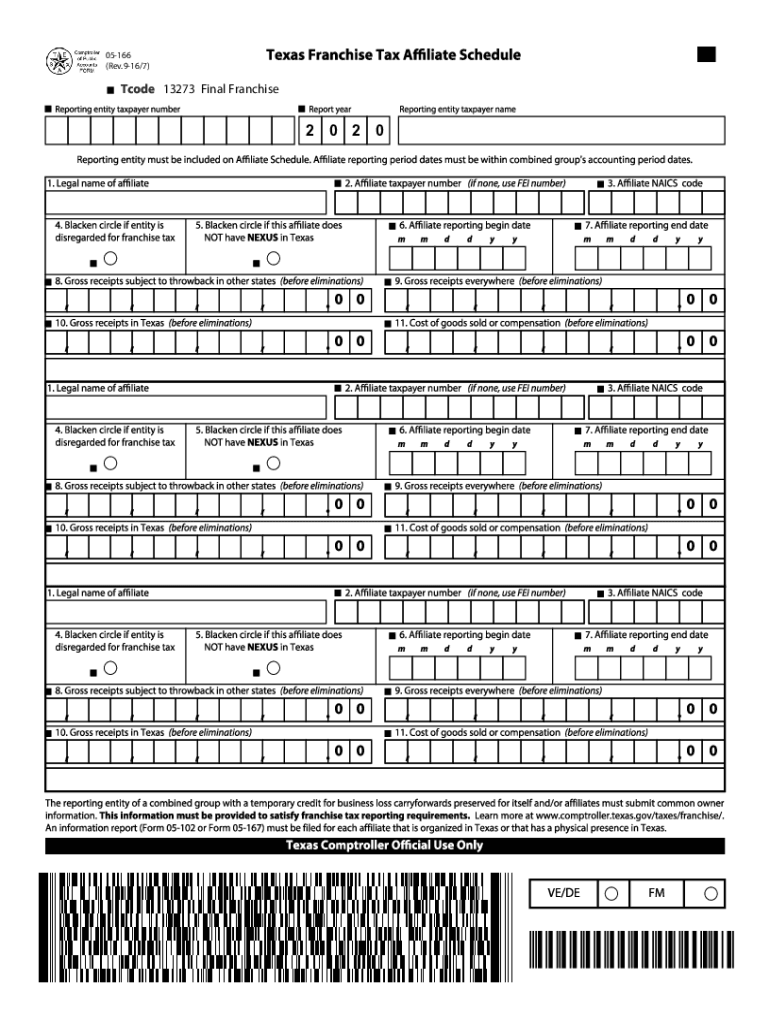

05 166 Texas Franchise Tax Affiliate Schedule for Final Report 2020

What is the 05 166 Texas Franchise Tax Affiliate Schedule?

The 05 166 Texas Franchise Tax Affiliate Schedule is a specific document required by the Texas Comptroller for businesses that are part of a group of affiliated entities. This form is used to report the franchise tax liability of each entity within the group, ensuring compliance with Texas tax laws. It is essential for businesses operating in Texas to accurately complete this form to avoid penalties and ensure proper tax reporting.

Steps to complete the 05 166 Texas Franchise Tax Affiliate Schedule

Completing the 05 166 Texas Franchise Tax Affiliate Schedule involves several steps:

- Gather necessary information about each affiliated entity, including their legal names, addresses, and tax identification numbers.

- Determine the total revenue and franchise tax for each entity within the group.

- Fill out the form by entering the required details for each affiliate, ensuring accuracy in financial reporting.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and compliance requirements.

Legal use of the 05 166 Texas Franchise Tax Affiliate Schedule

The 05 166 Texas Franchise Tax Affiliate Schedule is legally binding when completed correctly. It must be filed in accordance with Texas law to ensure that all affiliated entities are compliant with state tax regulations. Failure to properly file this form can result in penalties, including fines and interest on unpaid taxes. Therefore, it is important to understand the legal implications of this document and to maintain accurate records associated with its completion.

Filing Deadlines / Important Dates

Filing deadlines for the 05 166 Texas Franchise Tax Affiliate Schedule are crucial for compliance. Typically, the form must be submitted by May 15 of each year for entities operating on a calendar year basis. However, businesses should verify their specific deadlines based on their fiscal year and any extensions that may apply. Keeping track of these dates helps prevent late fees and ensures timely compliance with state tax obligations.

Required Documents

To complete the 05 166 Texas Franchise Tax Affiliate Schedule, several documents are typically required:

- Financial statements for each affiliated entity.

- Tax identification numbers for all entities involved.

- Previous year’s franchise tax reports, if applicable.

- Any supporting documentation that verifies revenue and expenses.

Form Submission Methods

The 05 166 Texas Franchise Tax Affiliate Schedule can be submitted through various methods:

- Online submission via the Texas Comptroller's website, which is the preferred method for many businesses.

- Mailing a printed copy of the form to the appropriate address provided by the Texas Comptroller.

- In-person submission at local Comptroller offices, if necessary.

Who Issues the Form

The 05 166 Texas Franchise Tax Affiliate Schedule is issued by the Texas Comptroller of Public Accounts. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating in Texas. The Comptroller provides the necessary forms and guidance to assist businesses in meeting their tax obligations effectively.

Quick guide on how to complete 05 166 2020 texas franchise tax affiliate schedule for final report

Complete 05 166 Texas Franchise Tax Affiliate Schedule For Final Report effortlessly on any device

Online document management has become popular among organizations and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage 05 166 Texas Franchise Tax Affiliate Schedule For Final Report on any platform using airSlate SignNow Android or iOS applications and streamline any document-based process today.

How to modify and electronically sign 05 166 Texas Franchise Tax Affiliate Schedule For Final Report with ease

- Find 05 166 Texas Franchise Tax Affiliate Schedule For Final Report and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your choice. Edit and electronically sign 05 166 Texas Franchise Tax Affiliate Schedule For Final Report to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 166 2020 texas franchise tax affiliate schedule for final report

Create this form in 5 minutes!

How to create an eSignature for the 05 166 2020 texas franchise tax affiliate schedule for final report

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is form 05 166 and how is it used?

Form 05 166 is a specific document often required in various business processes. It serves as an official form that can be signed electronically using airSlate SignNow, ensuring a streamlined approach to document management.

-

How does airSlate SignNow support form 05 166?

airSlate SignNow supports form 05 166 by allowing users to easily upload, edit, and share the form for eSignature. This solution eliminates the need for physical paperwork and enhances productivity through efficient document handling.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing tiers designed to accommodate businesses of all sizes looking to utilize form 05 166. Competitive pricing and flexible plans ensure you can find a solution that meets your document signing needs without breaking the bank.

-

Can I customize form 05 166 using airSlate SignNow?

Yes, you can customize form 05 166 with airSlate SignNow's intuitive interface. Users can add fields, features, and branding elements to the form to suit their specific requirements, making it a versatile tool for any business.

-

What are the benefits of using airSlate SignNow for form 05 166?

Using airSlate SignNow for form 05 166 provides numerous benefits, including increased efficiency, reduced turnaround time, and improved compliance. The user-friendly platform makes it simple to manage documents, ensuring you can focus more on your business.

-

Is form 05 166 legally binding when signed electronically?

Yes, form 05 166 is legally binding when signed electronically using airSlate SignNow, in compliance with federal regulations. The platform employs robust security measures to ensure each signing is legitimate and verifiable.

-

What integrations does airSlate SignNow offer for form 05 166?

airSlate SignNow integrates seamlessly with a variety of applications, enhancing the workflow for managing form 05 166. These integrations help in centralizing document processes by connecting with CRM systems, cloud storage, and more.

Get more for 05 166 Texas Franchise Tax Affiliate Schedule For Final Report

- Letter from tenant to landlord about landlords failure to make repairs vermont form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497428778 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession vermont form

- Letter from tenant to landlord about illegal entry by landlord vermont form

- Letter from landlord to tenant about time of intent to enter premises vermont form

- Letter from tenant to landlord containing notice to cease unjustified nonacceptance of rent vermont form

- Letter from tenant to landlord about sexual harassment vermont form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children vermont form

Find out other 05 166 Texas Franchise Tax Affiliate Schedule For Final Report

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple