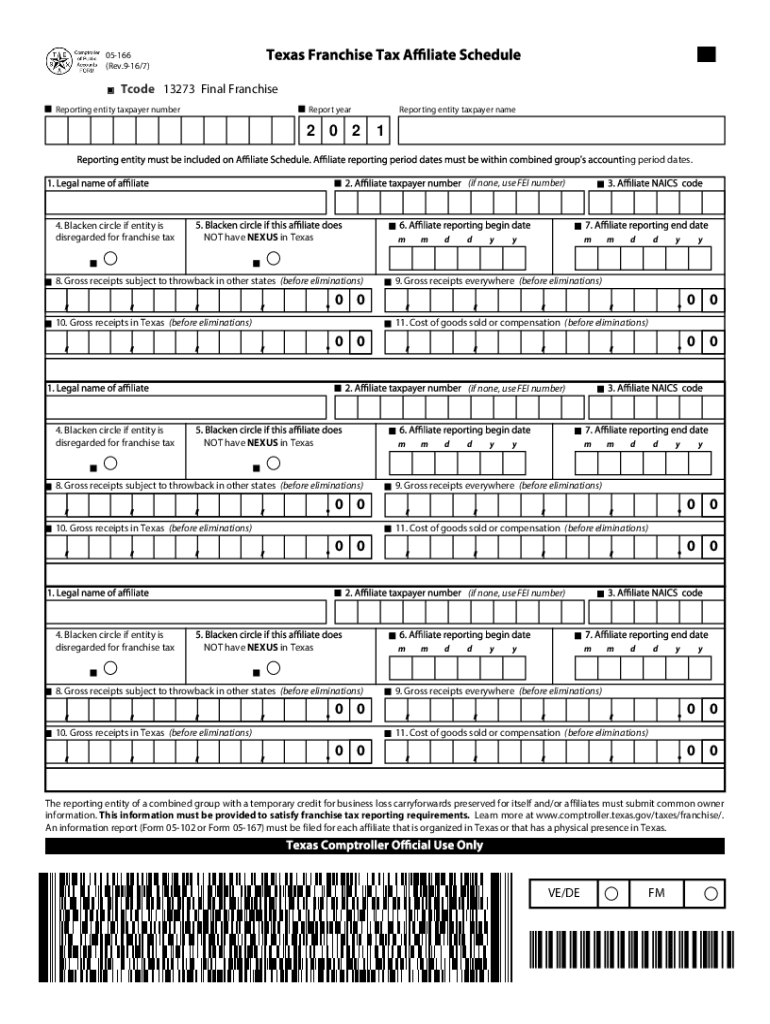

05 166 Texas Franchise Tax Affiliate Schedule for Final Report 2021

What is the 05 166 Texas Franchise Tax Affiliate Schedule?

The 05 166 Texas Franchise Tax Affiliate Schedule is a form used by businesses in Texas to report their franchise tax obligations. This schedule is specifically designed for entities that are affiliated with other businesses and need to disclose their relationship for tax purposes. It allows the Texas Comptroller to assess the tax liability of affiliated entities collectively, ensuring that all related businesses comply with Texas tax laws. The form is essential for maintaining transparency in business operations and ensuring that all affiliated entities are accurately represented in tax filings.

How to Use the 05 166 Texas Franchise Tax Affiliate Schedule

Using the 05 166 Texas Franchise Tax Affiliate Schedule involves several steps. First, gather all necessary information about your business and its affiliates, including their legal names, addresses, and Texas taxpayer identification numbers. Next, complete the form by providing details about each affiliated entity, including their share of revenue and expenses. Ensure that all information is accurate and complete, as discrepancies can lead to penalties. Once completed, the form can be submitted electronically or by mail, depending on your preference and the requirements set by the Texas Comptroller.

Steps to Complete the 05 166 Texas Franchise Tax Affiliate Schedule

Completing the 05 166 Texas Franchise Tax Affiliate Schedule requires careful attention to detail. Follow these steps:

- Collect all relevant information about your business and its affiliates.

- Fill out the identification section with the required details for each entity.

- Report the financial information, including revenues and expenses, for each affiliate.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through the Texas Comptroller's website or mail it to the appropriate address.

Legal Use of the 05 166 Texas Franchise Tax Affiliate Schedule

The 05 166 Texas Franchise Tax Affiliate Schedule must be used in compliance with Texas tax laws. It serves as a legal document that outlines the financial relationships between affiliated entities. Proper use of this form ensures that all parties fulfill their tax obligations and avoids potential legal issues. It is crucial to maintain accurate records and submit the form within the designated deadlines to uphold compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 05 166 Texas Franchise Tax Affiliate Schedule are critical for compliance. Typically, the form must be submitted by May 15 of each year for entities that operate on a calendar year basis. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to keep track of these dates to avoid penalties and ensure timely submission of your tax documents.

Required Documents

When preparing to file the 05 166 Texas Franchise Tax Affiliate Schedule, certain documents are required to support your submission. These may include:

- Financial statements for each affiliated entity.

- Taxpayer identification numbers for all businesses involved.

- Records of revenue and expenses for the reporting period.

- Any prior year tax filings that may be relevant.

Penalties for Non-Compliance

Failure to file the 05 166 Texas Franchise Tax Affiliate Schedule on time or inaccurate reporting can result in significant penalties. The Texas Comptroller may impose fines, interest on unpaid taxes, and other consequences for non-compliance. It is important to ensure that all information is accurate and submitted by the deadline to avoid these penalties and maintain good standing with state tax authorities.

Quick guide on how to complete 05 166 2021 texas franchise tax affiliate schedule for final report

Prepare 05 166 Texas Franchise Tax Affiliate Schedule For Final Report effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without delays. Manage 05 166 Texas Franchise Tax Affiliate Schedule For Final Report on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The most efficient way to alter and eSign 05 166 Texas Franchise Tax Affiliate Schedule For Final Report with ease

- Find 05 166 Texas Franchise Tax Affiliate Schedule For Final Report and select Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign 05 166 Texas Franchise Tax Affiliate Schedule For Final Report and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 166 2021 texas franchise tax affiliate schedule for final report

Create this form in 5 minutes!

How to create an eSignature for the 05 166 2021 texas franchise tax affiliate schedule for final report

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

How to make an e-signature from your smart phone

The best way to create an e-signature for a PDF document on iOS

How to make an e-signature for a PDF file on Android OS

People also ask

-

What is the 2021 tax schedule, and why is it important for businesses?

The 2021 tax schedule is a list of important tax deadlines and forms that businesses must be aware of to ensure compliance with IRS regulations. Understanding this schedule helps to avoid late fees and penalties, making it crucial for effective financial planning.

-

How can airSlate SignNow assist with the 2021 tax schedule?

airSlate SignNow streamlines the process of signing and sending necessary tax documents in line with the 2021 tax schedule. Our platform provides a secure and efficient way to manage electronic signatures, ensuring that your tax documents are filed on time.

-

Are there any costs associated with using airSlate SignNow for my 2021 tax schedule documents?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs. You can choose a plan that allows you to efficiently manage your 2021 tax schedule documents without breaking your budget.

-

What features does airSlate SignNow offer for handling the 2021 tax schedule?

Our platform offers features such as customizable templates, automated reminders, and secure document storage to help you manage your 2021 tax schedule. These tools ensure you can easily handle all of your tax document needs in one place.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is our top priority. airSlate SignNow uses advanced encryption and authentication protocols to protect your sensitive data when managing your 2021 tax schedule documents, ensuring privacy and compliance with regulations.

-

Can airSlate SignNow integrate with accounting software for handling the 2021 tax schedule?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, enabling you to easily synchronize your financial data and keep track of your 2021 tax schedule. This integration simplifies the workflow and ensures accuracy.

-

Is there a trial period available to test airSlate SignNow for the 2021 tax schedule?

Absolutely! We offer a free trial for potential users to explore airSlate SignNow's features and functionalities. This allows you to evaluate how our platform can assist in managing your 2021 tax schedule effectively.

Get more for 05 166 Texas Franchise Tax Affiliate Schedule For Final Report

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497301904 form

- Bill of sale of automobile and odometer statement delaware form

- Bill of sale for automobile or vehicle including odometer statement and promissory note delaware form

- Promissory note in connection with sale of vehicle or automobile delaware form

- Bill of sale for watercraft or boat delaware form

- Bill of sale of automobile and odometer statement for as is sale delaware form

- Construction contract cost plus or fixed fee delaware form

- Painting contract for contractor delaware form

Find out other 05 166 Texas Franchise Tax Affiliate Schedule For Final Report

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer