Amending a Property Tax RefundMinnesota Department of Revenue 2020

Understanding the 2017 Form M1PRX

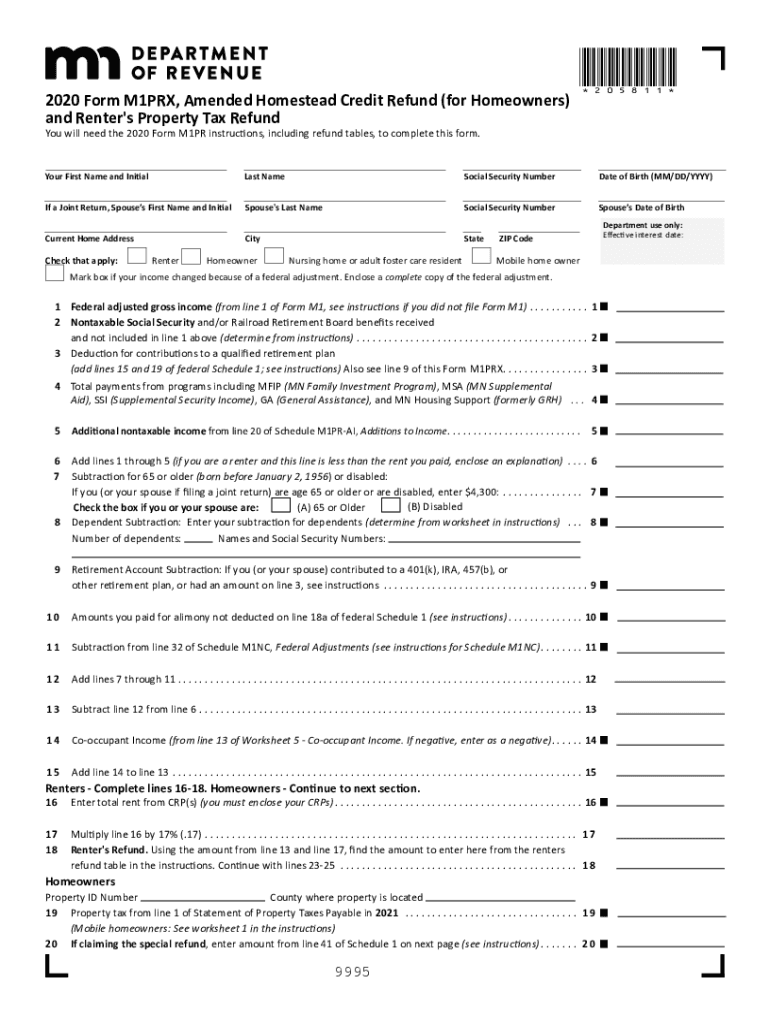

The 2017 Form M1PRX is a Minnesota Department of Revenue document used for amending a property tax refund. This form allows taxpayers to correct errors or update information related to their property tax refund claims. It is essential for ensuring that the information on file is accurate and reflects any changes that may affect the refund amount.

Steps to Complete the 2017 Form M1PRX

Completing the 2017 Form M1PRX involves several key steps:

- Gather necessary documentation, including previous tax returns and any supporting documents related to the property tax refund.

- Carefully read the instructions provided with the form to understand the required information.

- Fill out the form, ensuring that all fields are completed accurately. Pay special attention to the sections that require amendments.

- Review the completed form for any errors or omissions before submission.

- Submit the form either online, by mail, or in person, depending on your preference and the guidelines provided.

Eligibility Criteria for Amending Property Tax Refund

To be eligible to use the 2017 Form M1PRX, taxpayers must meet specific criteria:

- The original property tax refund claim must have been filed within the appropriate timeframe.

- The amendments should relate to errors or changes in personal information, property details, or tax calculations.

- Taxpayers must be residents of Minnesota and have owned property for which they are claiming the refund.

Key Elements of the 2017 Form M1PRX

The 2017 Form M1PRX includes several important elements that must be accurately completed:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Property Details: Information about the property for which the tax refund is being amended, including the property identification number.

- Amendment Details: A clear explanation of the changes being made and the reasons for the amendment.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the amendment.

Form Submission Methods for the 2017 Form M1PRX

Taxpayers have several options for submitting the 2017 Form M1PRX:

- Online Submission: Many taxpayers prefer to submit their forms electronically through the Minnesota Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address as indicated in the form instructions.

- In-Person: Taxpayers may also choose to deliver the form in person at designated Minnesota Department of Revenue offices.

Penalties for Non-Compliance with the 2017 Form M1PRX

Failure to comply with the requirements associated with the 2017 Form M1PRX can result in penalties. These may include:

- Delayed processing of the amended refund.

- Potential fines or interest on any unpaid taxes.

- Loss of eligibility for certain tax benefits or credits if the amendment is not filed correctly.

Quick guide on how to complete amending a property tax refundminnesota department of revenue

Effortlessly Prepare Amending A Property Tax RefundMinnesota Department Of Revenue on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your papers quickly and efficiently. Manage Amending A Property Tax RefundMinnesota Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and Electronically Sign Amending A Property Tax RefundMinnesota Department Of Revenue with Ease

- Find Amending A Property Tax RefundMinnesota Department Of Revenue and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize key sections of the documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details carefully and then press the Done button to save your modifications.

- Choose your preferred method of sending your form—by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Amending A Property Tax RefundMinnesota Department Of Revenue and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct amending a property tax refundminnesota department of revenue

Create this form in 5 minutes!

How to create an eSignature for the amending a property tax refundminnesota department of revenue

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 2017 form m1prx and why is it important?

The 2017 form m1prx is a Minnesota state tax form used for personal income tax adjustments. Understanding this form is crucial for taxpayers since it helps in correcting any discrepancies in previously filed returns. Filling it out correctly can ensure you receive the appropriate refunds or avoid any penalties.

-

How can airSlate SignNow help with the 2017 form m1prx?

airSlate SignNow simplifies the process of filling out the 2017 form m1prx by allowing users to easily prepare, sign, and send this document digitally. Our intuitive interface ensures that you can navigate through the form efficiently while maintaining compliance with state requirements. Plus, the platform's eSignature features speed up the submission process.

-

What pricing options are available for using airSlate SignNow to file the 2017 form m1prx?

airSlate SignNow offers competitive pricing plans to cater to various business needs. Our plans start with a basic option suitable for individual users and progress to advanced packages for larger organizations. This flexibility ensures that you can utilize our platform to manage the 2017 form m1prx without breaking the bank.

-

Are there any features specific to the 2017 form m1prx available through airSlate SignNow?

Yes, airSlate SignNow provides features specifically designed to assist with the 2017 form m1prx. Users can easily access templates, collaborate with multiple signers, and efficiently track the completion status of the form. These features streamline the preparation and submission process, making tax filing more convenient.

-

Is airSlate SignNow compliant with state regulations when submitting the 2017 form m1prx?

Absolutely! airSlate SignNow ensures compliance with all necessary state regulations, including those related to the 2017 form m1prx. Our platform regularly updates its features to accommodate changing laws, giving you peace of mind that your submissions are valid and lawful.

-

Can airSlate SignNow integrate with other tools for filing the 2017 form m1prx?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software tools. This allows you to import data directly for the 2017 form m1prx, reducing manual entry and minimizing errors. Check our integrations page to discover all compatible applications.

-

What are the benefits of using airSlate SignNow for the 2017 form m1prx?

Using airSlate SignNow for the 2017 form m1prx offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. Our digital solutions allow you to manage your tax documents from anywhere, ensuring you never miss a deadline. Additionally, our customer support team is always available to help you navigate any issues.

Get more for Amending A Property Tax RefundMinnesota Department Of Revenue

Find out other Amending A Property Tax RefundMinnesota Department Of Revenue

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed