"Information Only" FormsInternal Revenue ServiceDOR Attachments Wisconsin8 17 5 Special Computation Formats, F 2021

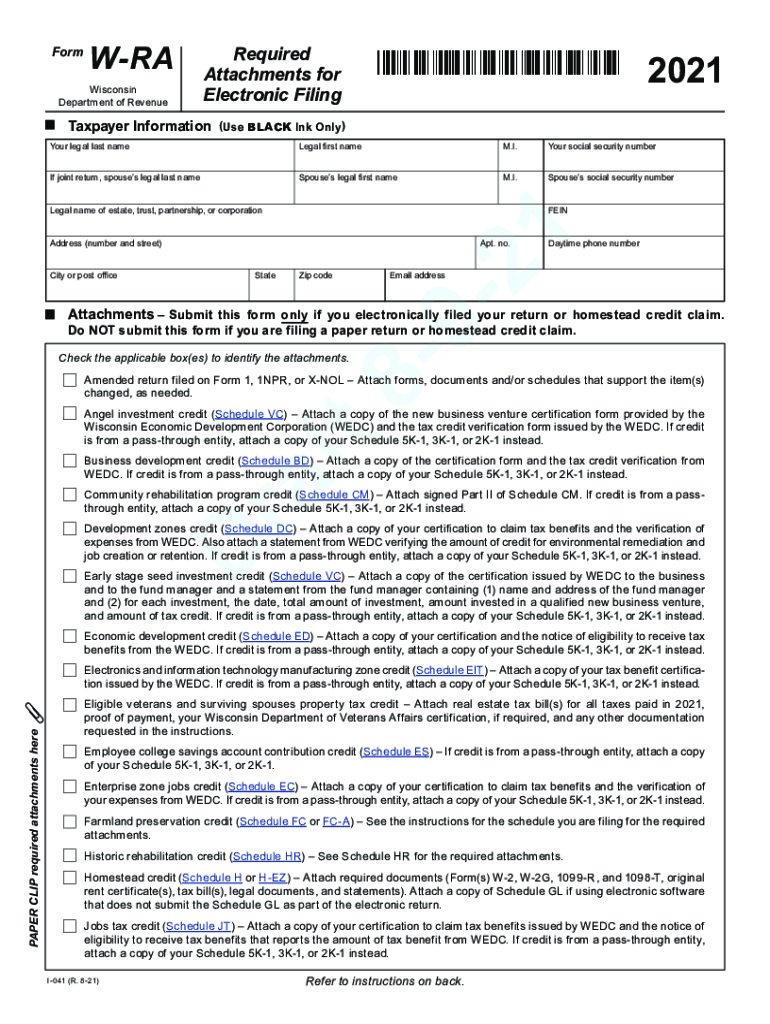

Understanding the W-RA Form

The W-RA form, or Wisconsin Resident Income Tax Withholding Exemption Certificate, is a crucial document for individuals in Wisconsin. It allows residents to claim exemption from state income tax withholding if they meet specific criteria. This form is particularly relevant for those who may not have a tax liability for the year, such as students or individuals with low income. Understanding the purpose and requirements of the W-RA form is essential for ensuring compliance with state tax laws.

Steps to Complete the W-RA Form

Completing the W-RA form involves several straightforward steps:

- Provide personal information, including your name, address, and Social Security number.

- Indicate your eligibility for exemption by checking the appropriate box.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer or the appropriate tax authority.

Ensure that all information is accurate to avoid delays or issues with your tax status.

Eligibility Criteria for the W-RA Form

To qualify for using the W-RA form, you must meet specific eligibility criteria. Generally, you may be eligible if:

- Your total income is below the threshold required for state income tax liability.

- You expect to have no tax liability for the current year.

- You are a full-time student or have other qualifying circumstances that justify the exemption.

Review these criteria carefully to determine if you can submit the W-RA form.

Filing Deadlines for the W-RA Form

It is essential to be aware of the filing deadlines associated with the W-RA form. Typically, the form should be submitted to your employer at the beginning of the tax year or whenever you start a new job. If you are claiming exemption, ensure that you submit the form before your first paycheck to avoid unnecessary withholding.

Legal Use of the W-RA Form

The W-RA form is legally recognized in Wisconsin, provided it is completed accurately and submitted to the correct entity. It serves as a declaration of your tax status and can protect you from unnecessary withholding. However, it is crucial to understand that submitting this form falsely can lead to penalties, including fines or back taxes owed.

Form Submission Methods

The W-RA form can be submitted through various methods, including:

- Directly to your employer, who will process it for payroll purposes.

- By mail to the Wisconsin Department of Revenue if required.

- Electronically, if your employer offers an online submission option.

Choose the method that best suits your situation to ensure timely processing.

Quick guide on how to complete ampquotinformation onlyampquot formsinternal revenue servicedor attachments wisconsin8175 special computation formats forms and

Complete "Information Only" FormsInternal Revenue ServiceDOR Attachments Wisconsin8 17 5 Special Computation Formats, F seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly and without delays. Manage "Information Only" FormsInternal Revenue ServiceDOR Attachments Wisconsin8 17 5 Special Computation Formats, F on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign "Information Only" FormsInternal Revenue ServiceDOR Attachments Wisconsin8 17 5 Special Computation Formats, F effortlessly

- Locate "Information Only" FormsInternal Revenue ServiceDOR Attachments Wisconsin8 17 5 Special Computation Formats, F and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or mask sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign "Information Only" FormsInternal Revenue ServiceDOR Attachments Wisconsin8 17 5 Special Computation Formats, F and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ampquotinformation onlyampquot formsinternal revenue servicedor attachments wisconsin8175 special computation formats forms and

Create this form in 5 minutes!

How to create an eSignature for the ampquotinformation onlyampquot formsinternal revenue servicedor attachments wisconsin8175 special computation formats forms and

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to w ra?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and eSign documents efficiently. With w ra, you can streamline your document workflows, making it easier to manage contracts and agreements. The user-friendly interface helps users adopt the software quickly, enhancing productivity.

-

How much does airSlate SignNow cost for businesses looking to implement w ra?

The pricing for airSlate SignNow is flexible, designed to fit different business needs. Depending on the feature set and volume of use, you can choose a plan that suits your requirements and budget while leveraging w ra. This cost-effective solution can lead to considerable savings compared to traditional paper-based processes.

-

What features does airSlate SignNow offer to enhance w ra?

airSlate SignNow includes a variety of features that enhance w ra, such as customizable templates, document tracking, and automated reminders. These features ensure that you can manage your documents efficiently and stay organized throughout the signing process. The platform’s robust security measures also protect your sensitive data.

-

Can airSlate SignNow integrate with other software to improve w ra workflows?

Yes, airSlate SignNow offers a range of integrations that can enhance your w ra workflows. Whether you're using CRM systems, project management tools, or cloud storage solutions, integrating SignNow can help streamline your processes. This connectivity further allows businesses to achieve seamless operations and improved efficiency.

-

What are the benefits of using airSlate SignNow for eSigning with w ra?

Using airSlate SignNow for eSigning with w ra greatly benefits businesses by reducing turnaround time for document approvals. It also eliminates the need for physical paperwork, leading to increased productivity and cost savings. Plus, be assured that your documents are secure and compliant with industry regulations.

-

Is it easy to get started with airSlate SignNow and w ra?

Absolutely! Getting started with airSlate SignNow and implementing w ra is straightforward. The user-friendly interface coupled with comprehensive onboarding resources makes it easy for anyone to begin using the platform. You can quickly set up your account and start sending documents for eSignature.

-

What support options are available for airSlate SignNow users focused on w ra?

airSlate SignNow provides excellent support options for users focused on optimizing w ra. Customers can access a rich library of resources, including FAQs, tutorials, and webinars. For more personalized assistance, dedicated support teams are available to help resolve any issues or answer questions.

Get more for "Information Only" FormsInternal Revenue ServiceDOR Attachments Wisconsin8 17 5 Special Computation Formats, F

- Quitclaim husband wife 497298316 form

- California life estate 497298317 form

- Ca husband wife 497298318 form

- Deed of rescission individual to individual california form

- Quitclaim deed four individuals to three individuals california form

- California warranty deed form

- California quitclaim deed 497298322 form

- Grant deed 497298323 form

Find out other "Information Only" FormsInternal Revenue ServiceDOR Attachments Wisconsin8 17 5 Special Computation Formats, F

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later