Form M1PRX, Amended Homestead Credit Refund for Homeowners 2017

What is the Form M1PRX, Amended Homestead Credit Refund for Homeowners

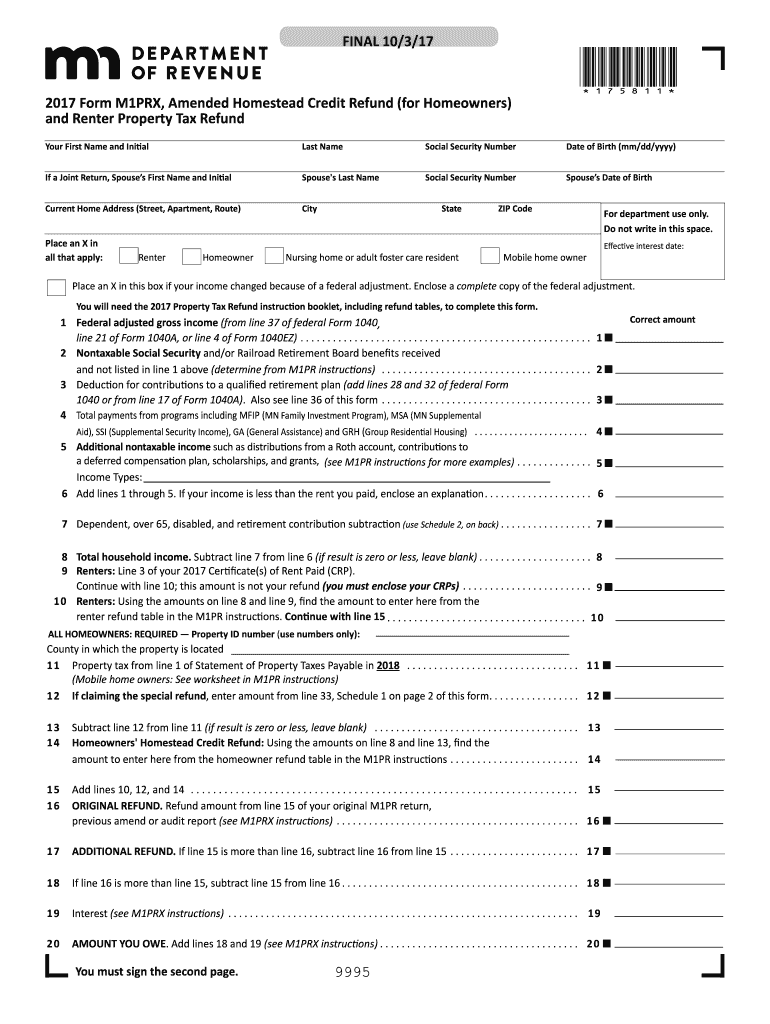

The Form M1PRX, Amended Homestead Credit Refund for Homeowners, is a tax form used by homeowners in Minnesota to amend their previously filed Homestead Credit Refund claims. This form allows individuals to correct any errors or omissions in their original submissions, ensuring they receive the appropriate refund amount based on their eligibility. The Homestead Credit Refund program is designed to provide financial relief to homeowners by reducing their property tax burden, making it vital for eligible homeowners to accurately report their information.

Steps to Complete the Form M1PRX, Amended Homestead Credit Refund for Homeowners

Completing the Form M1PRX involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including your original refund claim and any supporting materials that pertain to the amendments. Next, fill out the form with the corrected information, paying close attention to the specific sections that require changes. It is essential to explain the reasons for the amendments clearly, as this can aid in the review process. After completing the form, review it thoroughly for errors before submitting it to the appropriate state tax authority.

How to Obtain the Form M1PRX, Amended Homestead Credit Refund for Homeowners

The Form M1PRX can be obtained through the Minnesota Department of Revenue's official website. The form is available for download in PDF format, allowing homeowners to print it for completion. Additionally, taxpayers can request a physical copy by contacting the Minnesota Department of Revenue directly. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Eligibility Criteria for the Form M1PRX, Amended Homestead Credit Refund for Homeowners

To be eligible for filing the Form M1PRX, homeowners must have previously filed a Homestead Credit Refund claim that is now being amended. Eligibility for the original refund is typically based on factors such as income, property taxes paid, and residency status. Homeowners should ensure that their amended claim reflects any changes in these criteria, as this will impact their refund amount. Understanding the eligibility requirements is crucial for a successful amendment process.

Form Submission Methods for the Form M1PRX, Amended Homestead Credit Refund for Homeowners

The completed Form M1PRX can be submitted through various methods to the Minnesota Department of Revenue. Homeowners have the option to file the form electronically, which is often the fastest method for processing. Alternatively, the form can be mailed to the appropriate address provided by the Department of Revenue. In-person submissions are also possible at designated tax offices. Each submission method has its own processing times, so homeowners should choose the one that best fits their needs.

Key Elements of the Form M1PRX, Amended Homestead Credit Refund for Homeowners

The Form M1PRX includes several key elements that must be accurately completed to ensure a valid amendment. Essential sections include personal identification information, details of the original claim, and the specific changes being made. Homeowners must also provide a clear explanation for the amendments and any supporting documentation that validates their claims. Ensuring that all required fields are filled out correctly is critical for a smooth review process.

Quick guide on how to complete 2017 form m1prx amended homestead credit refund for homeowners

Your assistance manual on how to prepare your Form M1PRX, Amended Homestead Credit Refund for Homeowners

If you’re wondering how to generate and transmit your Form M1PRX, Amended Homestead Credit Refund for Homeowners, here are a few brief guidelines on how to simplify tax submission signNowly.

To begin, all you need to do is create your airSlate SignNow profile to revolutionize your document management online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to edit, produce, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check marks, and eSignatures, and return to modify details as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps outlined below to complete your Form M1PRX, Amended Homestead Credit Refund for Homeowners in no time:

- Create your account and start processing PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Form M1PRX, Amended Homestead Credit Refund for Homeowners in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can increase errors in returns and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form m1prx amended homestead credit refund for homeowners

Create this form in 5 minutes!

How to create an eSignature for the 2017 form m1prx amended homestead credit refund for homeowners

How to create an electronic signature for your 2017 Form M1prx Amended Homestead Credit Refund For Homeowners in the online mode

How to generate an eSignature for the 2017 Form M1prx Amended Homestead Credit Refund For Homeowners in Google Chrome

How to make an electronic signature for signing the 2017 Form M1prx Amended Homestead Credit Refund For Homeowners in Gmail

How to generate an electronic signature for the 2017 Form M1prx Amended Homestead Credit Refund For Homeowners straight from your smartphone

How to make an eSignature for the 2017 Form M1prx Amended Homestead Credit Refund For Homeowners on iOS devices

How to create an electronic signature for the 2017 Form M1prx Amended Homestead Credit Refund For Homeowners on Android

People also ask

-

What is Form M1PRX, Amended Homestead Credit Refund for Homeowners?

Form M1PRX, Amended Homestead Credit Refund for Homeowners, is a key tax document used by homeowners to amend their original Homestead Credit Refund claims. It allows eligible homeowners to request additional refunds based on changes to their property or income. Understanding this form is essential for maximizing potential tax benefits.

-

How does airSlate SignNow streamline the process of filing Form M1PRX?

airSlate SignNow simplifies the filing process of Form M1PRX, Amended Homestead Credit Refund for Homeowners by providing secure eSignature capabilities. With our platform, homeowners can easily complete, sign, and submit their documents online, saving time and reducing the risk of errors in the submission process.

-

Is there a cost associated with using airSlate SignNow for Form M1PRX?

Yes, airSlate SignNow operates on a subscription model that offers various pricing plans suitable for different needs. These plans provide affordable access to features that assist in completing Form M1PRX, Amended Homestead Credit Refund for Homeowners efficiently, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for managing Form M1PRX?

airSlate SignNow includes features such as custom templates, document sharing, and real-time tracking of signatures that can be utilized for Form M1PRX, Amended Homestead Credit Refund for Homeowners. This makes it easier for users to manage the document process from start to finish while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other tools while handling Form M1PRX?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, enhancing your workflow while managing Form M1PRX, Amended Homestead Credit Refund for Homeowners. These integrations allow for better collaboration and data management, ensuring all necessary information is easily accessible.

-

What are the benefits of using eSignatures for Form M1PRX?

Using eSignatures for Form M1PRX, Amended Homestead Credit Refund for Homeowners, offers numerous benefits including enhanced security, quicker turnaround times, and reduced paper use. This digital approach not only streamlines the signing process but also provides a more environmentally friendly solution.

-

How do I ensure my Form M1PRX submission is secure?

When you use airSlate SignNow for Form M1PRX, Amended Homestead Credit Refund for Homeowners, your information is protected by advanced encryption and security protocols. We prioritize the security of your documents, ensuring that your sensitive data remains confidential and protected throughout the eSignature process.

Get more for Form M1PRX, Amended Homestead Credit Refund for Homeowners

- Short courses for electro technical officer certificate of form

- Before application for a tanker endorsement to a certificate form

- Lesson 4 homework practice linear functions form

- Draw geometric shapes with given conditions worksheet form

- Download form 43 1 formupack

- Original petition for divorce divorce set b texaslawhelp org form

- Life estate deed form 695878

- Resources for county websites tac cira form

Find out other Form M1PRX, Amended Homestead Credit Refund for Homeowners

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile