS address. In-person submissions are generally not available for tax forms, but trustees should ensure they follow the correct procedures for electronic or mail submissions to guarantee timely processing.

Quick guide on how to complete form t3ret ampquott3 trust income tax and information return

Easily prepare Form T3RET 'T3 Trust Income Tax And Information Return on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Form T3RET 'T3 Trust Income Tax And Information Return on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

Effortlessly modify and eSign Form T3RET 'T3 Trust Income Tax And Information Return

- Find Form T3RET 'T3 Trust Income Tax And Information Return and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details, then click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Form T3RET 'T3 Trust Income Tax And Information Return and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t3ret ampquott3 trust income tax and information return

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is t3ret and how does it relate to airSlate SignNow?

T3ret is a feature that enhances document management within the airSlate SignNow platform. It empowers users to streamline their signing process, ensuring an efficient and secure way to handle electronic signatures.

-

How much does airSlate SignNow cost for using t3ret?

The pricing for airSlate SignNow varies depending on the plan chosen, but it offers competitive rates that include the t3ret feature. Businesses can select from different tiers to find the most cost-effective solution that meets their needs.

-

What features does t3ret offer in airSlate SignNow?

T3ret offers a variety of features, including advanced eSigning capabilities, document tracking, and user-friendly templates. These tools are designed to optimize the document workflow, making it easier for users to manage their signing processes.

-

How can t3ret benefit my business?

Implementing t3ret in airSlate SignNow can signNowly enhance your business's signing efficiency and reduce turnaround times. This allows your team to focus on more critical tasks while ensuring compliance and security in document management.

-

Can I integrate t3ret with other applications?

Yes, t3ret in airSlate SignNow seamlessly integrates with a variety of third-party applications. This flexibility allows businesses to incorporate eSigning directly into their existing workflows, driving productivity and streamlining processes.

-

Is t3ret secure for handling sensitive documents?

Absolutely, t3ret ensures the highest level of security for handling sensitive documents. airSlate SignNow complies with international security standards, providing encryption and authentication measures to protect your information.

-

What types of documents can I sign with t3ret?

T3ret supports a wide range of document types for signing, including contracts, agreements, and reports. This versatility makes airSlate SignNow an ideal solution for businesses across different industries.

Get more for Form T3RET 'T3 Trust Income Tax And Information Return

- Brick mason contractor package virginia form

- Roofing contractor package virginia form

- Electrical contractor package virginia form

- Sheetrock drywall contractor package virginia form

- Flooring contractor package virginia form

- Trim carpentry contractor package virginia form

- Fencing contractor package virginia form

- Hvac contractor package virginia form

Find out other Form T3RET 'T3 Trust Income Tax And Information Return

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement