Tax Year Form 500D Corporation Declaration of Estimated Income Tax 2024-2026

What is the Tax Year Form 500D Corporation Declaration Of Estimated Income Tax

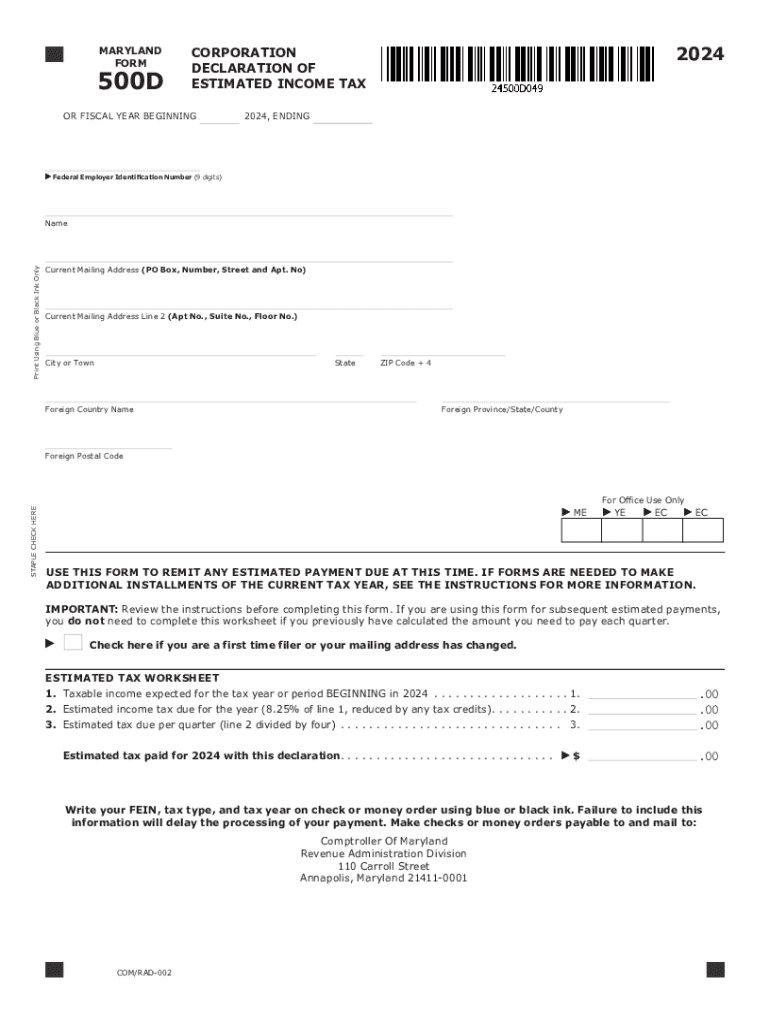

The Maryland Form 500D is a crucial document used by corporations to declare their estimated income tax for the tax year 2024. This form is specifically designed for corporations operating in Maryland, allowing them to report their expected tax liability based on projected income. By filing Form 500D, corporations can ensure compliance with state tax regulations while managing their tax obligations effectively. It is important for businesses to understand the implications of this form as it impacts their financial planning and tax strategy.

Steps to complete the Tax Year Form 500D Corporation Declaration Of Estimated Income Tax

Completing the Maryland Form 500D involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including projected income, deductions, and credits. Next, calculate the estimated tax liability based on the projected income. This includes applying the appropriate tax rates as specified by Maryland tax laws. After calculations are complete, fill out the form with the required information, ensuring that all sections are accurately completed. Finally, review the form for any errors before submission to avoid penalties.

Filing Deadlines / Important Dates

For the tax year 2024, the Maryland Form 500D must be filed by the specified deadlines to avoid penalties. Generally, corporations are required to submit their estimated income tax declarations by the 15th day of the fourth month following the end of their taxable year. This means that for most corporations, the due date will be April 15, 2024. It is essential for businesses to mark their calendars and ensure timely filing to maintain compliance with state tax laws.

Required Documents

To complete the Maryland Form 500D, corporations need to prepare several documents that support their estimated income tax calculations. These documents typically include financial statements, such as income statements and balance sheets, as well as any relevant tax forms from previous years. Additionally, corporations should have records of anticipated income, expenses, and any applicable tax credits or deductions. Having these documents ready will facilitate a smoother filing process and help ensure accuracy in the estimates provided.

Legal use of the Tax Year Form 500D Corporation Declaration Of Estimated Income Tax

The legal use of the Maryland Form 500D is essential for corporations to remain compliant with state tax regulations. Filing this form accurately and on time helps corporations avoid potential legal issues, including fines and penalties for non-compliance. Additionally, the information provided in Form 500D is used by the Maryland Comptroller's Office to assess the corporation's estimated tax liability. Therefore, it is crucial for businesses to understand the legal implications of this form and to ensure that all information submitted is truthful and complete.

How to obtain the Tax Year Form 500D Corporation Declaration Of Estimated Income Tax

The Maryland Form 500D can be obtained through the Maryland Comptroller's Office website or by visiting local tax offices. The form is typically available for download in PDF format, allowing businesses to print and complete it manually. Additionally, corporations can request a physical copy of the form by contacting the Comptroller's Office directly. It is advisable to obtain the most current version of the form to ensure compliance with any changes in tax regulations for the year 2024.

Quick guide on how to complete tax year form 500d corporation declaration of estimated income tax

Effortlessly Complete Tax Year Form 500D Corporation Declaration Of Estimated Income Tax on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly and without holdups. Manage Tax Year Form 500D Corporation Declaration Of Estimated Income Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Tax Year Form 500D Corporation Declaration Of Estimated Income Tax Without Stress

- Locate Tax Year Form 500D Corporation Declaration Of Estimated Income Tax and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using specialized tools provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to preserve your changes.

- Select your preferred method for sharing your form via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Edit and electronically sign Tax Year Form 500D Corporation Declaration Of Estimated Income Tax while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year form 500d corporation declaration of estimated income tax

Create this form in 5 minutes!

How to create an eSignature for the tax year form 500d corporation declaration of estimated income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 500D 2024?

The Maryland Form 500D 2024 is a tax form used by businesses to report income and calculate taxes owed to the state of Maryland. It is essential for ensuring compliance with state tax regulations. Understanding this form is crucial for accurate tax filing and avoiding penalties.

-

How can airSlate SignNow help with the Maryland Form 500D 2024?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the Maryland Form 500D 2024. This streamlines the process, making it easier to manage documents and ensuring timely submissions. With our solution, you can enhance your workflow and reduce paperwork.

-

What are the pricing options for using airSlate SignNow for the Maryland Form 500D 2024?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for those specifically handling the Maryland Form 500D 2024. Our plans are designed to be cost-effective, ensuring you get the best value for your document management needs. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Maryland Form 500D 2024?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the Maryland Form 500D 2024. These features enhance efficiency and ensure that your documents are handled securely and professionally. You can easily create, send, and store your forms in one place.

-

Are there any integrations available with airSlate SignNow for the Maryland Form 500D 2024?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, making it easier to manage the Maryland Form 500D 2024 alongside your existing tools. This integration capability allows for a smoother workflow and better data management. You can connect with popular software to enhance your document processes.

-

What are the benefits of using airSlate SignNow for the Maryland Form 500D 2024?

Using airSlate SignNow for the Maryland Form 500D 2024 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your business rather than administrative tasks. Additionally, you can ensure compliance with state regulations effortlessly.

-

Is airSlate SignNow user-friendly for filing the Maryland Form 500D 2024?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and use, even when filing the Maryland Form 500D 2024. Our intuitive interface allows users to quickly learn how to send and sign documents without extensive training. You can get started in minutes.

Get more for Tax Year Form 500D Corporation Declaration Of Estimated Income Tax

- Warranty deed for separate or joint property to joint tenancy south dakota form

- Warranty deed to separate property of one spouse to both spouses as joint tenants south dakota form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries south dakota form

- Warranty deed from limited partnership or llc is the grantor or grantee south dakota form

- South dakota ucc1 financing statement south dakota form

- South dakota ucc1 financing statement addendum south dakota form

- Ucc3 financing statement 497326512 form

- South dakota ucc3 financing statement amendment addendum south dakota form

Find out other Tax Year Form 500D Corporation Declaration Of Estimated Income Tax

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement