05 166 Texas Franchise Tax Affiliate Schedule for Final Report 05 166 Texas Franchise Tax Affiliate Schedule for Final Report 2022-2026

Understanding the Texas Franchise Tax Affiliate Schedule (Form 05-166)

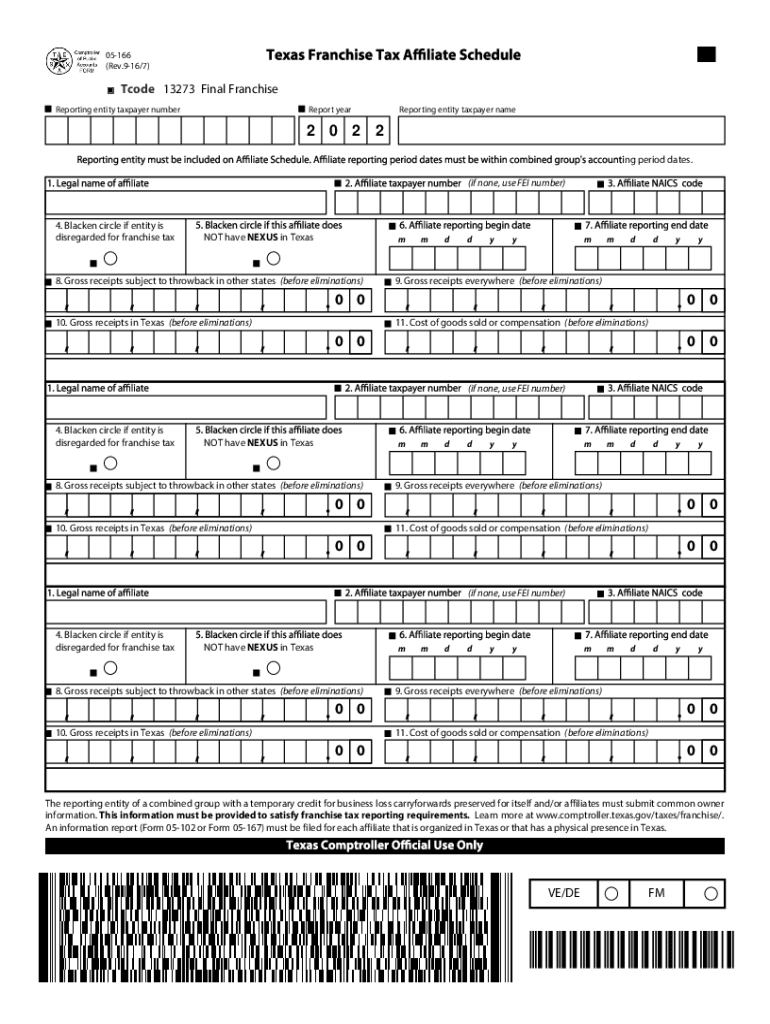

The 05-166 Texas Franchise Tax Affiliate Schedule is a crucial document for businesses operating in Texas that are required to report their franchise tax obligations. This form is specifically designed for entities that are affiliated with other businesses and need to disclose their financial information in a structured manner. The schedule assists in determining the total revenue and tax liability of the affiliate entities, ensuring compliance with Texas state tax regulations.

Steps to Complete the 05-166 Texas Franchise Tax Affiliate Schedule

Completing the 05-166 Texas Franchise Tax Affiliate Schedule involves several key steps. First, gather all necessary financial documents, including revenue statements and previous tax filings. Next, accurately report the total revenue for the affiliate entities, ensuring that all figures are consistent with your accounting records. It is important to fill out each section of the form completely, as incomplete submissions may lead to delays or penalties. Finally, review the completed form for accuracy before submission.

Legal Use of the 05-166 Texas Franchise Tax Affiliate Schedule

The 05-166 Texas Franchise Tax Affiliate Schedule is legally binding and must be completed in accordance with Texas tax laws. To ensure that the document is recognized as valid, it is essential to follow all compliance requirements outlined by the Texas Comptroller’s office. This includes providing accurate financial data and adhering to submission deadlines. Failure to comply with these regulations can result in penalties or additional scrutiny from tax authorities.

Filing Deadlines for the 05-166 Texas Franchise Tax Affiliate Schedule

Timely filing of the 05-166 Texas Franchise Tax Affiliate Schedule is critical for maintaining compliance with state tax laws. The deadline for submitting this form typically aligns with the annual franchise tax report deadline, which is usually May 15 for most entities. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Texas Comptroller’s website for any updates or changes to filing deadlines.

Required Documents for the 05-166 Texas Franchise Tax Affiliate Schedule

When preparing to file the 05-166 Texas Franchise Tax Affiliate Schedule, gather the following documents: financial statements for each affiliate entity, previous tax returns, and any relevant documentation that supports the reported revenue figures. Having these documents readily available will facilitate a smoother filing process and help ensure that all information is accurate and complete.

Who Issues the 05-166 Texas Franchise Tax Affiliate Schedule

The 05-166 Texas Franchise Tax Affiliate Schedule is issued by the Texas Comptroller of Public Accounts. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Texas. The Comptroller provides guidance on how to complete the form and offers resources for businesses seeking assistance with their franchise tax obligations.

Quick guide on how to complete 05 166 2022 texas franchise tax affiliate schedule for final report 05 166 2022 texas franchise tax affiliate schedule for

Prepare 05 166 Texas Franchise Tax Affiliate Schedule For Final Report 05 166 Texas Franchise Tax Affiliate Schedule For Final Report effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, as you can access the correct version and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 05 166 Texas Franchise Tax Affiliate Schedule For Final Report 05 166 Texas Franchise Tax Affiliate Schedule For Final Report on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign 05 166 Texas Franchise Tax Affiliate Schedule For Final Report 05 166 Texas Franchise Tax Affiliate Schedule For Final Report seamlessly

- Obtain 05 166 Texas Franchise Tax Affiliate Schedule For Final Report 05 166 Texas Franchise Tax Affiliate Schedule For Final Report and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to store your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any chosen device. Edit and eSign 05 166 Texas Franchise Tax Affiliate Schedule For Final Report 05 166 Texas Franchise Tax Affiliate Schedule For Final Report and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 166 2022 texas franchise tax affiliate schedule for final report 05 166 2022 texas franchise tax affiliate schedule for

Create this form in 5 minutes!

How to create an eSignature for the 05 166 2022 texas franchise tax affiliate schedule for final report 05 166 2022 texas franchise tax affiliate schedule for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for managing the 2022 schedule?

airSlate SignNow provides a range of features that enhance your ability to manage your 2022 schedule effectively. Key features include electronic signing, document templates, and automated workflows that streamline your operations. These features help ensure that your business stays on track and meets deadlines efficiently.

-

How can I integrate airSlate SignNow with other tools to optimize my 2022 schedule?

airSlate SignNow offers seamless integrations with various popular tools such as Google Drive, Dropbox, and Salesforce, which can signNowly optimize your 2022 schedule. This means you can easily manage your documents and eSignatures without leaving your preferred apps. The integration capabilities enhance productivity and minimize disruptions in your workflow.

-

What is the pricing structure for airSlate SignNow and how does it fit into my 2022 schedule?

airSlate SignNow's pricing structure is designed to be cost-effective, making it an ideal choice for maintaining a budget-friendly 2022 schedule. Various plans are available, allowing you to choose one that best fits your business needs. Each plan includes features that help you manage your signing processes without overspending.

-

Can airSlate SignNow help improve collaboration on projects scheduled for 2022?

Yes, airSlate SignNow facilitates improved collaboration by allowing multiple team members to review and sign documents simultaneously. This collaborative feature enables you to keep your 2022 schedule on track, as team members can contribute to documents in real-time. It ensures everyone is aligned and informed, reducing delays in decision-making.

-

Is it easy to use airSlate SignNow for creating a signing workflow for my 2022 schedule?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing you to create signing workflows for your 2022 schedule with ease. The intuitive interface lets you set up document flows without technical expertise, so you can quickly implement effective solutions for your signing needs.

-

What types of documents can be signed using airSlate SignNow within my 2022 schedule?

You can use airSlate SignNow to sign a wide variety of documents, from contracts and agreements to forms and waivers, all within your 2022 schedule. The flexibility allows businesses to customize their document management effectively. The platform supports various formats, ensuring that all necessary documents can be signed electronically.

-

What are the benefits of using airSlate SignNow for my 2022 schedule compared to traditional methods?

Using airSlate SignNow offers numerous benefits over traditional methods, including enhanced speed and efficiency for your 2022 schedule. Electronic signatures eliminate the need for printing and mailing documents, thus saving time and resources. Additionally, you can track document status in real-time, allowing for better project management.

Get more for 05 166 Texas Franchise Tax Affiliate Schedule For Final Report 05 166 Texas Franchise Tax Affiliate Schedule For Final Report

Find out other 05 166 Texas Franchise Tax Affiliate Schedule For Final Report 05 166 Texas Franchise Tax Affiliate Schedule For Final Report

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe