File the Right Government Forms After a Name Change 2024-2026

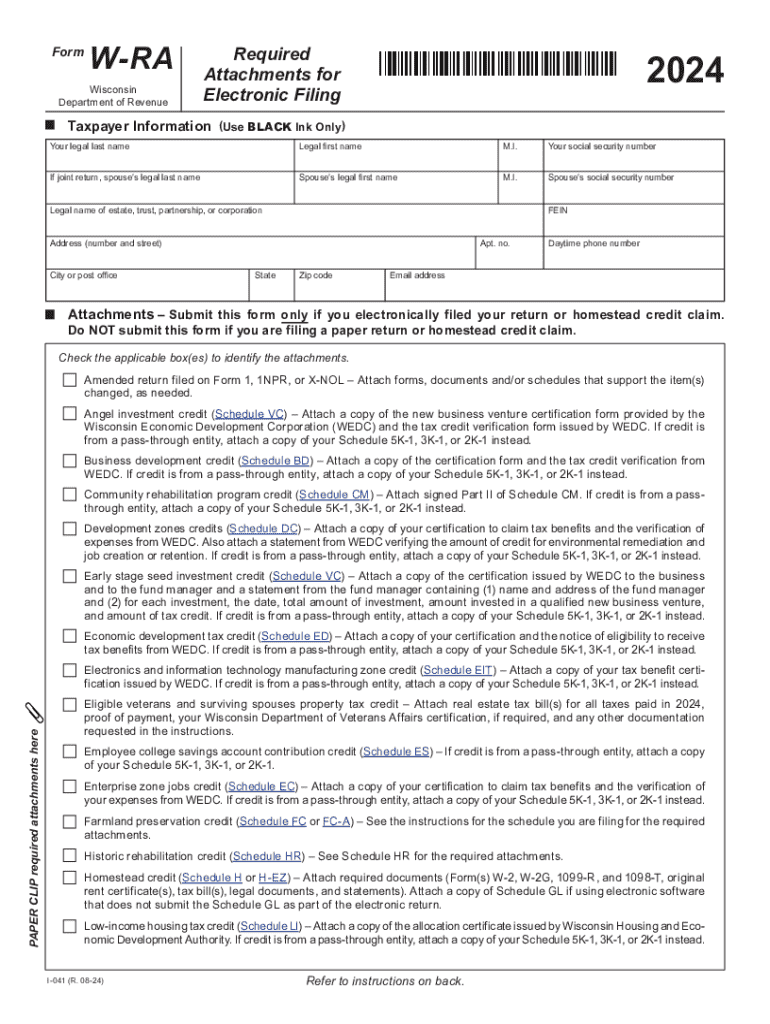

What is the Wisconsin Form W-RA?

The Wisconsin Form W-RA, also known as the Wisconsin Withholding Reconciliation Form, is a crucial document for employers in Wisconsin. It is used to report the total amount of state income tax withheld from employees' wages during the tax year. The form ensures that the state receives accurate information regarding the income tax collected, which is essential for maintaining compliance with Wisconsin tax laws.

Key Elements of the Wisconsin Form W-RA

The Wisconsin Form W-RA includes several key elements that employers must complete accurately. These elements typically include:

- Employer Information: This section requires the employer's name, address, and identification number.

- Employee Information: Employers must report the total wages paid and the total tax withheld for each employee.

- Summary of Withholdings: A summary section that aggregates the total amounts withheld for the year.

- Signature and Date: The form must be signed by an authorized representative of the employer, along with the date of submission.

Steps to Complete the Wisconsin Form W-RA

Completing the Wisconsin Form W-RA involves several straightforward steps:

- Gather all necessary payroll records for the tax year.

- Fill in the employer's information accurately.

- Calculate the total wages paid and the total state tax withheld for each employee.

- Complete the summary of withholdings section.

- Review the form for accuracy before signing it.

- Submit the completed form to the Wisconsin Department of Revenue by the specified deadline.

Filing Deadlines for the Wisconsin Form W-RA

Employers must be aware of the filing deadlines for the Wisconsin Form W-RA to avoid penalties. The form is typically due by January 31 of the following year after the tax year ends. It is essential to submit the form on time to ensure compliance with state regulations and avoid any potential fines.

Form Submission Methods for the Wisconsin Form W-RA

The Wisconsin Form W-RA can be submitted through various methods, including:

- Online Submission: Employers may file the form electronically through the Wisconsin Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Wisconsin Department of Revenue.

- In-Person Submission: Employers may also choose to deliver the form in person at designated state offices.

Penalties for Non-Compliance with the Wisconsin Form W-RA

Failure to file the Wisconsin Form W-RA on time or providing inaccurate information can result in penalties. These penalties may include fines, interest on unpaid taxes, and potential audits. It is crucial for employers to ensure accurate and timely submissions to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct file the right government forms after a name change

Create this form in 5 minutes!

How to create an eSignature for the file the right government forms after a name change

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form w ar wisconsin and how can airSlate SignNow help?

The form w ar wisconsin is a document used for various administrative purposes in Wisconsin. airSlate SignNow simplifies the process of filling out and signing this form by providing an intuitive platform that allows users to eSign documents securely and efficiently.

-

How much does airSlate SignNow cost for managing form w ar wisconsin?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage the form w ar wisconsin effectively.

-

What features does airSlate SignNow offer for the form w ar wisconsin?

airSlate SignNow provides a range of features including customizable templates, secure eSigning, and document tracking. These features make it easy to manage the form w ar wisconsin and ensure that all signatures are collected promptly.

-

Can I integrate airSlate SignNow with other applications for the form w ar wisconsin?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to streamline your workflow when handling the form w ar wisconsin and other documents.

-

Is airSlate SignNow secure for signing the form w ar wisconsin?

Absolutely! airSlate SignNow employs advanced security measures including encryption and secure cloud storage to protect your documents. This ensures that your form w ar wisconsin and other sensitive information remain confidential and secure.

-

How can airSlate SignNow improve my workflow for the form w ar wisconsin?

By using airSlate SignNow, you can automate the signing process, reducing the time spent on paperwork. This efficiency allows you to focus on more important tasks while ensuring that the form w ar wisconsin is processed quickly and accurately.

-

What support options are available for users of airSlate SignNow managing the form w ar wisconsin?

airSlate SignNow provides comprehensive customer support through various channels including live chat, email, and a detailed knowledge base. This ensures that you have the assistance you need when working with the form w ar wisconsin.

Get more for File The Right Government Forms After A Name Change

Find out other File The Right Government Forms After A Name Change

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now

- Can I eSign Missouri Business Insurance Quotation Form

- How Do I eSign Nevada Business Insurance Quotation Form

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form