Tc 14 1 2010

What is the Tc 14 1?

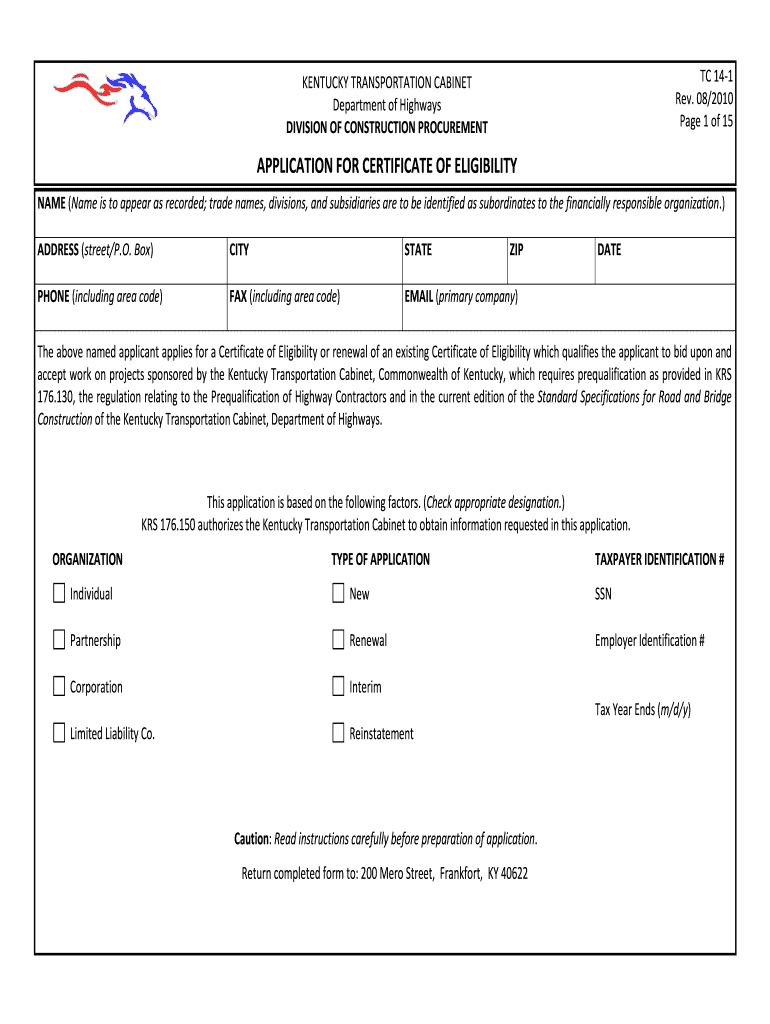

The certificate of eligibility form TC14 1 is a crucial document used in Kentucky for individuals seeking to verify their eligibility for transportation-related services. This form is primarily associated with the Kentucky Department of Transportation and is essential for those applying for various transportation certifications. It serves as a formal declaration of eligibility, ensuring that applicants meet specific criteria set forth by state regulations.

How to obtain the Tc 14 1

To obtain the TC14 1 form, individuals can visit the official website of the Kentucky Department of Transportation. The form is typically available for download in a PDF format, allowing users to print and fill it out. Additionally, applicants may contact their local transportation office for assistance in acquiring the form directly. It's important to ensure that you are using the most current version of the TC14 1 to avoid any issues during the application process.

Steps to complete the Tc 14 1

Completing the TC14 1 form requires careful attention to detail. Here are the key steps:

- Begin by downloading the form from the Kentucky Department of Transportation's website.

- Fill in your personal information, including your name, address, and contact details.

- Provide any required identification numbers, such as your driver's license or social security number.

- Complete the eligibility sections, ensuring that all information is accurate and truthful.

- Review the form for any errors or omissions before submission.

Legal use of the Tc 14 1

The TC14 1 form is legally binding and must be completed in accordance with Kentucky state laws. It is essential for individuals to understand that providing false information on this form can lead to legal repercussions, including penalties or denial of eligibility. The form must be submitted to the appropriate authorities for review and approval to ensure compliance with state regulations.

Required Documents

When submitting the TC14 1 form, applicants may need to provide additional documentation to support their eligibility claims. Commonly required documents include:

- A copy of the Kentucky State Police eligibility notification form.

- Proof of residency in Kentucky, such as a utility bill or lease agreement.

- Identification documents, including a driver's license or state ID.

Eligibility Criteria

Eligibility for the TC14 1 form is determined by specific criteria set by the Kentucky Department of Transportation. Applicants must demonstrate compliance with transportation regulations, which may include having a valid driver's license, meeting age requirements, and not having any disqualifying legal issues. It's advisable to review the eligibility requirements thoroughly before completing the form to ensure a smooth application process.

Quick guide on how to complete tc 14 1 form

Manage Tc 14 1 everywhere, anytime

Your everyday business activities may demand additional attention when working with state-specific business documents. Reclaim your office hours and reduce the paperwork expenses linked to document-based operations with airSlate SignNow. airSlate SignNow provides a wide range of pre-designed business documents, including Tc 14 1, which you can utilize and share with your business associates. Manage your Tc 14 1 smoothly with robust editing and eSignature features and send it directly to your recipients.

How to obtain Tc 14 1 in just a few clicks:

- Select a document pertinent to your state.

- Click on Learn More to view the document and confirm its accuracy.

- Select Get Form to start using it.

- Tc 14 1 will promptly appear in the editor. No additional steps are needed.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the document.

- Choose the Sign tool to create your personal signature and eSign your document.

- When ready, simply click Done, save your changes, and access your document.

- Share the document via email or text, or use a link-to-fill option with your partners, or allow them to download the files.

airSlate SignNow greatly reduces the time spent managing Tc 14 1 and enables you to find needed documents in one spot. An extensive library of forms is organized and designed to address critical business operations vital for your organization. The sophisticated editor minimizes the likelihood of mistakes, as you can quickly amend errors and review your documents on any device before sending them out. Start your free trial today to explore all the advantages of airSlate SignNow for your daily business processes.

Create this form in 5 minutes or less

Find and fill out the correct tc 14 1 form

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Can I fill out the AILET application form on the 14 or before the 14th of April? What is the last time?

itni jaldi kya hai

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

Create this form in 5 minutes!

How to create an eSignature for the tc 14 1 form

How to make an electronic signature for the Tc 14 1 Form online

How to create an electronic signature for your Tc 14 1 Form in Google Chrome

How to make an eSignature for putting it on the Tc 14 1 Form in Gmail

How to make an eSignature for the Tc 14 1 Form from your smartphone

How to make an eSignature for the Tc 14 1 Form on iOS

How to create an electronic signature for the Tc 14 1 Form on Android

People also ask

-

What is Tc 14 1 in relation to airSlate SignNow?

Tc 14 1 refers to a specific compliance standard that airSlate SignNow meets, ensuring that our e-signature solutions are secure and legally binding. By adhering to Tc 14 1, businesses can trust that their documents are handled with the utmost security and integrity, paving the way for smoother transactions.

-

How does airSlate SignNow's pricing compare for Tc 14 1 compliance?

airSlate SignNow offers competitive pricing that includes features tailored to meet Tc 14 1 compliance needs. Our plans are designed to provide cost-effective solutions without compromising on quality, making it easier for businesses to adopt secure e-signature processes.

-

What features of airSlate SignNow support Tc 14 1 compliance?

Key features of airSlate SignNow that support Tc 14 1 compliance include advanced encryption, audit trails, and secure storage of documents. These features ensure that all electronic signatures are captured securely and that every transaction is fully traceable, aligning with the standards of Tc 14 1.

-

Can airSlate SignNow integrate with other tools to enhance Tc 14 1 compliance?

Yes, airSlate SignNow offers seamless integrations with various business applications to enhance your workflow while ensuring Tc 14 1 compliance. Whether it's CRM systems, document management tools, or project management software, our integrations help streamline processes while maintaining the necessary compliance standards.

-

What are the benefits of using airSlate SignNow for Tc 14 1 compliant e-signatures?

Using airSlate SignNow for Tc 14 1 compliant e-signatures provides numerous benefits, including enhanced security, reduced processing time, and improved accuracy. With our platform, businesses can execute documents quickly and securely, ensuring compliance with industry regulations while boosting efficiency.

-

Is airSlate SignNow suitable for small businesses needing Tc 14 1 compliance?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses that require Tc 14 1 compliance. Our intuitive interface and affordable plans make it easy for smaller organizations to implement secure e-signature solutions without extensive resources.

-

How does airSlate SignNow ensure the security of documents related to Tc 14 1?

airSlate SignNow employs industry-leading security measures, including encryption, secure cloud storage, and access controls to protect documents related to Tc 14 1 compliance. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for Tc 14 1

- Student help hire template department of medicine form

- Strongbodies fitness program to be offered at fond du lac form

- The 10 best home care services for seniors in south elgin form

- Skip a pay application disclosure and agreement form

- Dcccd transcript form

- Field studies coursesfield and experiential learning form

- 560 t form

- Official visit requests must be submitted five 5 working days prior to the scheduled visit form

Find out other Tc 14 1

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free