Skip a Pay Application, Disclosure, and Agreement 2017

What is the Skip A Pay Application, Disclosure, And Agreement

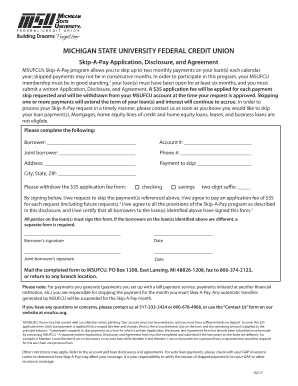

The Skip A Pay application, disclosure, and agreement is a financial tool that allows borrowers to temporarily defer their loan payments for a specified period. This option is often available for various types of loans, including auto loans and personal loans. By utilizing this agreement, borrowers can manage their finances more effectively during challenging times, such as unexpected expenses or temporary loss of income.

This document outlines the terms and conditions under which the borrower may skip a payment, including any fees that may apply and the impact on the loan's overall repayment schedule. It is essential for borrowers to fully understand these terms before proceeding with the application.

How to use the Skip A Pay Application, Disclosure, And Agreement

To use the Skip A Pay application, borrowers must first obtain the necessary form from their lender, typically available online or through customer service. Once the form is acquired, borrowers should carefully read the disclosure section to understand the implications of skipping a payment.

After reviewing the terms, borrowers can fill out the application by providing required information such as their account number, personal details, and the specific payment they wish to skip. It is important to ensure that all information is accurate to avoid processing delays.

Steps to complete the Skip A Pay Application, Disclosure, And Agreement

Completing the Skip A Pay application involves several key steps:

- Obtain the Skip A Pay application form from your lender.

- Read the disclosure carefully to understand the terms and conditions.

- Fill out the application with accurate information, including your account details.

- Sign the agreement electronically or manually, depending on your lender's requirements.

- Submit the completed form through the specified method, which may include online submission or mailing it to the lender.

Legal use of the Skip A Pay Application, Disclosure, And Agreement

The Skip A Pay application, disclosure, and agreement is legally binding when executed according to the lender's guidelines and applicable laws. To ensure its validity, the document must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Additionally, it is crucial for borrowers to retain a copy of the signed agreement for their records. This documentation serves as proof of the agreement and can be referenced in case of any disputes regarding the skipped payment.

Eligibility Criteria

Eligibility for the Skip A Pay option may vary by lender, but common criteria include:

- The borrower must be in good standing with their loan payments.

- The loan must not be in default or subject to any legal actions.

- Borrowers may need to provide a valid reason for requesting to skip a payment.

- There may be limits on how often a borrower can utilize this option within a specific timeframe.

Form Submission Methods (Online / Mail / In-Person)

Borrowers can typically submit the Skip A Pay application through various methods, depending on their lender's policies. Common submission methods include:

- Online submission via the lender’s website or mobile app.

- Mailing the completed form to the lender's designated address.

- In-person submission at a local branch or office, if applicable.

It is advisable for borrowers to confirm the preferred submission method with their lender to ensure timely processing of their request.

Quick guide on how to complete skip a pay application disclosure and agreement

Effortlessly Prepare Skip A Pay Application, Disclosure, And Agreement on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without holdups. Manage Skip A Pay Application, Disclosure, And Agreement on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Skip A Pay Application, Disclosure, And Agreement Seamlessly

- Locate Skip A Pay Application, Disclosure, And Agreement and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Edit and electronically sign Skip A Pay Application, Disclosure, And Agreement to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct skip a pay application disclosure and agreement

Create this form in 5 minutes!

How to create an eSignature for the skip a pay application disclosure and agreement

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is msufcu skip a pay?

The msufcu skip a pay program allows eligible members of MSU Federal Credit Union to defer a monthly loan payment, providing financial flexibility during difficult times. This feature can help ease your budget temporarily while maintaining your credit health. It’s an excellent option for those experiencing unexpected expenses.

-

How do I enroll in the msufcu skip a pay program?

Enrolling in the msufcu skip a pay program is straightforward. Members can apply through their online banking portal or visit a local branch. Make sure to check the eligibility requirements and provide any necessary documentation to ensure a smooth application process.

-

Are there fees associated with the msufcu skip a pay option?

There may be a nominal fee associated with the msufcu skip a pay feature, depending on the specific loan terms and conditions. It's essential to review the details provided by MSU Federal Credit Union to understand any costs involved. This program is designed to provide flexibility without imposing heavy financial burdens.

-

Can I use msufcu skip a pay for multiple loans?

Yes, members may be able to apply the msufcu skip a pay option to multiple eligible loans, depending on their individual circumstances. However, it’s crucial to check with MSU Federal Credit Union for specific terms and limits regarding multiple skips. This flexibility can be beneficial for managing various loan obligations.

-

What are the benefits of using msufcu skip a pay?

The primary benefit of msufcu skip a pay is the temporary relief it provides from monthly payments during financial strain. This program can help maintain your credit score by avoiding late payments while offering breathing room in your budget. It's a valuable tool for managing unexpected challenges without long-term financial repercussions.

-

How does msufcu skip a pay affect my loan term?

Using msufcu skip a pay may extend the term of your loan since the skipped payment will be added to the end of your loan. This means you'll continue making payments as usual after the deferred month, but your overall repayment schedule will be adjusted. Always consult your loan agreement and MSU Federal Credit Union for specific impact details.

-

Is the msufcu skip a pay program available for all loan types?

Not all loan types may qualify for the msufcu skip a pay program. Typically, eligible loans include personal and auto loans, but terms can vary. It’s best to confirm with MSU Federal Credit Union which particular loans are eligible for this feature to make the most of it.

Get more for Skip A Pay Application, Disclosure, And Agreement

Find out other Skip A Pay Application, Disclosure, And Agreement

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document