Www Taxformfinder OrgindexmarylandMaryland Declaration of Estimated Corporation Income Tax 2022

Understanding the Maryland Form 500D 2023

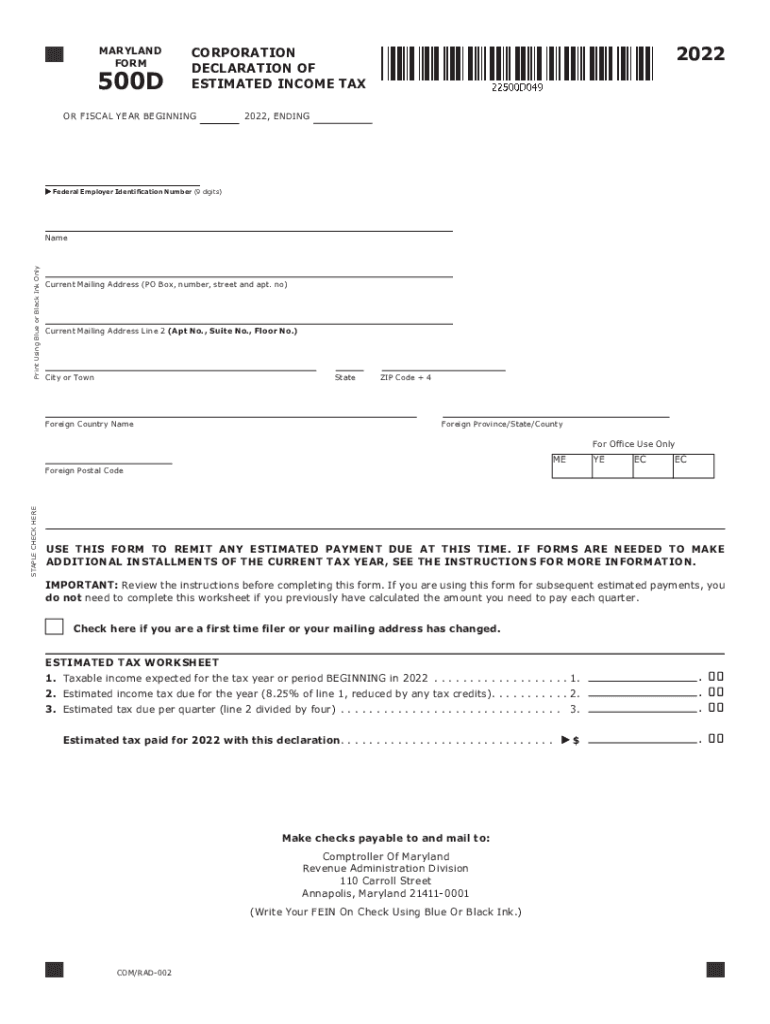

The Maryland Form 500D is the official declaration of estimated corporation income tax for businesses operating in Maryland. This form is essential for corporations that expect to owe tax of $500 or more during the tax year. It allows businesses to estimate their tax liability and make timely payments to avoid penalties. The 2023 version includes updated rates and guidelines that reflect the current tax laws and regulations in Maryland.

Steps to Complete the Maryland Form 500D 2023

Filling out the Maryland Form 500D requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather financial information, including income statements and expense reports.

- Calculate your estimated taxable income for the year.

- Apply the appropriate tax rate to determine your estimated tax liability.

- Complete the form by entering your business information and estimated tax amount.

- Review the form for accuracy before submission.

Filing Deadlines for Maryland Form 500D 2023

It is crucial to be aware of the filing deadlines to avoid penalties. For the 2023 tax year, the Maryland Form 500D must be filed by the 15th day of the fourth month after the end of your tax year. If your corporation operates on a calendar year, this means the form is due on April 15, 2023. Corporations should also make estimated payments quarterly to stay compliant with state tax regulations.

Legal Use of the Maryland Form 500D 2023

The Maryland Form 500D is legally binding when completed and submitted according to state regulations. To ensure its validity, corporations must follow the guidelines set forth by the Maryland Comptroller's Office. This includes using the correct form version, providing accurate financial information, and adhering to submission deadlines. Electronic submissions are accepted, and using a reliable eSignature solution can enhance the legal standing of the document.

Key Elements of the Maryland Form 500D 2023

Several key elements make up the Maryland Form 500D. These include:

- Business Identification: Name, address, and federal employer identification number (FEIN) of the corporation.

- Estimated Tax Calculation: A section to calculate the estimated tax based on projected income.

- Payment Information: Details on how to submit payments, including electronic options.

- Signature Section: Required signatures to validate the form.

Form Submission Methods for Maryland Form 500D 2023

Corporations have multiple options for submitting the Maryland Form 500D. These methods include:

- Online Submission: Using the Maryland Comptroller's online portal for electronic filing.

- Mail: Sending a printed copy of the form to the appropriate address provided by the Comptroller's Office.

- In-Person: Delivering the form directly to a local Comptroller office.

Quick guide on how to complete wwwtaxformfinderorgindexmarylandmaryland declaration of estimated corporation income tax

Prepare Www taxformfinder orgindexmarylandMaryland Declaration Of Estimated Corporation Income Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents since you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Www taxformfinder orgindexmarylandMaryland Declaration Of Estimated Corporation Income Tax on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Www taxformfinder orgindexmarylandMaryland Declaration Of Estimated Corporation Income Tax without hassle

- Obtain Www taxformfinder orgindexmarylandMaryland Declaration Of Estimated Corporation Income Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Www taxformfinder orgindexmarylandMaryland Declaration Of Estimated Corporation Income Tax and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxformfinderorgindexmarylandmaryland declaration of estimated corporation income tax

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxformfinderorgindexmarylandmaryland declaration of estimated corporation income tax

How to make an e-signature for your PDF online

How to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Maryland Form 500D for 2023?

The Maryland Form 500D for 2023 is a document used by businesses to report and pay state income tax owed. This form is specifically designed for pass-through entities, allowing them to indicate their total income and expenses for accurate tax calculation. Understanding the details of the Maryland Form 500D 2023 can help you ensure compliance and avoid penalties.

-

How can airSlate SignNow help with the Maryland Form 500D 2023?

airSlate SignNow provides a streamlined way to prepare, send, and eSign the Maryland Form 500D 2023 digitally. With easy integrations and a user-friendly interface, you can manage all of your forms efficiently, signNowly easing the process of tax filing. By using airSlate SignNow, you can ensure that your 2023 forms are completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Maryland Form 500D 2023?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan provides a cost-effective solution for managing your documents, including the Maryland Form 500D 2023. By investing in airSlate SignNow, you gain access to features that save you time and enhance your document management processes.

-

What are the key features of airSlate SignNow relevant to the Maryland Form 500D 2023?

Key features of airSlate SignNow include secure eSignature capabilities, document templates, and real-time tracking, which are all crucial when managing the Maryland Form 500D 2023. You can easily customize templates to fit your needs, saving time on document preparation. These features ensure a hassle-free experience when preparing important tax documents.

-

Can I easily integrate airSlate SignNow with other software for the Maryland Form 500D 2023?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow when preparing the Maryland Form 500D 2023. This integration capability allows you to pull necessary data from your existing systems, ensuring that your tax forms are accurate and complete without extra manual work.

-

What benefits does airSlate SignNow offer for eSigning the Maryland Form 500D 2023?

Using airSlate SignNow to eSign the Maryland Form 500D 2023 brings numerous benefits, including eliminating the need for physical paperwork and speeding up the signing process. You can invite multiple signers, track the document's status, and securely store signed copies for future reference. These benefits enhance productivity and streamline tax compliance.

-

Is airSlate SignNow user-friendly for filing the Maryland Form 500D 2023?

Yes! airSlate SignNow is designed with a user-friendly interface that simplifies the process of filing the Maryland Form 500D 2023. Even those with minimal technical skills can navigate through the application easily, making it accessible for everyone involved in the document signing process. You can quickly learn to use it without extensive training.

Get more for Www taxformfinder orgindexmarylandMaryland Declaration Of Estimated Corporation Income Tax

- Plumbing contract for contractor maryland form

- Brick mason contract for contractor maryland form

- Roofing contract for contractor maryland form

- Electrical contract for contractor maryland form

- Sheetrock drywall contract for contractor maryland form

- Flooring contract for contractor maryland form

- Maryland new home construction contract maryland form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract maryland form

Find out other Www taxformfinder orgindexmarylandMaryland Declaration Of Estimated Corporation Income Tax

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy