Scientific Research and Experimental Development SR&ED Expenditures Claim 2020-2026

Understanding the Scientific Research And Experimental Development SR&ED Expenditures Claim

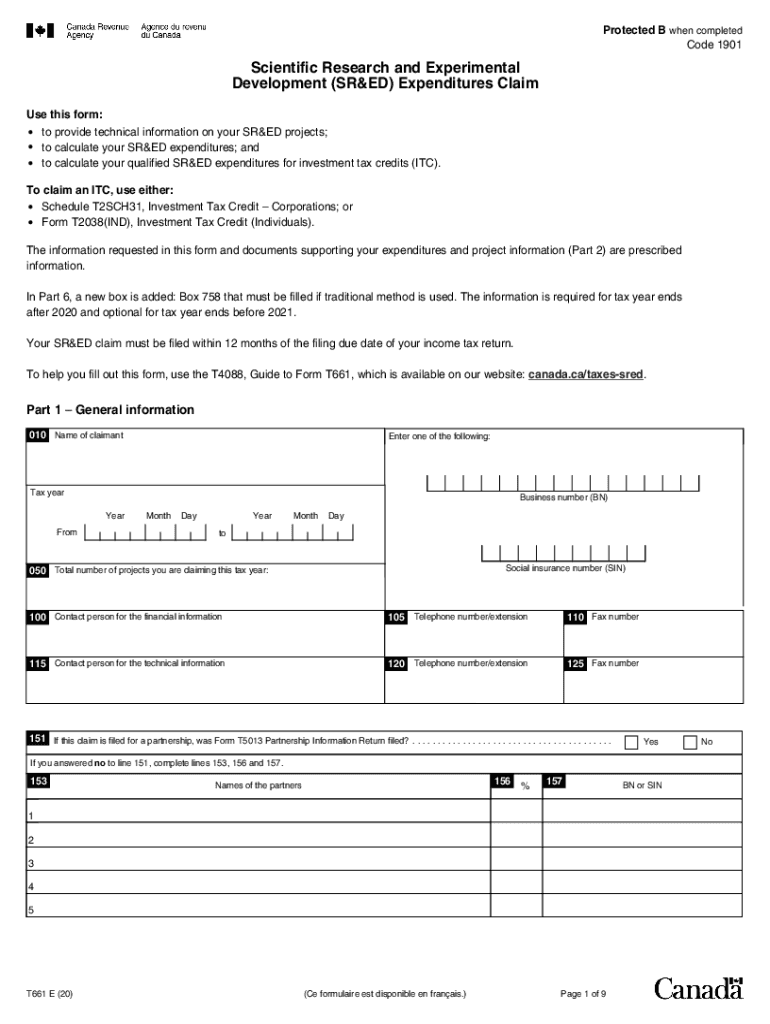

The Scientific Research And Experimental Development (SR&ED) Expenditures Claim is a tax incentive program designed to encourage Canadian businesses to conduct research and development activities. This program allows businesses to claim a tax credit for eligible expenditures related to their R&D efforts. The claim can include costs associated with salaries, materials, and overhead incurred during the research process. Understanding the nuances of the SR&ED claim is essential for businesses aiming to maximize their tax benefits while ensuring compliance with regulatory requirements.

Steps to Complete the Scientific Research And Experimental Development SR&ED Expenditures Claim

Completing the SR&ED Expenditures Claim involves several key steps to ensure accuracy and compliance. First, businesses need to identify eligible R&D activities and expenditures. This includes documenting the nature of the research, the objectives, and the results achieved. Next, businesses should gather all necessary documentation, such as receipts, payroll records, and project descriptions. Finally, the completed claim form must be submitted to the Canada Revenue Agency (CRA) along with any supporting documents. It is advisable to review the claim thoroughly before submission to avoid potential issues.

Eligibility Criteria for the Scientific Research And Experimental Development SR&ED Expenditures Claim

To qualify for the SR&ED Expenditures Claim, businesses must meet specific eligibility criteria. Primarily, the activities must involve systematic investigation or search carried out in a field of science or technology. Additionally, the work must aim to achieve advancements in knowledge or technology. Eligible claimants include corporations, partnerships, and sole proprietorships engaged in R&D. It is crucial for businesses to maintain detailed records and documentation to support their claims, as the CRA may request this information during the review process.

Required Documents for the Scientific Research And Experimental Development SR&ED Expenditures Claim

When submitting the SR&ED Expenditures Claim, businesses must provide various documents to substantiate their claims. Key documents include:

- Detailed project descriptions outlining the objectives and outcomes of the R&D activities.

- Financial records, including receipts and payroll information related to eligible expenditures.

- Technical documentation that supports the scientific or technological advancements achieved.

- Any correspondence with the CRA regarding previous claims or inquiries.

Having these documents organized and readily available can streamline the claim process and enhance the likelihood of approval.

Legal Use of the Scientific Research And Experimental Development SR&ED Expenditures Claim

The SR&ED Expenditures Claim is governed by specific legal frameworks that dictate how claims must be filed and what qualifies as eligible expenditures. Businesses must adhere to the guidelines set forth by the CRA to ensure their claims are legally valid. This includes understanding the definitions of eligible R&D activities and maintaining compliance with any reporting requirements. Failure to comply with these regulations can lead to penalties or denial of the claim, making it essential for businesses to stay informed about their legal obligations.

Form Submission Methods for the Scientific Research And Experimental Development SR&ED Expenditures Claim

Businesses can submit their SR&ED Expenditures Claim through various methods. The most common submission methods include:

- Online submission via the CRA's secure portal, which allows for faster processing times.

- Mailing a paper form directly to the CRA, which may take longer for processing.

- In-person submissions at designated CRA offices, although this option may vary by location.

Choosing the appropriate submission method can impact the speed and efficiency of the claim processing, so businesses should consider their options carefully.

Quick guide on how to complete scientific research and experimental development srampamped expenditures claim

Effortlessly Prepare Scientific Research And Experimental Development SR&ED Expenditures Claim on Any Device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily acquire the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents quickly without delays. Manage Scientific Research And Experimental Development SR&ED Expenditures Claim on any device using the airSlate SignNow applications for Android or iOS and enhance any document-oriented procedure today.

The easiest way to modify and eSign Scientific Research And Experimental Development SR&ED Expenditures Claim seamlessly

- Obtain Scientific Research And Experimental Development SR&ED Expenditures Claim and then click Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as an old-fashioned wet ink signature.

- Review all the details and then click on the Done button to finalize your modifications.

- Select your preferred delivery method for your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow efficiently addresses all your document management requirements with just a few clicks from any device you choose. Edit and electronically sign Scientific Research And Experimental Development SR&ED Expenditures Claim and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct scientific research and experimental development srampamped expenditures claim

Create this form in 5 minutes!

How to create an eSignature for the scientific research and experimental development srampamped expenditures claim

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the t661 form?

The t661 form, also known as the Scientific Research and Experimental Development (SR&ED) claim form, is used by Canadian businesses to claim tax credits on eligible research activities. Understanding how to fill out the t661 form accurately can greatly benefit businesses seeking financial assistance for their innovation projects.

-

How can airSlate SignNow help with submitting the t661 form?

airSlate SignNow provides a seamless platform for you to electronically sign and send your t661 form quickly. With its user-friendly interface, you can streamline your submission process, ensuring that all necessary signatures are obtained in a timely manner.

-

Is airSlate SignNow affordable for businesses needing to file the t661 form?

Yes, airSlate SignNow offers cost-effective solutions tailored for businesses of all sizes looking to file their t661 form. With flexible pricing plans, you can choose an option that fits your budget while accessing an array of useful features.

-

What features does airSlate SignNow offer for the t661 form?

airSlate SignNow provides features such as document templates, customizable workflows, and secure eSignature options specifically designed for forms like the t661 form. These tools enhance efficiency and ensure compliance with legal standards.

-

Are there integrations available for filing the t661 form with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications commonly used for managing tax-related documents, making it easier to file your t661 form. These integrations help streamline your workflow and ensure all necessary information is at your fingertips.

-

What are the benefits of using airSlate SignNow for the t661 form?

Using airSlate SignNow for the t661 form offers numerous benefits, including increased accuracy, time-saving features, and enhanced security. These advantages lead to a more efficient filing process, allowing businesses to focus on their research and development.

-

Can airSlate SignNow assist in ensuring compliance when submitting the t661 form?

Absolutely! airSlate SignNow's platform is designed with compliance in mind, ensuring your t661 form meets necessary regulations. By using our tools, you can minimize the risk of errors and enhance the legitimacy of your submission.

Get more for Scientific Research And Experimental Development SR&ED Expenditures Claim

Find out other Scientific Research And Experimental Development SR&ED Expenditures Claim

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online