Form 502D Maryland Personal Declaration of Estimated 2020

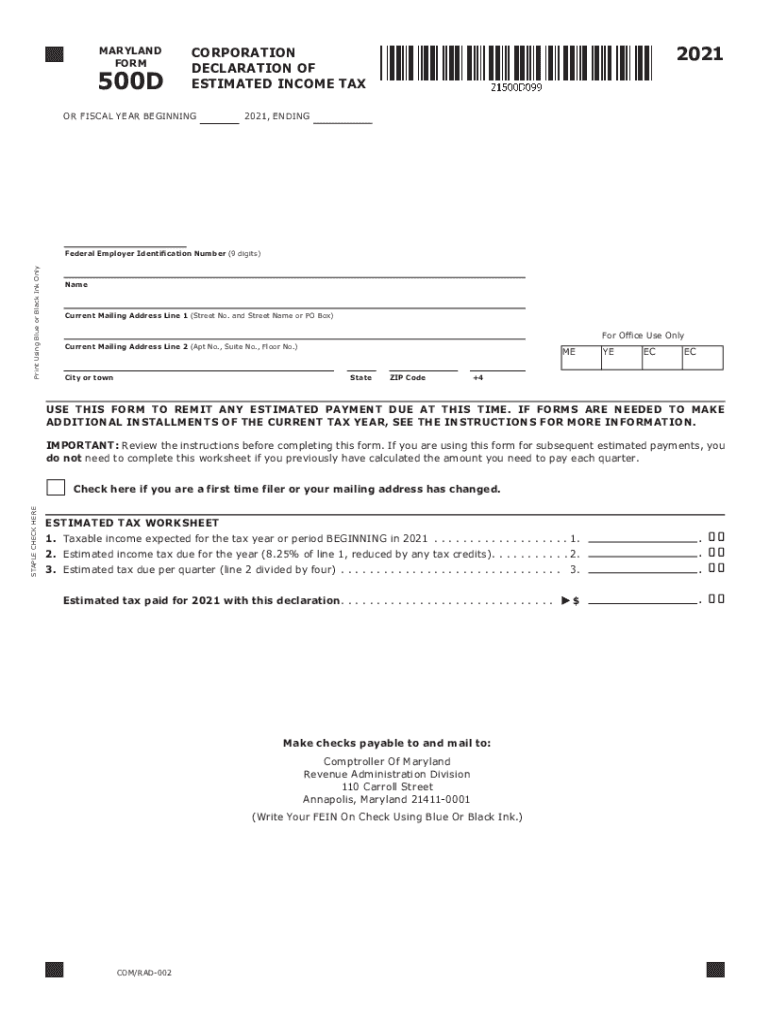

What is the Maryland Form 500D?

The Maryland Form 500D, also known as the Maryland Personal Declaration of Estimated Income Tax, is a crucial document for residents who expect to owe state income tax. This form allows individuals to report their estimated income tax liability for the year, ensuring they meet their tax obligations. By submitting the 500D, taxpayers can avoid penalties associated with underpayment of taxes. It is particularly relevant for those who have income that is not subject to withholding, such as self-employed individuals, freelancers, or those with investment income.

Steps to Complete the Maryland Form 500D

Completing the Maryland Form 500D involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including income sources and deductions. Next, calculate your estimated income for the year. Use this figure to determine your expected tax liability based on Maryland's tax rates. After calculating your tax, fill out the form by entering your personal details and the estimated amounts. Finally, review the form for accuracy before submitting it either online or by mail, ensuring you adhere to any filing deadlines.

Filing Deadlines for the Maryland Form 500D

Timely submission of the Maryland Form 500D is essential to avoid penalties. Generally, the form must be filed by April 15 of the tax year, aligning with the federal tax deadline. If you expect to owe tax, it is advisable to make estimated payments throughout the year, typically due on April 15, June 15, September 15, and January 15 of the following year. Keeping track of these deadlines helps ensure compliance with state tax regulations.

Legal Use of the Maryland Form 500D

The Maryland Form 500D serves as a legally binding document when completed correctly. It is essential to provide accurate information, as discrepancies can lead to penalties or audits. The form must be signed and dated by the taxpayer, affirming that the information provided is true and complete. Additionally, using a secure platform for electronic submission can enhance the legal standing of the document, ensuring compliance with eSignature laws.

Who Issues the Maryland Form 500D?

The Maryland Form 500D is issued by the Maryland Comptroller’s Office, which is responsible for administering state tax laws. This office provides the necessary forms and instructions for taxpayers, ensuring they have the resources needed to fulfill their tax obligations. Taxpayers can access the form and related materials through the Comptroller's official website or by contacting their office directly for assistance.

Required Documents for the Maryland Form 500D

To complete the Maryland Form 500D, certain documents are necessary. Taxpayers should have their previous year's tax return, current income statements, and any relevant documentation regarding deductions or credits. This information is crucial for accurately estimating income and tax liability. Having these documents on hand can streamline the completion of the form and help ensure that all calculations are correct.

Quick guide on how to complete form 502d maryland personal declaration of estimated

Effortlessly Prepare Form 502D Maryland Personal Declaration Of Estimated on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and electronically sign your documents promptly without delays. Handle Form 502D Maryland Personal Declaration Of Estimated on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Alter and Electronically Sign Form 502D Maryland Personal Declaration Of Estimated with Ease

- Obtain Form 502D Maryland Personal Declaration Of Estimated and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choosing. Adjust and electronically sign Form 502D Maryland Personal Declaration Of Estimated to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 502d maryland personal declaration of estimated

Create this form in 5 minutes!

How to create an eSignature for the form 502d maryland personal declaration of estimated

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the Maryland Form 500 D?

The Maryland Form 500 D is a tax form used by businesses in Maryland to report their income and tax obligations. It is essential for corporate entities that need to file corporate income tax returns in the state. Utilizing airSlate SignNow can streamline the process of signing and submitting the Maryland Form 500 D quickly and efficiently.

-

How can airSlate SignNow help me with my Maryland Form 500 D?

airSlate SignNow offers an easy-to-use platform for businesses to prepare and eSign the Maryland Form 500 D. With our software, you can seamlessly send documents for signature, ensuring that your form is completed accurately and on time, simplifying the filing process.

-

What are the pricing options for airSlate SignNow when using it for the Maryland Form 500 D?

airSlate SignNow provides various pricing plans that cater to different business needs, even when preparing documents like the Maryland Form 500 D. These plans are cost-effective and designed to accommodate the requirements of small businesses to larger enterprises, helping you save money while managing your documents efficiently.

-

Are there any features specifically useful for the Maryland Form 500 D in airSlate SignNow?

Yes, airSlate SignNow offers various features that enhance the experience of managing the Maryland Form 500 D. Features such as customizable templates, reminders for deadlines, and secure cloud storage make it easier for businesses to ensure compliance and timely submission of their tax forms.

-

Can airSlate SignNow integrate with other software when preparing the Maryland Form 500 D?

Absolutely! airSlate SignNow provides integrations with popular accounting and tax software to cater specifically to businesses filing the Maryland Form 500 D. This can help streamline your workflow by allowing you to sync data seamlessly between platforms, reducing manual entry and errors.

-

Is airSlate SignNow secure for handling sensitive documents like the Maryland Form 500 D?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect sensitive documents such as the Maryland Form 500 D. Our platform uses advanced encryption protocols and secure data storage solutions to ensure that your information remains confidential and protected.

-

How user-friendly is airSlate SignNow for preparing the Maryland Form 500 D?

airSlate SignNow is designed with user-friendliness in mind, making it accessible for users of all skill levels when preparing the Maryland Form 500 D. With an intuitive interface, users can easily navigate the platform to quickly create, send, and sign documents without any prior training.

Get more for Form 502D Maryland Personal Declaration Of Estimated

- Warranty deed from husband and wife to husband and wife washington form

- Washington property 497429269 form

- Wa agreement form

- Washington amendment form

- Quitclaim deed from husband and wife to an individual washington form

- Warranty deed from husband and wife to an individual washington form

- Quitclaim deed two individuals to one individual washington form

- Wa husband wife 497429275 form

Find out other Form 502D Maryland Personal Declaration Of Estimated

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word