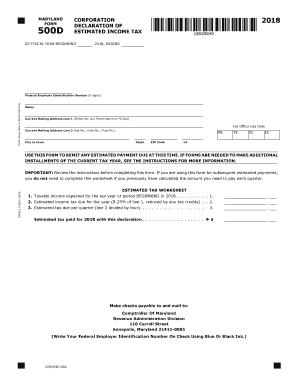

Maryland 500d 2018

What is the Maryland 500d

The Maryland 500d is a tax form used by corporations to report their estimated tax payments to the state of Maryland. Specifically designed for corporate taxpayers, this form allows businesses to calculate their estimated tax liability based on projected income for the year. It is essential for ensuring compliance with state tax laws and helps corporations manage their tax obligations effectively.

How to use the Maryland 500d

To utilize the Maryland 500d, corporations must first gather their financial information, including projected income, deductions, and credits. This data will inform the estimated tax calculations. Once the necessary information is compiled, businesses can fill out the form, ensuring all sections are completed accurately. After completing the Maryland 500d, corporations can submit the form electronically or via mail, depending on their preference and compliance requirements.

Steps to complete the Maryland 500d

Completing the Maryland 500d involves several key steps:

- Gather financial documents, including income statements and previous tax returns.

- Calculate the estimated taxable income for the upcoming year.

- Determine applicable deductions and credits that may reduce the tax liability.

- Fill out the Maryland 500d form with the calculated figures.

- Review the completed form for accuracy and completeness.

- Submit the form either online through an approved platform or by mailing it to the appropriate state office.

Legal use of the Maryland 500d

The Maryland 500d is legally recognized by the state as an official document for reporting estimated tax payments. It is important for corporations to use this form in compliance with Maryland tax regulations to avoid penalties. The form must be filled out accurately and submitted by the designated deadlines to ensure that businesses meet their tax obligations and maintain good standing with the state.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when submitting the Maryland 500d. Typically, estimated tax payments are due quarterly. The deadlines for these payments are generally the 15th day of April, June, September, and December. It is crucial for businesses to mark these dates on their calendars to avoid late fees and penalties associated with non-compliance.

Required Documents

When preparing to complete the Maryland 500d, corporations should have the following documents on hand:

- Previous year’s tax return for reference.

- Financial statements detailing projected income and expenses.

- Documentation for any deductions or credits being claimed.

- Any correspondence from the Maryland Comptroller's office regarding tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Maryland 500d can be submitted through various methods to accommodate different preferences. Corporations may choose to file online using an approved eSignature platform, which streamlines the process and enhances security. Alternatively, businesses can mail the completed form to the appropriate tax office or, in some cases, submit it in person. Each method has its own benefits, and corporations should select the one that best fits their operational needs.

Quick guide on how to complete 2017 md estimated 2018 2019 form

Your assistance manual on how to prepare your Maryland 500d

If you're wondering how to fill out and submit your Maryland 500d, here are some convenient tips to simplify the tax submission process.

To begin, simply create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax paperwork effortlessly. With its editing tool, you can alternate between text, checkboxes, and electronic signatures, and revisit to make changes as necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow these steps to complete your Maryland 500d in just a few minutes:

- Set up your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Maryland 500d in our editor.

- Input the required fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding electronic signature (if necessary).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Take advantage of this manual to electronically file your taxes with airSlate SignNow. Kindly remember that submitting on paper can lead to more errors and delay refunds. Additionally, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2017 md estimated 2018 2019 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the 2017 md estimated 2018 2019 form

How to make an electronic signature for your 2017 Md Estimated 2018 2019 Form online

How to generate an electronic signature for your 2017 Md Estimated 2018 2019 Form in Chrome

How to make an eSignature for signing the 2017 Md Estimated 2018 2019 Form in Gmail

How to generate an eSignature for the 2017 Md Estimated 2018 2019 Form from your mobile device

How to create an eSignature for the 2017 Md Estimated 2018 2019 Form on iOS devices

How to generate an electronic signature for the 2017 Md Estimated 2018 2019 Form on Android devices

People also ask

-

What is the Maryland 500d and how does it work with airSlate SignNow?

The Maryland 500d is a specific document type that can be easily managed using airSlate SignNow's platform. With airSlate SignNow, users can upload, eSign, and send the Maryland 500d document quickly and securely. Our user-friendly interface simplifies the signing process, ensuring that your documents are processed efficiently.

-

What are the pricing options for using airSlate SignNow with Maryland 500d?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including options tailored for handling the Maryland 500d document. Our plans are designed to be cost-effective, making it easy for businesses to access essential eSigning features without breaking the bank.

-

What features does airSlate SignNow provide for the Maryland 500d?

With airSlate SignNow, you gain access to a suite of features specifically beneficial for managing the Maryland 500d. These include customizable templates, secure cloud storage, and real-time tracking of document status, ensuring that you have everything you need to manage your documents effectively.

-

How can I integrate airSlate SignNow with my existing systems for Maryland 500d management?

airSlate SignNow offers seamless integration capabilities with various applications commonly used for managing the Maryland 500d. Whether you use CRM systems, project management tools, or cloud storage solutions, our platform can be integrated to streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for Maryland 500d eSigning?

Using airSlate SignNow for the Maryland 500d provides numerous benefits, including enhanced security, faster turnaround times, and improved compliance. Our platform ensures that all signatures are legally binding and encrypted, making it a reliable choice for your eSigning needs.

-

Is airSlate SignNow compliant with Maryland laws for eSigning the 500d document?

Yes, airSlate SignNow is fully compliant with Maryland laws regarding electronic signatures, ensuring that your Maryland 500d document is signed legally and securely. Our platform adheres to the highest standards of compliance to protect your business and its documents.

-

Can I track the status of my Maryland 500d documents in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features for your Maryland 500d documents. You can easily monitor who has signed, who still needs to sign, and the overall status of your document, allowing for better management and follow-up.

Get more for Maryland 500d

- Londra mae ro form

- Dd2648 form

- Consumer complaint form florida attorney general

- Specialty order form cigna specialty pharmacy services order form for

- William alvarez roll form tool design

- Gr 1040es form

- Authorization to collect and disclose personal information

- Bc human rights tribunal use this form to file a discrimination complaint in bc for yourself or another person

Find out other Maryland 500d

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online