Form G 26 2019

What is the Form G 26

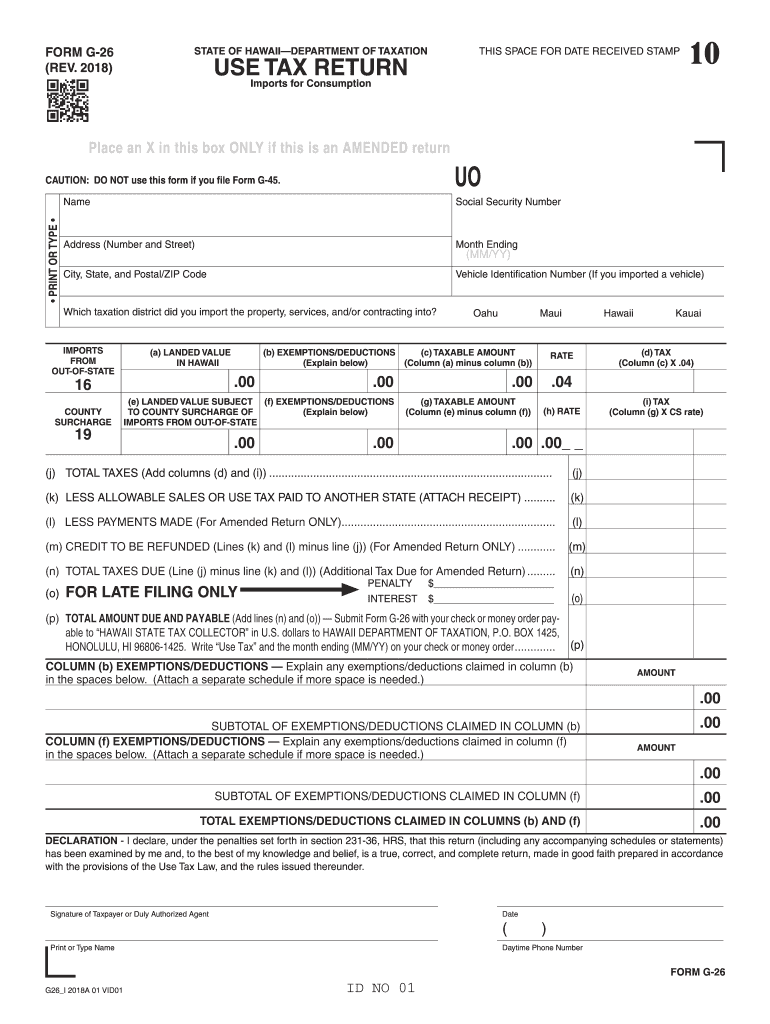

The Hawaii State Tax Form G 26 is a crucial document used for reporting specific tax information to the state of Hawaii. This form is primarily utilized by individuals and businesses to disclose income and calculate tax liabilities. Understanding the purpose of the Form G 26 is essential for ensuring compliance with state tax regulations. It serves as a means for taxpayers to report various types of income, including wages, self-employment income, and other taxable earnings.

How to Obtain the Form G 26

Obtaining the Hawaii Form G 26 is straightforward. Taxpayers can access the form through the official Hawaii Department of Taxation website. Additionally, physical copies may be available at local tax offices or government buildings. It is important to ensure that you are using the most current version of the form to avoid any discrepancies in your tax filing.

Steps to Complete the Form G 26

Completing the Hawaii State Tax Form G 26 involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, accurately fill out the form by entering your personal information, income details, and any deductions or credits you may qualify for. Review the form carefully for accuracy before submission. Finally, ensure that you sign and date the form, as an unsigned document may be considered invalid.

Legal Use of the Form G 26

The legal use of the Hawaii Form G 26 is governed by state tax laws. To be considered valid, the form must be filled out completely and accurately. Submitting a false or misleading form can result in penalties or legal consequences. It is advisable to consult with a tax professional if you have questions about the legal implications of your tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii State Tax Form G 26 typically align with the federal tax filing schedule. Generally, individual taxpayers must submit their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. It is crucial to stay informed about specific dates to avoid late fees or penalties.

Form Submission Methods

The Hawaii Form G 26 can be submitted through various methods, including online, by mail, or in person. For online submissions, taxpayers can use the Hawaii Department of Taxation's e-filing system. Alternatively, completed forms can be mailed to the appropriate tax office or delivered in person. Each submission method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Hawaii State Tax Form G 26 can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to file the form accurately and on time to avoid these consequences. Understanding the penalties associated with non-compliance can help taxpayers prioritize their tax responsibilities.

Quick guide on how to complete form g 26

Prepare Form G 26 with ease on any device

Digital document management has gained traction among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents promptly and without hassle. Manage Form G 26 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form G 26 effortlessly

- Locate Form G 26 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to submit your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form G 26 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form g 26

Create this form in 5 minutes!

How to create an eSignature for the form g 26

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the hawaii state tax formg 26, and who needs it?

The hawaii state tax formg 26 is a document used for claiming tax credits against Hawaii state income taxes. Individuals and businesses who need to settle their tax liabilities or claim benefits may require this form. It's essential for anyone looking to ensure compliance with state tax regulations.

-

How can airSlate SignNow help me with hawaii state tax formg 26?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out, sign, and send the hawaii state tax formg 26 electronically. This streamlines the submission process and helps you avoid common errors associated with paper forms. Additionally, our solution ensures secure storage of your documents for future reference.

-

What are the costs associated with using airSlate SignNow for hawaii state tax formg 26?

The pricing for airSlate SignNow varies based on the features you select, but it is designed to be cost-effective for users managing the hawaii state tax formg 26. We offer various subscription plans to accommodate different needs and budgets. Check our pricing page for detailed information on the plans available.

-

Are there any special features in airSlate SignNow that assist with hawaii state tax formg 26?

Yes, airSlate SignNow includes features such as templates specifically for the hawaii state tax formg 26, eSignature options, and document tracking. These features simplify the form-filling process and provide a clear record of when and who signed the form. This can be particularly beneficial for businesses ensuring compliance.

-

Can I integrate airSlate SignNow with other software for managing hawaii state tax formg 26?

Absolutely! airSlate SignNow supports various integrations with popular accounting and tax software, making it easier to manage the hawaii state tax formg 26 alongside your regular bookkeeping tasks. This integration streamlines your workflow and enhances efficiency.

-

Is eSigning the hawaii state tax formg 26 legally valid?

Yes, eSigning the hawaii state tax formg 26 using airSlate SignNow is legally valid in Hawaii. Our platform complies with all eSigning regulations, ensuring that your signed documents are binding and enforceable. This is important for maintaining compliance with state laws.

-

How secure is my information when using airSlate SignNow for hawaii state tax formg 26?

Security is a top priority at airSlate SignNow. We use advanced encryption and authentication protocols to protect your information while filling out the hawaii state tax formg 26. You can have confidence knowing your sensitive data is secure throughout the document signing process.

Get more for Form G 26

Find out other Form G 26

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online