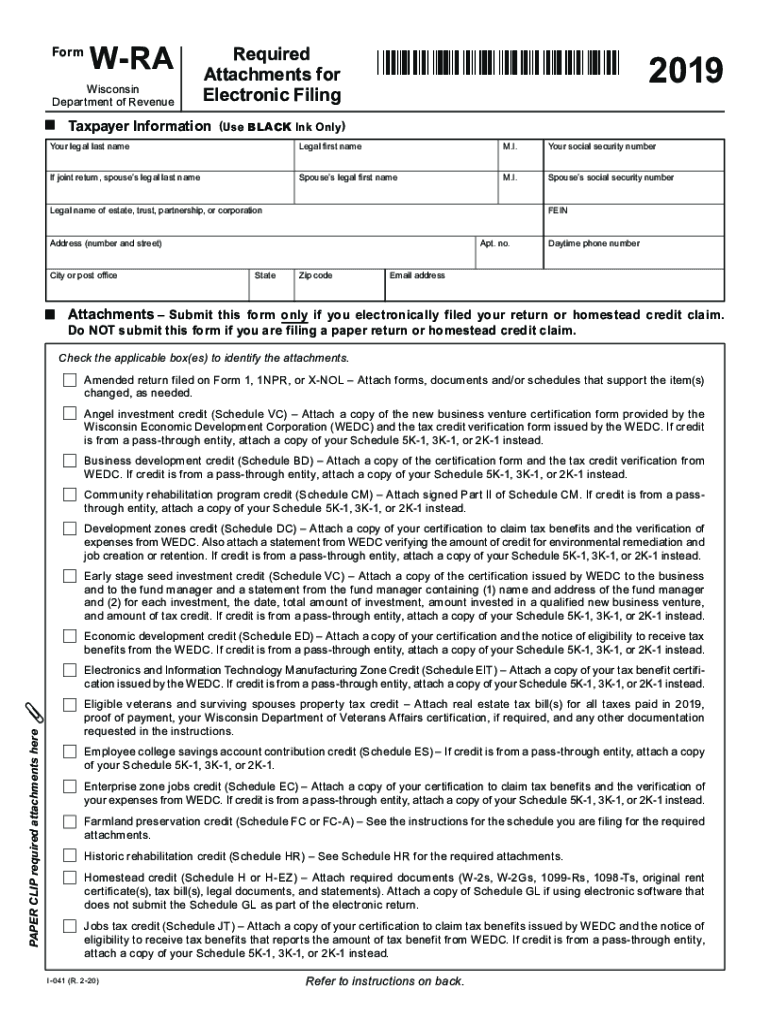

Form W RA Wisconsin Department of Revenue WI Gov 2019

What is the Form W-RA?

The Form W-RA is a tax document used by the Wisconsin Department of Revenue. It serves as a request for the refund of Wisconsin income tax withheld from wages or other payments. This form is essential for individuals who have had taxes withheld but are not required to file a Wisconsin income tax return. Understanding its purpose is crucial for those seeking to reclaim excess withholding.

Steps to Complete the Form W-RA

Completing the Form W-RA involves several straightforward steps. First, gather necessary information, including your Social Security number and details about the income from which taxes were withheld. Next, accurately fill out the form, ensuring all entries are correct to avoid delays in processing. Finally, review the completed form for accuracy before submission to ensure compliance with state requirements.

Legal Use of the Form W-RA

The Form W-RA is legally recognized as a valid request for tax refunds in Wisconsin. To ensure its legal standing, it must be filled out correctly and submitted within the designated time frame. Adhering to the guidelines set by the Wisconsin Department of Revenue is essential for the form to be accepted without issues.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form W-RA. Typically, the form must be submitted within a specific time frame following the end of the tax year in which the withholding occurred. Keeping track of these dates ensures that individuals do not miss their opportunity to reclaim withheld taxes.

Who Issues the Form W-RA?

The Form W-RA is issued by the Wisconsin Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. Understanding the issuing authority helps individuals navigate the process of obtaining and submitting the form correctly.

Eligibility Criteria for the Form W-RA

To be eligible to use the Form W-RA, individuals must meet specific criteria. Generally, this includes having Wisconsin income tax withheld from wages or other payments without the requirement to file a full income tax return. Familiarizing oneself with these criteria is essential to determine if the form can be utilized for a refund request.

Quick guide on how to complete form w ra wisconsin department of revenue wigov

Complete Form W RA Wisconsin Department Of Revenue WI gov effortlessly on any device

Digital document management has become widely adopted by organizations and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can acquire the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and eSign your files promptly without delays. Handle Form W RA Wisconsin Department Of Revenue WI gov on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven workflow today.

How to edit and eSign Form W RA Wisconsin Department Of Revenue WI gov with ease

- Obtain Form W RA Wisconsin Department Of Revenue WI gov and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches, or mistakes that require new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Form W RA Wisconsin Department Of Revenue WI gov and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w ra wisconsin department of revenue wigov

Create this form in 5 minutes!

How to create an eSignature for the form w ra wisconsin department of revenue wigov

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow, and how does it relate to w ra?

airSlate SignNow is an eSignature solution that enables businesses to send and eSign documents quickly and efficiently. The platform addresses the needs for w ra by providing a seamless workflow, ensuring that all parties can easily sign documents electronically, thereby saving time and resources.

-

How much does airSlate SignNow cost for businesses looking to implement w ra?

airSlate SignNow offers various pricing plans tailored to different business needs. To understand the cost specifics related to w ra, prospective customers should review the pricing page, which outlines the features included in each plan and how they can benefit from an efficient eSigning solution.

-

What key features does airSlate SignNow offer for w ra?

airSlate SignNow provides several advanced features designed to enhance the w ra experience, including customizable templates, secure cloud storage, and real-time tracking of document status. These features support efficient document management and ensure compliance, making it an ideal choice for businesses focused on w ra.

-

Can airSlate SignNow integrate with other applications relevant to w ra?

Yes, airSlate SignNow supports integration with numerous applications to streamline your w ra processes. You can connect with popular tools such as Google Drive, Salesforce, and others, allowing for a unified experience that makes managing eSignatures easier than ever.

-

What are the benefits of using airSlate SignNow for w ra?

Using airSlate SignNow for w ra brings numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. By adopting this digital solution, businesses can expedite their document processes while maintaining compliance and reducing the risk of errors associated with manual signing.

-

Is airSlate SignNow secure for handling w ra documents?

Absolutely! airSlate SignNow follows stringent security protocols to protect all documents related to w ra. With data encryption, secure cloud storage, and compliance with various industry standards, users can be confident that their sensitive information remains safe and secure.

-

How does airSlate SignNow simplify the w ra process for teams?

airSlate SignNow simplifies the w ra process by providing an intuitive interface that allows teams to send, sign, and manage documents easily. Features like in-app reminders and collaborative editing ensure that all team members can participate in the w ra process, regardless of location.

Get more for Form W RA Wisconsin Department Of Revenue WI gov

- Postnuptial agreements package vermont form

- Letters of recommendation package vermont form

- Vermont mechanics lien form

- Vt corporation 497429110 form

- Storage business package vermont form

- Child care services package vermont form

- Special or limited power of attorney for real estate sales transaction by seller vermont form

- Special or limited power of attorney for real estate purchase transaction by purchaser vermont form

Find out other Form W RA Wisconsin Department Of Revenue WI gov

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast